Reference no: EM131306792

Quiz Three

The Demand for Resources

Complete the following table:

|

Units Of Resources

|

TP

|

MP

|

Price $2

|

TR

|

ARP

|

MRP

|

|

1

|

17

|

|

$2

|

_____

|

_____

|

|

|

|

|

_______

|

|

|

|

_____

|

|

2

|

31

|

|

$2

|

_____

|

_____

|

|

|

|

|

_______

|

|

|

|

_____

|

|

3

|

43

|

|

$2

|

_____

|

_____

|

|

|

|

|

_______

|

|

|

|

_____

|

|

4

|

53

|

|

$2

|

_____

|

_____

|

|

|

|

|

_______

|

|

|

|

_____

|

|

5

|

60

|

|

$2

|

_____

|

_____

|

|

|

|

|

_______

|

|

|

|

_____

|

|

6

|

65

|

|

$2

|

_____

|

_____

|

|

1. What is the MRP from the 4th to 5th worker

a. 14

b. 2.5

c. 2

d. 5

2. What is the Total Revenue of the firm with one worker hired

a. 14

b. 17

c. 28

d. 34

3. What is the Average Revenue Product of the 6th worker

a. 65

b. 21.67

c. 10

d. 24

Use the Chart Below

A. Assume the cost of labor is $10 per person per day. Calculate the TRC and MRC per day.

B. Assume the cost of labor is $20 per person per day. Calculate TRC' and MRC" per day.

|

Units Of Resources

|

Wage Rate

|

TRC

|

MRC

|

Wage Rate

|

TRC'

|

MRC'

|

|

1

|

$10

|

_____

|

|

$20

|

_____

|

|

|

|

|

|

_______

|

|

|

_____

|

|

2

|

$10

|

_____

|

|

$20

|

_____

|

|

|

|

|

|

_______

|

|

|

_____

|

|

3

|

$10

|

_____

|

|

$20

|

_____

|

|

|

|

|

|

_______

|

|

|

_____

|

|

4

|

$10

|

_____

|

|

$20

|

_____

|

|

|

|

|

|

_______

|

|

|

_____

|

|

5

|

$10

|

_____

|

|

$20

|

_____

|

|

|

|

|

|

_______

|

|

|

_____

|

|

6

|

$10

|

_____

|

|

$20

|

_____

|

|

Questions 4-6 are based on the table above.

4. What is the value of TRC' at the 6th unit of resource?

a. 60

b. 80

c. 120

d. 140

5. What is the Value of MRC at the $10 wage rate?

a. 10

b. 20

c. 30

d. 40

6. What type of labor market does the table above represent?

a. Monopsony

b. Monopoly

c. Union

d. Purely Competitive

7. Which of the following statements best explains why we can say that demand for a factor input is a "derived" demand.

a. The demand for the factor inputs is based on the demand for the final product.

b. The demand for the factor input is based on the productivity of the factor inputs

c. The demand for the factor inputs is developed from the relative availability of the factor inputs

d. The demand for the factor inputs is based on the changes in demand resulting from advanced technology

8. Which of the following statements best describes the relationship between "marginal product" and "diminishing returns"?

a. Increasing marginal product is indicative of diminishing returns from increasing the units of resource

b. Decreasing marginal product reflects diminishing returns from increasing the units of resource

c. Decreasing marginal product is the result of diminishing returns from decreasing the units of resource.

d. Decreasing marginal product reflects diminishing returns from the units of resource, which are always constant.

9. Which of the following best accounts for the shape of the resource demand curve in imperfect competition?

a. A factor demand curve will have an initial positive slope due to the increase in demand for a product

b. A factor curve will have a downward slope due to the slope of the demand curve for the final product

c. A factor demand curve will be downward sloping due to the diminishing returns associated with factor productivity and the downward slope of the demand curve for the final product.

d. A factor demand curve has a shape, which depends solely on the shape of the demand curve for the final product.

