Reference no: EM131206372

Managerial Economics Assignment

The homework covers Ch 11~13. It has to be your individual work. Copying answer from others will violate ACADEMIC HONESTY policy to cause a failing grade. For each question, please show the necessary derivation (if applicable) and highlight the answer. Limit your answers within 5 pages. No cover sheet is required.

Q1: The manager of All City Realtors wants to hire some real estate agents to specialize in selling housing units acquired by the Resolution Trust Corporation (RTC) in its attempt to bail out the savings and loan industry. The commission paid by the RTC to the company to sell these homes is a flat rate of $2,000 per unit sold, rather than the customary commission that is based on the sale price of a home. The manager estimates the following marginal product schedule for real estate agents dealing in government- owned housing:

|

Number of real estate agents

|

Marginal product (MP) (number of additional units sold per year)

|

Marginal revenue product (MRP)

|

|

1

|

30

|

|

|

2

|

26

|

|

|

3

|

21

|

|

|

4

|

15

|

|

|

5

|

8

|

|

|

6

|

2

|

|

a. Construct the marginal revenue product (MRP) schedule by filling in the blanks in the table.

b. If the manager of All City Realtors must pay a wage rate of $30,000 per year to get agents who will specialize in selling RTC housing, how many agents should the manager hire? Why?

c. If the wage rate falls to $14,000 per year, how many agents should the manager hire?

Q2: EverKleen Pool Services provides weekly swimming pool maintenance in Atlanta. Dozens of firms provide this service. The service is standardized; each company cleans the pool and maintains the proper levels of chemicals in the water. The service is typically sold as a four- month summer contract. The market price for the four-month ser- vice contract is $115. EverKleen Pool Services has fixed costs of $3,500. The manager of EverKleen has estimated the following marginal cost function for EverKleen, using data for the last two years:

SMC = 125 - 0.42Q + 0.0021Q2

where SMC is measured in dollars and Q is the number of pools serviced each summer.

a. Given the estimated marginal cost function, what is the average variable cost function for EverKleen?

b. Should the manager of EverKleen continue to operate, or should the firm shut down? Explain.

c. How much profit (or loss) can the manager of EverKleen Pool Services expect to earn?

Q3: QuadPlex Cinema is the only movie theater in Idaho Falls. The nearest rival movie theater, the Cedar Bluff Twin, is 35 miles away in Pocatello. Thus QuadPlex Cinema possesses a degree of market power. Despite having market power, QuadPlex Cinema is currently suffering losses. In a conversation with the owners of QuadPlex, the manager of the movie theater made the following suggestions: "Since QuadPlex is a local monopoly, we should just increase ticket prices until we make enough profit."

a. Comment on this strategy. Will it work in short run?

b. Is the Lerner index an appropriate measure for the market power of QuadPlex Cinema? Please explain your answer briefly.

c. What options should QuadPlex consider in the long run?

Q4: The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high- school sporting events, and so on. The El Dorado Star faces the demand and cost schedules shown in the spreadsheet that follows:

|

Number of newspapers per day

|

Total Revenue per day

|

Total cost per day

|

|

(Q)

|

$(TR)

|

$(TC)

|

|

0

|

0

|

2,000

|

|

1,000

|

1,500

|

2,100

|

|

2,000

|

2,500

|

2,200

|

|

3,000

|

3,000

|

2,360

|

|

4,000

|

3,250

|

2,520

|

|

5,000

|

3,450

|

2,700

|

|

6,000

|

3,625

|

2,890

|

|

7,000

|

3,725

|

3,090

|

|

8,000

|

3,625

|

3,310

|

|

9,000

|

3,475

|

3,550

|

a. Please calculate and show the marginal revenue and marginal cost in another two columns.

b. How many papers should be sold daily to maximize profit?

c. What is the maximum profit the El Dorado Star can earn?

Q5: Suppose that a monopoly faces inverse market demand function as

P = 70-2Q,

and its marginal cost function is

MC = 40 - Q.

Please answer the following two questions:

a. What should be the monopoly's profit-maximizing output?

b. What is the monopoly's price?

Q6: Recently one of the nation's largest consumer electronics retailers began a nationwide television advertising campaign kicking off its "Take It Home Today" program, which is designed to encourage electronics consumers to buy today rather than continue postponing a purchase hoping for a lower price. For example, the "Take It Home Today" promotion guarantees buyers of new plasma TVs that they are entitled to get any sale price the company might offer for the next 30 days.

a. Do you think such a policy will increase demand for electronic appliances? Explain.

b. What other reason could explain why this program is offered? Would you expect the other large electronics stores to match this program with one of their own? Why or why not?

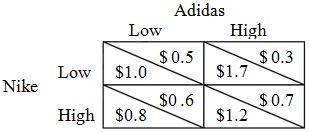

Q7: Suppose that Nike and Adidas are the only sellers of athletic footwear in the United States. They are deciding how much to charge for similar shoes. The two choices are "Low" and "High". The payoff (profit as million) 2X2 matrix is as follows:

a. Is there a dominant strategy for Nike? Is there a dominant strategy for Adidas?

b. If Nike is the price leader and the first mover, what will be the Nash equilibrium in the game?