Reference no: EM132334020

Set Up and Operate A Computerised Accounting System Assignment - Quiz

Purpose of the Assessment - The purpose of this assessment is to assess the student in the following learning outcomes:

Element 1: Implement integrated accounting system

1.1 Implement general ledger, chart of accounts and subsidiary accounts in accordance with organisational requirements, procedures and policy.

1.2 Set up customers, suppliers and inventory items in system to meet organisational requirements and reporting requirements of goods and services tax (GST).

1.3 Use appropriate technical help to solve any operational problems.

Element 2: Process transactions within system

2.1 Collate, code and classify input data before processing.

2.2 Process wide range of cash and credit transactions in service and trading environment.

2.3 Use general journal to make any balance day adjustments for prepayments and accruals.

2.4 Regularly review system output to verify accuracy of data input and make adjustments for any detected processing errors.

2.5 Perform end of financial year rollover.

Element 3: Maintain system

3.1 Add any new general ledger accounts, customer, supplier, inventory and fixed asset records as required.

3.2 Maintain and update existing chart of accounts, customer, supplier, inventory and fixed asset records and subsidiary accounts.

3.3 Customise chart of accounts to meet reporting requirements of organisation.

Element 4: Produce reports

4.1 Generate reports to indicate financial performance and financial position of organisation and for GST purposes as required or requested.

4.2 Generate reports to ensure that subsidiary ledgers and accounts reconcile with general ledger.

4.3 Generate reports, which ensure that bank account reconciles with bank statement, over at least two reporting periods.

Element 5: Ensure system integrity

5.1 Regularly back-up system to ensure against loss or corruption of data.

5.2 Restore data from back-ups in event of loss or corruption of current data.

5.3 Maintain secure record of all processed transactions for audit purposes.

Instruction - Please answer all questions.

Quiz 1 -

Question 1 - In Accounting the golden rule is Asset = Owner's Equity + Liability. When we set up a new company in a computer system, this formula differs

Question 2 - MYOB is an ERP software

Question 3 - An accounting system involves the process of recording and posting business transactions during the accounting period, maintaining the accounts and reporting at the end of the period

Question 4 - Office supplies can remain in both ASSET and EXPENSE

Question 5 - I have to pay rent of $250 for next month. And I have recorded this transaction with the below journal entry,

Rent Expense Debit $250

Cash Credit $250

This journal entry correct.

Question 6 - A Chart of Accounts, (Select one or more)

i. Accountants can change accounts according to business requirements

ii. Itemizes accounts within classification

iii. None of the above

iv. Plays an important role in Accounting Computer System

v. Is a list of the accounts of a business

vi. Shows five classifications of Accounts

Question 7 - Which of the following is not a Non Current ASSET?

a. Building

b. Car

c. Land

d. Cash

Question 8 - ABC LTD has the following Chart of Accounts (Not Registered for GST).

1-1100 Cash

1-1200 Petty Cash

1-1300 Car

1-1400 Building

4-1100 Accounts Payable

6-1100 Office Supplies

After purchasing a $10 pen (Stationary), which account will you credit?

a. 1-1100 Cash

b. 6-1100 Office Supplies

c. 1-1300 Car

d. 4-1100 Accounts Payable

e. 1-1200 Petty Cash

Question 9 - If, ABC Ltd has the following asset and liability,

CAR $ 50000, Land $ 150000, Building $ 300000, Accounts Payable $ 300000

Calculate Equity for ABC LTD.

a. 800000

b. 300000

c. 200000

d. 150000

e. 50000

Question 10 - How many digits does an ABN number have?

a. 10

b.12

c. 7

d. 9

e. 11

Quiz 2 -

Question 1 - MYOB Command Centre, Select one or more:

a. You can move from one command centre to another by clicking these icons

b. The icons at the top of the window represent the various command centres in your software

c. The command centre is the central location for key functions, such as sales, purchases, banking and accounts

d. None of the above

Question 2 - MYOB Command Centre, Select one or more:

a. None of the above

b. The command centres represent key aspects of your business

c. The command centre gives you access to the To Do List, Reports, Analysis and transaction locating tools

Question 3 - Using Accounts command centre, we can do the following: Select one or more:

a. Process Purchase Order

b. Analyse your Balance Sheet and Profit and Loss

c. None of the above

d. Manage your accounts list

e. Examine the performance of your business

f. Prepare employee infromation

g. Complete BAS tasks

h. Enter journal entry adjustments

Question 4 - Using Banking command centre, we can do the following. Select one or more:

a. None of the above

b. Reconcile your accounts

c. Record payment of bills and expenses such as rent, electricity and petty cash.