10. Select from the alternatives below the one that correctly completes the following sentence: "Since the demand for butter is _________ because of the availability of margarine, the demand for the resource factors that produce butter tends to be _________".

a. Elastic; Inelastic

b. Elastic; Available

c. Elastic; Elastic

d. Inelastic; Inelastic

11. Which of the following is not a justification for studying resource pricing?

a. Resource pricing influences the size of individual income

b. Resource prices allocate scarce resources

c. Resources represent a cost to the firm

d. Resources bring equality in a competitive market

12. The circular flow model helps explain

a. The price and quantity of goods and services

b. The price and quantity of the factors of production

c. The interaction of households and businesses in the product and resource markets

d. All of the above

13. The MRP curve is the

a. Demand curve for the competitive seller

b. Demand curve for the imperfectly competitive seller

c. Demand curve for the market

d. All of the above

14. Which of the following will cause a change in resource demand?

a. The rate of decline of MP

b. Productivity changes

c. A change in the wage rate

d. The percentage of total production costs

15. The least cost approach states that:

a. When given a specific output, the least - cost approach will also be the profit - maximizing combination.

b. The profit-maximizing combination will also be the least-cost approach

c. The least-cost approach is a separate formula and therefore, independent of the profit-maximizing combination

d. To maximize profits, a firm must maximize the number of inputs.

16. A firm is producing 100 pencils per week. The production process requires labor and capital as inputs. Labor costs $6 per labor hour and capital costs $12 per machine hour. Currently, the marginal product of labor is 18 pencils and the marginal product of capital is 36 pencils. To minimize the cost of producing this level of output the firm should use:

a. More capital and less labor

b. More labor and less capital

c. Less labor and less capital

d. The current amounts of labor and capital

17. Marginal revenue product describes the:

a. Output produced by the last unit of labor employed

b. Revenue received for the last unit of output produced

c. Price a consumer paid for the last unit of output produced

d. Revenue received for the additional output produced by the last unit of labor employed

|

Workers

|

Total Revenue

|

|

1

|

$ 1,000

|

|

2

|

1,400

|

|

3

|

2,000

|

|

4

|

1,600

|

|

5

|

800

|

18. Refer to the above table. What is the marginal revenue product of the third worker?

a. $600

b. $667

c. $400

d. $6000

19. Refer to the above table. What is the marginal revenue product of the fifth worker?

a. $160

b. $400

c. -$800

d. $2

20. Marginal resource cost is:

a. The increase in variable costs resulting from producing one more unit of output

b. The increase in fixed costs resulting from producing one more unit of output

c. The same as the marginal cost of the product

d. The same as the resource price when a firm is acquiring the resource in a purely competitive market.

Questions 21-24 are based on the below table

|

Units of Resource

|

Total Production

|

|

1

|

24

|

|

2

|

42

|

|

3

|

54

|

|

4

|

64

|

|

5

|

72

|

21. Refer to the above table. If the product the firm produces sells for a constant $2 per unit, the marginal revenue product of the third unit of the resource is:

a. $6

b. $12

c. $18

d. $24

22. Refer to the above table. If the firm's product sells for a constant $2 and the price of the resource is a constant $16, the firm will employ how many units of the resource?

a. 5

b. 4

c. 3

d. 2

23. Refer to the above table. If the firm can sell 24 units of output at a price of $1.00 and 42 units of output at a price of $0.80, the marginal revenue product of the second unit of the resource is:

a. $5.40

b. $7.80

c. $9.60

d. $12.20

24. Refer to the above table. If the firm can produce 24 units at a price of $1.00, 42 units at a price of $0.80, and 54 units at a price of $0.60, then the firm is:

a. Selling in a purely competitive market

b. Selling in an imperfectly competitive market

c. Minimizing its costs at a product price of $1.00

d. Maximizing profits at a product price of $0.60

|

Units of X

|

Marginal Product

|

|

1

|

10.0

|

|

2

|

9.9

|

|

3

|

8.8

|

|

4

|

7.7

|

|

5

|

6.6

|

|

6

|

5.5

|

|

7

|

4.4

|

|

8

|

3.3

|

|

9

|

2.2

|

25. Under pure competition the market price of an output is $3. The output schedule of a firm using input X is listed in the table above. If the price of input X is $12, how many units of input X will the firm employ to maximize profits?

