Reference no: EM13497485

1.Acort Industries owns assets that will have an 80% probability of having a market value of $50 million in one year. There is a 20% chance that the assets will be worth only $20 million. The current risk-free rate is 5%, and Acort’s assets have a cost of capital of 10%.

a. If Acort is unlevered, what is the current market value of its equity?

b. Suppose instead that Acort has debt with a face value of $20 million due in one year. According to MM, what is the value of Acort’s equity in this case?

c. What is the expected return of Acort’s equity without leverage? What is the expected return of Acort’s equity with leverage?

d. What is the lowest possible realized return of Acort’s equity with and without leverage?

2.Wolfrum Technology (WT) has no debt. Its assets will be worth $450 million in one year if the economy is strong, but only $200 million in one year if the economy is weak. Both events are equally likely. The market value today of its assets is $250 million.

a. What is the expected return of WT stock without leverage?

b. Suppose the risk-free interest rate is 5%. If WT borrows $100 million today at this rate and uses the proceeds to pay an immediate cash dividend, what will be the market value of its equity just after the dividend is paid, according to MM?

c. What is the expected return of MM stock after the dividend is paid in part (b)?

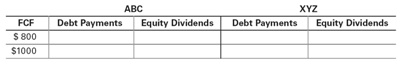

3.Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $5000 on which it pays interest of 10% each year. Both companies have identical projects that generate free cash flows of $800 or $1000 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year.

a. Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows.

b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows?

c. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows?

4.Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm, with 10 million shares outstanding that trade for a price of $22 per share. Omega Technology has 20 million shares outstanding as well as debt of $60 million.

a. According to MM Proposition I, what is the stock price for Omega Technology?

b. Suppose Omega Technology stock currently trades for $11 per share. What arbitrage opportunity is available? What assumptions are necessary to exploit this opportunity?

|

Find the magnitude of the force on the car from the rope

: A man is trying to get his car out of mud on the shoulder of a road. He ties one end of a rope tightly around the front bumper and the other end tightly around a utility pole a distance d away. What is the magnitude of the force on the car from the..

|

|

What is erins ordinary income for the current tax year

: What is Erins ordinary income for the current tax year and Advise ABC of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending in 31 March 2011.

|

|

Compare the accounting treatment of dividends

: Compare the accounting treatment of dividends appropriated from pre-control and post control equities of a subsidiary. Consider the accounting by the companies paying and receiving the dividend, as well as by the corporate group.

|

|

Compute the frequency of rotation

: What is the frequency of rotationA 10kg baby is perched at the rim of a 40kg disk. The disk rotates freely in a horizontal plane at 1 rev/s. What is the frequency of rotation in rev/s when the baby arrives at the center

|

|

What is the stock price for omega technology

: Suppose Alpha Industries and Omega Technology have identical assets that generate identical cash flows. Alpha Industries is an all-equity firm, with 10 million shares outstanding that trade for a price of $22 per share. Omega Technology has 20 millio..

|

|

In what direction should the aircraft head

: In what direction should the aircraft head?

|

|

Evaluate the radius of the path

: A charged ion has a mass of 2.5x10^-26 kg and charge 1.25x10^-19 C. Determine the radius of the path

|

|

Composition of planets detected outside the solar system

: Although there are a lot of ways to detect planets, can someone further expand on the techniques and methods used to determine the composition of planets detected outside the solar system ?

|

|

Find the indifference point

: Your current sales revenue in the new year is projected to be $505,000. Find the indifference point (the break even point of sales revenue at which the fixed rent and variable rent for a year are the same). Explain which alternative you would acce..

|