Reference no: EM13195615

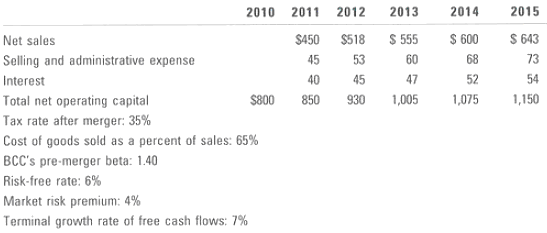

VolWorld Communications Inc., a large telecommunications company, is evaluating the possible acquisition of Bulldog Cable Company (BCC), a regional cable company. VolWor1d's analysts project the following post-merger data for BCC (in thousands of dollars, with a year end of December 31) :

If the acquisition is made, it will occur on January 1, 2011. All cash flows shown in the income statements are assumed to occur at the end of the year. BCC currently has a capital structure of 40% debt, which Costs 10%, but over the next 4 years VolWorld would increase that to 50%, and the target capital structure would he reached by the start of 2015. BCC, if independent, would pay taxes at 20%, hut its income would be taxed at 35% ii it were consolidated. BCC's current market-determined beta is 1.4. The cost of goods sold is expected to be 65% of sales.

a. What is the unlevered cost of equity for BCC?

b. What are the free cash flows and interest tax shields for the first 5 years?

c. What is BCC's horizon value of interest tax shields and unlevered horizon value?

d. What is the value of BCC's equity to VolWorld's shareholders if BCC has $300,000 in debt outstanding now?

|

How much will it cost to build a 90-foot tower

: A person hired a firm to build a CB radio tower.The firm charges $100 for labor for the first 10 feet. After that, the cost of the labor for each succeeding 10 feet is $25 more than the preceding 10 feet. That is, the next 10 feet will cost $125, ..

|

|

Depict a sheme o both reactions inlcuding structures

: draw a sheme o both reactions inlcuding structures and names of all possible products of monosubustitution only. Choose one reaction and provide appropriate mechanism including all resonance strucutres.

|

|

Evaluate the hardness values

: How long will it take for 100% pearlite to form at 650 °C and at 600 °C? Estimate the hardness values resulting from these transformations.

|

|

What number of brochures are the costs the same

: For what number of brochures are the costs the same for both companies?

|

|

What is the unlevered cost of equity for bcc

: What is the unlevered cost of equity for BCC and what are the free cash flows and interest tax shields for the first 5 years?

|

|

Find the probability of passing

: A quiz cosists of 10 multiple-choice questions, each with 4 possible answers. For someone who makes random guesses for all of the answers, find the probability of passing if the minimum passing grade is 60 %.

|

|

Find the length of the field

: Find the length of the field, to the nearest tenth, that will give the entire field a maximum area if 414 m of fencing is available.

|

|

Compute the ph at the equivalence point

: (a) How many mL of KOH will it take to reach the equivalence point? (b) Calulate the pH at the equivalence point. The Ka of HClO is 3.8x10^-8

|

|

Find the probabilities that the driver will pick up

: A taxi driver knows from past experience that the number of fairs he will pick up during an evening is a random variable which has the mean 25.6 and S.D 4.2 .Find the probabilities that the driver will pick up.

|