a. 4

b. 5

c. 7

d. 9

Table below shows the cost of a revenue schedule for a Monopsonist

|

Quantity of Labor Supplies

|

Wage Rate

|

TRC

|

MRC

|

MRP

|

|

1

|

3.02

|

_____

|

|

|

|

|

|

|

_____

|

14.25

|

|

2

|

3.04

|

_____

|

|

|

|

|

|

|

_____

|

14.20

|

|

3

|

3.06

|

_____

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150

|

6.00

|

_____

|

|

|

|

|

|

|

_____

|

9.02

|

|

151

|

6.02

|

_____

|

|

|

|

|

|

|

_____

|

9.00

|

|

152

|

6.04

|

_____

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200

|

7.00

|

_____

|

|

|

|

|

|

|

_____

|

7.00

|

|

201

|

7.02

|

_____

|

|

|

|

|

|

|

_____

|

6.90

|

|

202

|

7.04

|

______

|

|

|

Questions 26 & 27 are based on the above table

26. What is the TRC at a wage rate of 3.04?

a. 2.00

b. 3.04

c. 3.06

d. 6.08

27. What is MRC at a quantity of labor going to 201 laborer?

a. .02

b. 11.02

c. 1411.02

d. 11.06

28. According to the marginal productivity theory of resource demand, the labor-demand schedule for a producer selling in a purely competitive market is:

a. The same as the marginal resource cost schedule

b. The same as the marginal productivity schedule

c. The same as the marginal revenue product schedule

d. Independent of the value of the product being produced

The following table is for a purely competitive market for resources.

|

Number of Workers

|

Total Product

|

Product Price ($)

|

|

0

|

0

|

3

|

|

1

|

16

|

3

|

|

2

|

26

|

3

|

|

3

|

34

|

3

|

|

4

|

40

|

3

|

|

5

|

44

|

3

|

29. Refer to the above table. At a wage rate of $23 per worker, the firm will choose to employ:

a. 2 workers

b. 3 workers

c. 4 workers

d. 5 workers

30. Refer to the above table. How many more workers will the firm hire when the wage rate is $15 instead of $30?

a. 1 worker

b. 2 workers

c. 3 workers

d. 4 workers

31. Refer to the above table. If the product price increases from $3 to $4, then at the wage rate of $15, the firm will hire:

a. 2 workers

b. 3 workers

c. 4 workers

d. 5 workers

32. The labor demand curve of a firm that sells its product in a purely competitive market:

a. Is horizontal or perfectly elastic

b. Is down-sloping and flatter than the labor demand curve of a firm that sells its product in an imperfectly competitive (or monopolistic) market

c. Is up-sloping

d. Is down-sloping and steeper than the labor demand curve of a firm that sells its product in an imperfectly competitive (or monopolistic) market

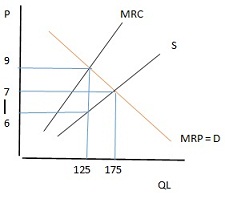

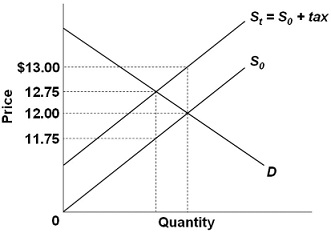

Questions 33 - 38 are based on the above graph.

33. In equilibrium, the perfectly competitive employer will pay a wage rate of:

a. $4

b. $6

c. $7

d. $9

34. In equilibrium, the perfectly competitive employer will hire how many workers

a. 100

b. 150

c. 200

d. 175

35. In equilibrium, the Monopsonistic employer will pay a wage rate of

a. $4

b. $6

c. $7

d. $9

36. In equilibrium, the Monopsonistic employer will hire how many workers?

a. 100

b. 150

c. 200

d. 125

37. The amount of monopsonistic exploitation in the wage rate is

a. $1

b. $2

c. $3

d. $4

38. Under Bilateral Monopoly, the wage rate will be:

a. $2

b. $4

c. $6

d. Indeterminate range between $6-$9

|

(1) Number of Labor Units

|

(2) MRP of Labor

|

(3) Wage Rate

|

|

0

|

|

|

|

1

|

$ 21

|

$ 9

|

|

2

|

19

|

10

|

|

3

|

17

|

11

|

|

4

|

15

|

12

|

|

5

|

13

|

13

|

|

6

|

11

|

14

|

|

7

|

9

|

15

|

|

8

|

7

|

16

|

39. Refer to the above table and information. For maximum profits, how many labor-units will the monopsonist hire and what will be the wage rate paid?

a. 2 and $10

b. 3 and $11

c. 4 and $12

d. 5 and $13

|

Units of Labor

|

Total Output/Day

|

Price of Good ($)

|

|

2

|

20

|

$ 10

|

|

3

|

30

|

9

|

|

4

|

38

|

8

|

|

5

|

46

|

7

|

|

6

|

54

|

6

|

|

7

|

62

|

5

|

40. A firm's resource input, total output of labor, and product price schedules are given below. If labor is the only variable input, how much labor should the firm employ if the wage rate is $15 per day?

