Reference no: EM131488042

Question: This Mini Case is available in My Finance Lab. Superior Europe, is a medium-sized company, located in the Netherlands, and has successfully been doing business in the matting industry for 15 years now. Its business model is based on the sales of commercial- and industrial-floor matting for professional use, through distributors. Superior Europe manufactures mats and sells them in Europe and the United States. It developed a strong brand image over time, and its deep knowledge of the market and strong focus on quality and customization are its advantages. Robert Lucassen, the managing director of Superior Europe, has been running the company since its establishment. As the business grew, in 2014, Robert started considering different opportunities to expand the company's operations. Such an opportunity came as an offer for partnership from a leading Chinese manufacturer of products for industrial and construction safety. This meant that the Chinese partner would complement its product offering in China with Superior mats. The deal also would ensure that Superior would increase its offerings to include products for industrial and construction safety, using its existing distribution channels. The introduction of new items in Superior's product portfolio required new expertize and was perceived as a factor of uncertainty which led to a reduction in the company's stock prices, from $38 in 2014 to $34 in 2015.

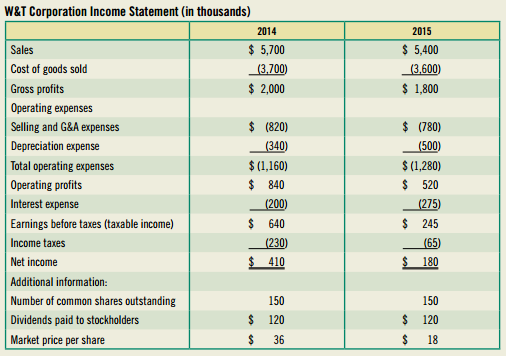

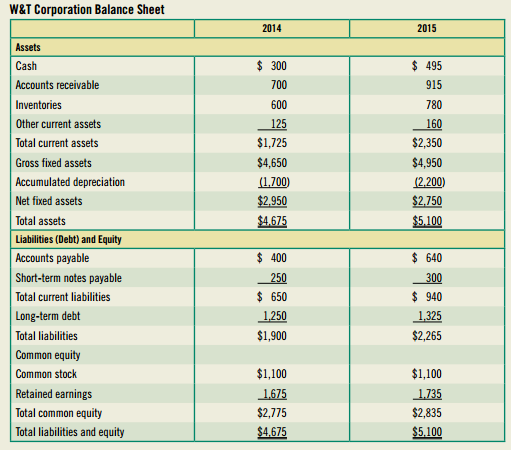

Even though the sales were increasing for Superior Europe, the profitability was more difficult to maintain. This is because company was expected to increase its capacities, especially warehouse capacities, and expand its offerings to products for industrial safety besides mats. Its inventories went up for 44 percent. In order to support the sales of new products to existing clients, more favorable sales conditions were provided resulting in an increase in account receivables. The company that traditionally had a policy of strong liquidity started to experience difficulties in short-term financing. Robert's bonuses were paid on the basis of the Economic Value Added (EVA). The bonus is determined as 1 percent of the firm's EVA; 70 percent of the bonus is paid in cash and 30 percent in stocks. Financial information for Superior Europe for both years has been provided, where all the numbers, except for per-share data, are shown in thousands of dollars. The company's estimated cost of capital for all its financing is 12 percent.

a. Using what you have learnt in Chapters 3 and 4, prepare a financial analysis of Superior Europe and evaluate its financial performance, comparing the firm's performance between 2 years.

b. What conclusions can you make from your analysis?

c. How much will Robert's bonus be in 2014 and 2015, in the form of both cash and stock?

d. Based on the conclusions of your financial analysis, what recommendations would you make to management?