Reference no: EM13212590

Problems

1) Dive Pharmaceuticals has EBIT of $485 million in 2013. In addition Viking has interest expenses of $190 million, dividends of $15 million and a corporate tax rate of 40%.

Required:

a) What is the 2013 net income?

b) What is the total 2013 net income and interest payments?

c) If Dive had no interest expense, what would its 2013 net income be? How does it compare to the answer in part b?

d) What is the amount of Viking's interest tax shield in 2013?

2) You have been offered a unique investment opportunity. If you invest $15,000 today, you will receive $750 one year from now, $2,000 two years from now, $4,000 and $15,000 ten years from now.

Required:

a) Calculate the net present value of the opportunity if the interest rate is 6% per year. Should you take the opportunity?

b) Calculate the net present value of the opportunity if the interest rate is 2% per year. Should you take the opportunity now and how is this different from Part a?

3) Professor Harris has been offered a very interesting project opportunity: A consulting firm would like to retain him for an upfront payment of $34,000. In return, for the next 6 months, the firm would have access to 10 hours of her time each month. Schilling's rate is $575 per hour and her opportunity cost of capital is 16%.

Required:

a) Calculate the net present value of this opportunity.

b) Calculate the IRR of this opportunity (remember, to consider monthly vs. annual %

C) Are the NPV rule and IRR rule consistent in evaluating this opportunity - what decision would you make under each rule (accept or reject the project opportunity)?

4) The market value of Chunky Ice Creamery equity is $8 million and the market value of its debt is $6 million, with book value of debt at $2 million and book value of equity at $2.5 million. The CFO estimates that the beta of the stock current is 1.43 and that the expected risk premium on the market is 8%. The Treasury bill rate is 3%.

Required:

a) What is the required rate of return on Coldstone stock?

b) What is the beta of the company's existing portfolio of assets? The debt is perceived to be risk free.

c) Estimate the Weighted Average Cost of Capital assuming a tax rate of 40%

5) Cool Shoes (CS) had 2013 sales of $518 million. You expect sales to grow at 9% next year (2014), but, decline by 1% per year after until you settle to a long-run growth rate of 4%. You expect EBIT to be 9% of sales, increases in net working capital requirements to be 10% of any increase in sale (hint: just the increase from the prior year), and net investment to be 8% of any increase in sales. (Note: this is in excess of depreciation).

Other 2013 data for Cool Shoes:

? EPS = $1.65

? Book value of equity = $12.05 per share

? EBITDA = $55.6 million

? Excess cash = $100 million

? Debt = $3 million

? Shares outstanding = 21 million

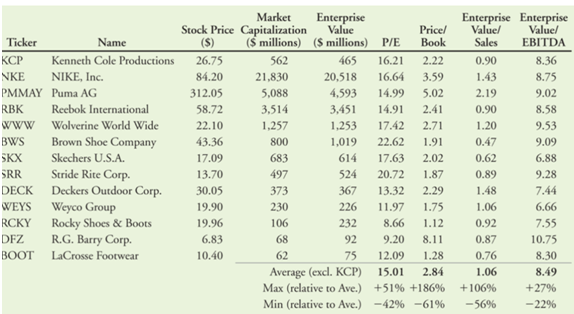

Comparable stock prices and multiples for the Footwear Industry, 2013

Required:

a) Using the DCF method, determine the enterprise value of CS. (Hint: Don't forget the terminal value).

b)Using the answer from part a), what is the price per share?

c) Using the information from the comparable stock prices and multiples table above, estimate the price per share using the average P/E multiple.

d) Using the information from the comparable stock prices and multiples table above, estimate the price per share using the average Enterprise Value to sales multiple.

e) Using the information from the comparable stock prices and multiples table above, estimate the price per share using the average Enterprise Value to EBITDA multiple.

f) What range of prices do you estimate based on your analysis in Reqs b-e?