d. Print cheques and remittance advices

e. Process invoice entry

f. Prepare bank deposits and electronic payments

g. Receive money into your business from sources such as the bank, investment income or loan

Question 5 - Using Sales command centre, we can do the following, Select one or more:

a. Invoice your clients and customers, and record payments received

b. Create quotes and orders that can be changed to invoices

c. All of the above

d. Can't print customer statements and receipts

e. Track outstanding customer balances-money owed to your business

Question 6 - Using Purchases command centre, we can do the following.

a. Track outstanding payables and reimbursable expenses

b. All of the above

c. Create quotes and make them recurring

d. Record purchases from and payments to your suppliers

e. Pay your suppliers electronically

f. None of the above

Question 7 - Using Inventory command centre, we can do the following, Select one or more:

a. Stocktake your inventory

b. Set item prices for different customer levels. (AccountRight Premier, AccountRight Enterprise and AccountEdge only).

c. Adjust levels and transfer inventory between different locations (AccountRight Enterprise and AccountEdge only)

d. Automatically build, buy or backorder items when required

e. None of the above

f. Print price lists, packing slips and shipping labels

g. Manage the items and services you buy, sell and inventory

Question 8 - Using Card File command centre, we can do the following,

a. Do mail merges for sending letters to many contacts at once

b. All of the above

c. Create cards for customers, suppliers, employees and personal contacts

d. Link cards to jobs

e. Link cards to a contact alert system

Question 9 - You can track the money you spend and receive in your software through the Banking command centre.

Question 10 - Which Layout is suitable for retail business?

a. Item

b. None of the above

c. Miscellaneous

d. Professional

e. Service

Quiz 3 -

Question 1 - What is the percentage of GST?

a. 9%

b. 10%

c. 30%

d. 11%

e. 15%

Question 2 - How do I calculate GST? Select one or more:

a. None of the above

b. Devide the net total by 11

c. Devide the net total by 10

d. Devide the sub total/ gross total by 10

e. Devide the sub total/ gross total by 11

Question 3 - If the total of $100 includes GST, how much is GST?

a. $9.09

b. $10.00

c. $90.90

d. $1

e. $9.90

Question 4 - Calculate the GST amount of $231.00 from the following purchase (price includes GST).

Laptop $110

Bag $110

Milk $11

a. $22.00

b. $12

c. $23.10

d. $1.00

e. $10.00

f. $21.00

g. $20.00

h. $11

Question 5 - Where should I check supplier's ABN, GST registration details. Select one or more:

a. Search in CPA Australia website

b. None of the above

c. Go to Australian Taxation Office (ATO) website, search for ABN Lookup

d. Go to Australian Business Register (ABR) Website, Click "Verify Business ABN Details", Fill ABN numbers or company name in the search filed

e. All of the above

Question 6 - AAAAA Pty Ltd has charged me GST in the invoice. I have checked supplier's ABN details and have found that AAAAA Pty Ltd is not registered for GST. What Should I do? (My company has a flexible policy, depends on my judgement) Select one or more:

a. Pay the full amount and request for a credit note of GST amount (to claim discount)

b. Or, pay the net amount and send a discrepancy notice

c. Or, notify supplier of their error, and request for a correct invoice, Hold payment until supplier send correct invoice (I have no discount period)

d. Or, do not pay at ale. Let the supplier comeback with the correct invoice. It's not my issue at all.

e. All of the above

f. Or, advise supplier to contact Australian Taxation Office or report to Austalian Taxation Office

g. None of the above

h. It's not possible, because AAAAA Pty Ltd is not registered for GST. They can't charge GST in their invoice

Question 7 - When you make taxable sales, your GST-registered customers will need tax invoices from you to claim their GST credits for purchases. When you my provide a tax invoice? Select one or more:

a. None of the above

b. Sales less than $75.00 (excluding GST)

c. Depends on my wish

d. Sales less than equal to $82.50 (including GST)

e. Sales more than equal to $82.50 (including GST)

f. For every sales I have to provide a tax invoice

g. Sales more than $75.00 (excluding GST)

h. Sales more than equal to $80.00 (including GST)

