Reference no: EM13492378

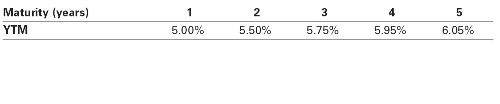

1.Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

a. What is the price per $100 face value of a two-year, zero-coupon, risk-free bond?

b. What is the price per $100 face value of a four-year, zero-coupon, risk-free bond?

c. What is the risk-free interest rate for a five-year maturity?

2.In the box in Section 8.1, Bloomberg.com reported that the three-month Treasury bill sold for a price of $100.002556 per $100 face value. What is the yield to maturity of this bond, expressed as an EAR?

3.Suppose a 10-year, $1000 bond with an 8% coupon rate and semiannual coupons is trading for a price of $1034.74.

a. What is the bond’s yield to maturity (expressed as an APR with semiannual compounding)?

b. If the bond’s yield to maturity changes to 9% APR, what will the bond’s price be?