a. 3 units

b. 4 units

c. 6 units

d. 5 units

41. The concept of "wages" includes the following items, except:

a. Direct money payments like salaries and commissions

b. Bonuses and royalties

c. Amounts spent by workers

d. Fringe benefits like health insurance and paid leave

42. If the price level rises by 4 percent in a year and nominal wages increase by 2 percent, then real wages will:

a. Decrease by 6 percent

b. Decrease by 4 percent

c. Decrease by 2 percent

d. Increase by 2 percent

43. Nominal monthly wages increase from $1,500 to $1,800 while the price level increases by 4 percent. The percentage change in real monthly wages is about:

a. 10 percent

b. 12 percent

c. 14 percent

d. 16 percent

44. Which of the following has not been a major factor contributing to the high productivity of labor in the United States?

a. High wage rates

b. Technological advancement

c. Education and training of workers

d. High levels of capital investment

45. The consumer price index is 113 in Year 1 and 118 in Year 2. The nominal wage rate is $8 in Year 1 and $9 in Year 2. What is the approximate percentage change in the real wage rate from Year 1 to Year 2?

a. 2 percent

b. 4 percent

c. 6 percent

d. 8 percent

46. A firm finds that it must increase wages to attract extra workers. The firm will hire labor up to the point where the marginal:

a. Product of labor equals the wage rate

b. Revenue product of labor is greater than the wage rate

c. Revenue product of labor starts to decline

d. Revenue product equals the additional cost of hiring an extra worker

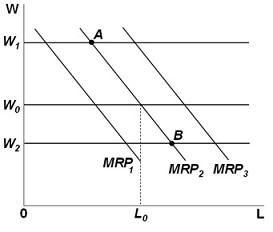

47. Refer to the above graph. Suppose that a competitive firm in long-run equilibrium along MRP2 faces a market wage rate of W0. If the price of the firm's product increases, other things remaining the same, the effect of this change in price would be to:

a. Increase the firm's demand for labor from MRP2 to MRP3

b. Decrease the firm's demand for labor from MRP2 to MRP1

c. Move along MRP2 from point A to point B

d. Move along MRP2 from point B to point A

48. Compared to a purely competitive firm, a monopsonist will pay:

a. A higher wage rate to its workers

b. Lower wages but hire more workers than the purely competitive firm

c. Lower wage rates and hire fewer workers than the purely competitive firm

d. Lower wages while hiring the same quantity of workers as the purely competitive firm

Monopsonist's employment schedule

|

Units of Labor

|

Wage Rate

|

|

9

|

$ 14

|

|

10

|

15

|

|

12

|

20

|

49. Refer to the above table. What is the total labor cost for 11 workers?

a. $100

b. $150

c. $198

d. $220

50. An industrial union:

A. Is most concerned with decreasing the supply of workers in an industry

B. Organizes workers with similar skills or jobs in an industry

C. Organizes skilled and unskilled workers in an industry

D. Is most effective in a purely competitive industry

51. Craft unions have typically been most effective in raising wage rates by:

A. Increasing the supply of labor

B. Increasing the demand for labor

C. Decreasing the supply of labor

D. Decreasing the demand for labor

52. The American Medical Association, a physicians' union, is a good example of a(n):

a. Demand-enhancing union

b. Craft union

c. Inclusive union

d. Industrial union

53. The best example of an industrial union is the:

a. United Association of Plumbers and Pipefitters

b. International Brotherhood of Electrical Workers

c. American Medical Association

d. United Auto Workers

54. Which of the following factors is not a typical cause of changes in land rent?

a. Demand for land

b. Supply of land

c. Prices of the products produced from the land

d. Prices of other resources employed along with land

55. Which of the following is not a source of loanable funds?

A. the saving of households

B. business saving

C. commercial bank lending

D. government budget deficits

56. If the interest rate is 15%, what is the future of value of $10,000 two years from now?

A. $13,225

B. $225

C. $13,000

D. $7,576

57. The largest single share of all income earned by Americans consists of:

A. Wages and salaries.

B. Interest.

C. Rents.

D. Corporate profits.

58. The average tax rate is the:

A. Sum of all individual tax rates

B. Tax rate paid by middle-income households

C. Total tax paid divided by a comparison base

D. Increase in taxes as a percentage of an increase in income

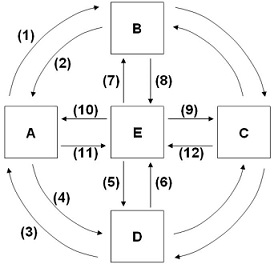

59. Refer to the diagram above. If box E represents government, box C businesses, and box A households, then flows (11) and (12) would represent:

a. Goods and services

b. Government expenditures

c. Resources

d. Net taxes

60. Refer to the diagram above. If box E represents government, box D the resource market, and box B the product market, then flows (5) and (7) represent:

a. Goods and services

b. Government expenditures

c. Resources

d. Net taxes

61. The marginal tax rate is the:

a. Sum of all individual tax rates

b. Tax rate paid by those with the lowest family incomes

c. Total amount of taxes paid as a percentage of total income

d. Increase in taxes as a percentage of an increase in income

|

Taxable Income

|

Total Tax

|

|

$ 15,000

|

$ 1,500

|

|

30,000

|

3,500

|

|

60,000

|

9,000

|

|

120,000

|

25,000

|

62. Refer to the table above. The average tax rate at the $60,000 level of income is:

a. 10.0 percent

b. 11.6 percent

c. 15.0 percent

d. 20.8 percent

63. What would be the Marginal Tax Rate from 30K to 60k?

a. 10%

b. 18.3%

c. 5%

d. 15%

64. Refer to the above table. As income increases, the average tax rate:

a. Increases

b. Decreases

c. Remains constant

d. Has no definite pattern

65. With a tax of $4,000 on $24,000 taxable income, the average tax rate is:

a. 16.67 percent

b. 20 percent

c. 23.45 percent

d. 25 percent

66. The progressive structure of the income-tax system is based on the:

a. Benefits-received principle

b. Principle of diminishing returns

c. Ability-to-pay principle

d. Principle that "taxes are the price we pay for civilization"

67. A tax structure is called progressive when:

a. The average tax rate decreases if income decreases

b. High-income groups pay more taxes absolutely than do low-income groups

c. The average tax rate on low-income groups exceeds the tax rate of high-income groups

d. The average tax rate is constant, but the absolute amount of taxes paid increases with income increases

|

Income

|

Tax A

|

Tax B

|

Tax C

|

Tax D

|

|

$ 10,000

|

$ 650

|

$ 1,000

|

$ 500

|

$ 1,000

|

|

20,000

|

850

|

2,000

|

1,000

|

3,000

|

|

30,000

|

950

|

4,000

|

1,500

|

6,000

|

|

40,000

|

1,050

|

6,000

|

2,000

|

9,5000

|

68. Answer the question on the basis of the following four tax schedules for the given base of taxable income. Which of the above tax schedules is a progressive tax schedule throughout?

a. A

b. B

c. C

d. D

69. If government levies a tax or fee on hunting licenses and uses the resulting revenue for wildlife stocking programs, this would be an example of:

a. A progressive tax

b. A regressive tax

c. The ability-to-pay principle of taxation

d. The benefits-received principle of taxation

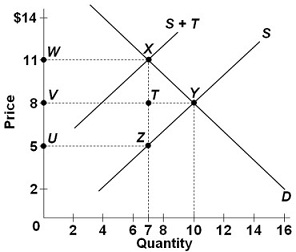

70. Refer to the above graph. What is the amount of the tax per unit of product?

a. $3

b. $5

c. $6

d. $8

71. Refer to the above graph. What was the price of the product before the tax was imposed, and what is the price with the tax?

a. $8 and $5, respectively

b. $11 and $8, respectively

c. $8 and $11, respectively

d. $5 and $8, respectively

72. Refer to the above graph. What is the area that represents the portion of the excise tax that is the burden to consumers?