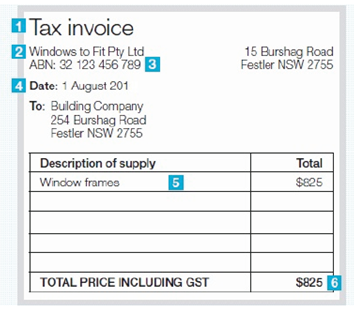

Question 8 - Is it tax invoice is a valid tax invoice (complied to ATO requirements)

a. It's a valid tax invoice

b. It's not a valid tax invoice

c. It meets partial requirements, so it is a valid tax invoice

d. None of the above

Quiz 4 -

Question 1 - For MYOB technical help / support, I can do the following, Select one or more:

a. Go to Online Help

b. Ask a question in Community Forum

c. Consult with a Certified Consultant

d. Use LiveChat with a MYOB consultant

e. Enrol at a Training Program to develop skill

Question 2 - I am using Windows XP operating system. Today I have upgraded my operating system to Windows 8. Is my MYOB software compatible to run into Windows 8? Select one or more:

a. Need to upgrade my MYOB

b. Yes

c. No

Question 3 - I have the below error massage while operating my MYOB software.

Termination Code 1100

How should I solve this?

a. Call your lawyer friend

b. Search in MYOB help menu

c. Call Receptionist

d. Ask manager / supervisor

Question 4 - To ensure Windows (and your compatible MYOB software) continues operating at its best, make sure you install all available 'Important" Windows updates. Is it true or false?

Question 5 - Every time I dose MYOB software, I have to do back up for security purpose. Is it true or false?

Question 6 - How much to deduct if supplier doesn't provide ABN (Australian Business Number)?

a. 46.50%

b. 30%

c. I do not trade with suppliers who doesn't provide ABN

d. 50%

e. 15%

Question 7 - Today is January 01, 201X and I have received an invoice from the supplier. I have a credit term of Net 14 days and 10% discount with an early payment of 7 days with this supplier. Which of the day below I can claim discount if I make a payment?

a. January 05, 201X

b. January 14, 201X

c. January 01, 201X

d. January 07, 201X

e. January 02, 201X

Question 8 - Today is January 24, 201X and I have received an invoice from the supplier. I have a credit term of Net 14 days and 5% discount with an early payment of 7 days with this supplier. Which is the invoice due date for payment?

a. February 07, 201X

b. February 14, 201X

c. February 01, 201X

d. January 24, 201X

e. February 17, 201X

Question 9 - Today is January 24, 201X and I have received an invoice from the supplier. I have a credit term of EOM 14 days and 5% discount with an early payment of 7 days with this supplier. Which is the invoice due date for payment?

a. February 17, 201X

b. January 24,201X

c. February 07, 201X

d. February 01, 201X

e. February 14, 201X

Question 10 - Today is January 01, 201X and I have received an invoice from the supplier. I have a credit term of net 14 days and 5% discount with an early payment of 7 days with this supplier. Which is the invoice due date for payment?

a. January 14, 201X

b. January 07, 201X

c. January 01, 201X

d. January 30, 201X

e. February 01, 201X

Question 11 - Today is January 01, 201X and I have received an invoice from the supplier. I have a credit term of EOM 14 days and 5% discount with an early payment of 7 days with this supplier. Which is the invoice due date for payment?

a. February 01, 201X

b. January 01, 201X

c. February 07, 201X

d. January 14, 201X

e. February 14, 201X

Quiz 5 -

Question 1 - What is the difference between Spend Money and Pay Bills? Select one or more:

a. Spend Money is a function of Banking Command Centre and Pay Bills is a function of Purchase Command Centre

b. We usually pay all purchase invoices using Pay Bills, not the expense invoices

c. None

d. Using Spend Money, We can make a payment and sales

e. If we are efficient, we can use Spend Money for all payments or invoices

f. We usually pay all expense invoices using Spend Money, not inventory purchase invoice

Question 2 - You can enter a purchase in,

a. Accounts Window

b. Purchases window

c. Bank Register window

d. Sales Window

Question 3 - A bill is, Select one or more:

a. Recording a bill will update the appropriate accounts, including the account for tracking payables

b. Usually created when you receive the items or services you ordered and are required to pay the supplier

c. None

d. Bills can be open (unpaid), closed (pad) or debit (negative purchase)

e. A bill cannot be changed to a quote or an order

Question 4 - You can use a receive item,

a. An accounts payable transaction is not recorded at this time. You can only record a received items transaction in the item layout, and only against an order

b. None of them are correct

c. Purchase to record the receipt of items you have ordered but have not yet been billed for

d. All statements are correct

e. When you record items received, the item is added to your inventory and the cost of the item is added to an accrual account for inventory items until you record a purchase for it

Question 5 - An order is, Select one or more:

a. An order can be changed to a bill but not a quote

b. Orders don't create transactions unless you have paid a deposit to the supplier

c. While orders do not affect your financial figures, they do affect your inventory levels

d. None

e. A purchase where no service or item has been received

Question 6 - You can enter a quote, Select one or more:

a. A quote has no impact on your inventory levels and can be changed to an order or a bill when you are ready to purchase

b. None

c. To keep a record of an estimate or quote you received from one of your suppliers

d. It's a purchase order

Question 7 - Which statement is true? Select one or more:

a. When customers make payments against invoices, you record the payments in the Receive Payments window

b. You can record the payments against one or more of the customer's outstanding invoices

c. If you don't want to create an invoice for a customer, you can enter the customer payment in the Receive Money window

d. a + d

e. If customers make payments when purchasing merchandise or services and you are issuing them an invoice, you can type the payment amount in the Paid Today field of the invoice

Question 8 - You can control credit by, Select one or more:

i. Adding finance charges to customer statements

ii. Placing customer accounts on hold

iii. Setting and enforcing customer credit limits

iv. a + b

v. a + c

Question 9 - To enter a Sales transaction, the steps are below (probably not in order)

a. Enter information about the customer

b. Choose the type of sale

c. Enter the items or services you are selling

d. Enter additional information about the sale

e. Complete the sale

Which one is the right order?

i. a c d e

ii. b c e d

iii. a d b c e

iv. a b c d e

v. a d e

Question 10 - Payment receipts correspond directly to receipt transactions. Is this statement true or false?

Quiz 6 -

Question 1 - To Print Profit and Loss Statement of Period ending 30 June 2013 for ABCD Ltd, which step you should follow, 1. Click to Report from any window 2. Click on accounts and click on report 3. Go to Account tab 4. Double Click on "Profit & Lose and done 5. Single Click on Profit & Loss and Click on 'Customise 6. Change the date range to match requirements 7. Click on Display 8. Click on Print Which is the correct sequence?

a. 1 3 4 8

b. 1 3 5 6 7 8

c. 1 2 3 4 5 6 7 8

d. 2 3 4 5 6 7 8

e. 2 3 5 6 7

Question 2 - Use the Bank Register to find, Select one or more:

a. Spend money

b. Receive payments

c. Pay bills

d. Receive money transactions

e. None

Question 3 - Use the "Item Register" to find. Select one or more:

a. Inventory item transactions for a particular date range

b. This includes adjustments, auto-build and other inventory transactions

c. None

Question 4 - To Print Balance Sheet for the period ending 30 June 2013 for ABCD Ltd, which step you should follow,

1. Click to Report from any window

2. Click on accounts and dick on report

3. Go to Account tab

4. Double Click on 'Standard Balance Sheet" and done

5. Single Click on "Standard Balance Sheet" and Click on "Customise"

6. Change the date range to match requirements

7. Click on Display

8. Click on Print

Which is the correct sequence?

a. 1 3 4 8

b. 1 2 3 4 5 6 7 8

c.1 3 5 6 7 8

d. 2 3 4 5 6 7 8

e. 2 3 5 6 7

Question 5 - To Print Bank Reconciliation Report on 30 June 2013 for ABCD Ltd. which step you should follow,

1. Click to Report from any window

2. Click on Banking and click on report

3. Go to Banking tab

4. Double Click on "Reconciliation Report" and done

5. Single Click on "Reconciliation Report" and Click on 'Customise"

6. Select the right bank accounts for reconciliation

7. Change the statement date according to bank statement and click on display

8. Click on Print

Which is the correct sequence?

a. 1 3 4 8

b. 2 3 4 5 6 7 8

c. 1 2 3 4 5 6 7 8

d. 1 3 5 6 7 8

e. 2 3 5 6 7

Question 6 - Use the 'Purchase Register to find. Select one or more:

a. Transactions relating to purchases (such as open and closed bills) quotes

b. Orders

c. Debits and returns

d. None

Question 7 - Use the "Sale Register" to find. Select one or more:

a. Transactions relating to sales (such as open and closed invoices) quotes

b. Orders

c. Credits and returns

d. None

Question 8 - Use the "Find Transactions Windows" to find. Select one or more:

i. Journal entries

ii. Sales

iii. Purchases

iv. Cheques

v. Deposits

vi. None

vii. i + ii

viii. i + ii + iv