a. WXTV

b. WXZU

c. VTZU

d. WXYZU

73. Refer to the above graph. What is the area that represents the total amount of tax revenue going to the government?

a. WXTV

b. WXZU

c. VTZU

d. WXYZU

74. Refer to the above graph. How much is the total amount of tax revenue going to the government?

a. $77

b. $80

c. $42

d. $56

75. Refer to the above graph. How much is the efficiency (or deadweight) loss due to the excise tax?

a. $6

b. $9

c. $18

d. $21

76. Refer to the above graph. It shows the supply curve for a product before tax (S0) and after an excise tax is imposed (S1). If 500 units of the product are sold after the tax is imposed, the amount of the tax borne by the consumer is:

a. $125

b. $250

c. $375

d. $500

77. If the taxes by state and local governments were combined with the Federal tax system, the overall tax structure in the U.S. would best be characterized as

a. Progressive

b. Highly regressive

c. Slightly regressive

d. Proportional

78. If the price elasticity of supply is 0 and the market demand curve is downward sloping:

a. The producer bears the full burden of a per unit tax upon the good.

b. The consumer bears the full burden of a per unit tax upon the good

c. The economic incidence of a per unit tax upon the good is borne by the consumer and the producer

d. Although the economic incidence is uncertain, a per unit tax upon the good will shift the supply curve leftward

79. A major distinction between government purchases and government transfer payments is that:

a. Government purchases divert resources from private uses to public uses while transfer payments do not

b. Transfer payments divert resources from private uses to public uses while government purchases do not

c. Government purchases have to be approved by Congress while transfer payments do not

d. Government purchases of goods and services have increased more rapidly during the past twenty years than have transfer payments.

80. Other things equal

a. workers with higher levels of human capital will tend to migrate to countries providing greater wage opportunities

b. workers with lower levels of human capital will tend to migrate to countries providing greater wage opportunities

c. smaller wage differences between countries will tend to increase the flow a immigration between countries

d. workers with higher levels of human capital will migrate to higher-wage countries regardless of the distance between countries

81. The U.S. Census Bureau estimates the number of illegal immigrants by subtracting the:

a. Sum of the past annual flows of legal immigrants from the past annual inflows of all immigrants

b. Current number of legal immigrants from the current total number of all immigrants

c. Current of legal immigrants from the past annual inflows of all immigrants

d. Sum of the past annual flows of legal immigrants from the current total number of all immigrants

82. Who tends to be generally very much against labor migration?

a. The migrant workers

b. The labor unions in the country of origin

c. The firms in the destination country

d. The labor unions in the destination country

83. Who tends to lose from labor migration?

a. The firms in the country of origin

b. The migrant workers

c. The firms in the destination country

d. The workers in the country of origin who did not migrate

84. As it relates to migration, self-selection is most likely to apply to:

a. Highly-skilled immigrants

b. Low-skilled immigrants

c. Highly-skilled domestic workers

d. Low-skilled domestic workers

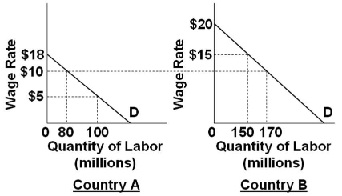

85. Refer to the above graphs. (Assume that the pre-migration labor force in Country A is 100 and that it is 150 in country B.) The migration of labor will:

a. Increase wages in country A and decrease wages in country B

b. Decrease wages in country A and decrease wages in country B

c. Decrease wages in country A and increase wages in country B

d. Increase wages in country A and increase wages in country B

86. Refer to the above graphs. (Assume that the pre-migration labor force in Country A is 100 and that it is 150 in country B.) The migration of labor will:

a. Increase domestic output in both countries

b. Decrease domestic output in both countries

c. Increase domestic output in country A and decrease domestic output in country B

d. Decrease domestic output in country A and increase domestic output in country B

87. Human capital refers to:

A. the accumulated knowledge and skills that allow a person to be productive.

B. machinery that requires extensive human interaction to be productive.

C. the accumulated financial assets of people.

D. all of these things.

88. A basic assumption of the two-nation production possibilities curves that are straight lines is that:

A. Opportunity costs are constant

B. Opportunity costs are increasing

C. Each nation is operating at a point inside its production possibilities curve

D. Each nation is operating at a point outside its production possibilities curve

89. Which is a valid counterargument to the call for higher tariffs to save U.S. jobs?

A. The need to protect U.S. workers from the dumping of foreign products

B. Strategic trade policy calls for equal treatment of all trading nations so that they will have the same competitive conditions

C. U.S. firms and workers must be protected from the ruinous competition of nations where wages for workers are low

D. Imports may eliminate some U.S. jobs, but they create others, so they may have little or no effect on employment

90. If there is no comparative advantage between two countries:

A. One country must be more productive in producing all goods than the other

B. The benefits resulting from trade are increased

C. There are no gains from specialization and trade

D. Each country should specialize in the production of a particular commodity

91. Import quotas:

a. Have the same effect on producers as export subsidies

b. Can be considered to be a form of voluntary export restraints

c. Require agreement between importing and exporting nations

d. Set the number of units of a product that can be imported

|

|

Wat's Production Possibilities

|

|

Product

|

A

|

B

|

C

|

D

|

E

|

F

|

|

Rice

|

750

|

600

|

450

|

300

|

150

|

0

|

|

Corn

|

0

|

50

|

100

|

150

|

200

|

250

|

|

|

Xat's Production Possibilities

|

|

Product

|

A

|

B

|

C

|

D

|

E

|

F

|

|

Rice

|

2,500

|

2,000

|

1,500

|

1,000

|

500

|

0

|

|

Corn

|

0

|

100

|

200

|

300

|

400

|

500

|

92. Refer to the data above. Which of the following statements about the two nations is correct based on the principle of comparative advantage?

a. Xat should specialize in the production of corn

b. Wat should specialize in the production of rice

c. Xat has a comparative advantage in the production of rice

d. Xat has a comparative advantage in the production of corn

93. Specialization and trade between individuals or between nations leads to:

a. Greater self-sufficiency

b. Higher product prices

c. Higher utilization of resources

d. Higher total output

94. Which organization meets regularly to establish rules and settle disputes related to international trade?

a. The United Nations Commission on Trade Law

b. The United Nations Conference on Trade and Development

c. The World Trade Organization

d. The World Economic Forum

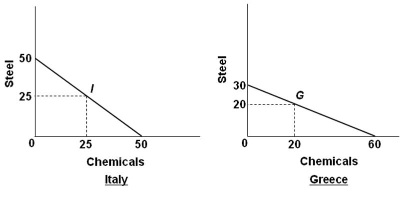

95. Refer to the graphs and information above. Assume that prior to specialization and trade, Italy and Greece preferred points I and G on their respective production possibilities curves. As a result of complete specialization according to comparative advantage, the resulting gains in total output will be:

a. 5 steel and 15 chemicals

b. 10 chemicals

c. 15 steel and 5 chemicals

d. 25 steel

|

Quality Demanded Domestically

|

Price

|

Quality Supplied Domestically

|

|

1,400

|

$ 10

|

2,200

|

|

1,600

|

9

|

2,000

|

|

1,800

|

8

|

1,800

|

|

2,000

|

7

|

1,600

|

|

2,200

|

6

|

1,400

|

|

2,400

|

5

|

1,200

|

96. Refer to the table above for a certain product's market in Econland. If the world price of the product were $6 and a tariff of $1 per unit were applied to imports of the product, then the total revenue (after tariff) going to domestic producers would be:

a. $11,200, and the total revenue (after tariff) going to foreign producers would be $2,800

b. $11,200, and the total revenue (after tariff) going to foreign producers would be $2,400

c. $8,400, and the total revenue (after tariff) going to foreign producers would be $2,800

d. $13,200, and the total revenue (after tariff) going to foreign producers would be $2,400

|

|

Meat Per Worker per Day

|

Houses Per Worker per Day

|

|

A

|

40

|

80

|

|

B

|

10

|

40

|

97. Refer to the table above. Based on the data provided, it can be deduced that:

a. Country A can produce more meat and houses than country B

b. Country A has a comparative advantage in producing houses

c. Country B has the absolute advantage in producing houses

d. Country B has a comparative advantage in producing houses

98. Tariffs and import quotas would benefit the following groups, except:

a. Consumers of the product

b. Domestic producers of the product

c. Workers in domestic firms producing the product

d. The government of the importing country

99. Answer the question on the basis of the following information: The equations for the demand and supply curves for a particular product are P = 10 - .4Q and P = 2 + .4Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 3 + .4Q. The equilibrium quantity before the excise tax is imposed is:

a. 800 units.

b. 1,000 units.

c. 1,200 units.

d. 1,400 units.

100. Answer the question on the basis of the following information: The equations for the demand and supply curves for a particular product are P = 10 - .4Q and P = 2 + .4Q, where P is price and Q is quantity expressed in units of 100. After an excise tax is imposed on the product, the supply equation is P = 3 + .4Q. The equilibrium quantity after the excise tax is imposed is:

a. 750 units.

b. 850 units.

c. 875 units.

d. 950 units.