Reference no: EM13343371

-A disadvantage of the corporate form of business entity is

a. unlimited liability for stockholders

b. corporations are subject to more governmental regulations

c. mutual agency for stockholders

d. the ease of transfer of ownership

-The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the number of shares outstanding?

a. 40,000

b. 70,000

c. 60,000

d. 50,000

-The Sneed Corporation issues 10,000 shares of $50 par value preferred stock for cash at $70 per share. The entry to record the transaction will consist of a debit to Cash for $700,000 and a credit or credits to

a. Preferred Stock for $700,000.

b. Paid-in Capital from Preferred Stock for $700,000.

c. Preferred Stock for $500,000 and Retained Earnings for $200,000.

d. Preferred stock for $500,000 and Paid-in Capital in Excess of Par Value-Preferred Stock for $200,000

-The date on which a cash dividend becomes a binding legal obligation is on the

a. date of record.

b. declaration date.

c. last day of the fiscal year end.

d. payment date.

-If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually with a face value of $100,000 will be

a. Equal to $100,000

b. Greater than or less than $100,000, depending on the maturity date of the bonds

c. Less than $100,000

d. Greater than $100,000

-The present value of $30,000 to be received in two years, at 12% compounded annually, is (rounded to nearest dollar)

a. $37,632

b. $23,916

c. $30,000

d. $23,700

The Marx Company issued $100,000 of 12% bonds on April 1, 2010 at face value. The bonds pay interest semiannually on January 1 and July

1. The bonds are dated January 1, 2010, and mature on January 1, 2014. The total interest expense related to these bonds for the year ended December 31, 2010 is

a. $9,000

b. $1,000

c. 12,000

d. $3,000

-Any unamortized premium should be reported on the balance sheet of the issuing corporation as

a. a direct deduction from the face amount of the bonds in the liability section

b. a direct deduction from retained earnings

c. as paid-in capital

d. an addition to the face amount of the bonds in the liability section

-Ruben Company purchased $100,000 of Evans Company bonds at 100 plus $1,500 in accrued interest. The bond interest rate is 8% and interest is paid semi-annually. The journal entry to record the purchase would be:

a. Debit: Investment in Bonds $100,000; Credit: Interest Revenue $1,500 and Cash $98,500

b. Debit: Investment in Bonds $101,500; Credit: Cash $101,500

c. Debit: Investment in Bonds $100,000 and Interest Receivable $1,500; Credit: Cash $101,500

d. Investment in Bonds $100,000; Credit: Cash $100,000

-Wendell Company owns 28% of the common stock of Porter Company and accounts for the investment using the equity method. Assuming that Wendell Company purchased the stock several years ago, the balance in the investment account would be equal to the cost of the

a. investment plus the total amount of dividends Wendell has received from Porter since the investment was purchased

b. investment plus Wendell's share of Porter's net income earned since the investment was purchased

c. investment plus Wendell's share of Porter's net income earned since the investment was purchased minus the total amount of dividends Wendell has received from Porter since the investment was purchased

d. investment only

-All of the following are factors contributing to the trend for regulators to adopt accounting principles using fair value concepts except:

a. pressure on regulators to adopt an international set of accounting principles and standards.

b. the ease of applying market values to assets and liabilities.

c. hybrid measurement methods within GAAP that conflict with each other.

d. a greater percentage of total assets existing as receivables and securities.

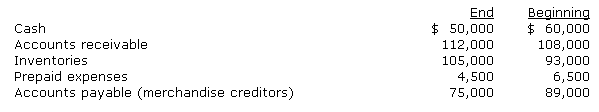

The net income reported on the income statement for the current year was $275,000. Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:

-What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

a. $352,000

b. $198,000

c. $324,000

d. $296,000

-A building with a book value of $ 46,000 is sold for $51,000 cash Using the indirect method, this transaction should be shown on the statement of cash flows as follows:

a. an increase of $46,000 from investing activities and an addition to net income of $5,000

b. an increase of $46,000 from investing activities

c. an increase of $51,000 from investing activities

d. an increase of $51,000 from investing activities and a deduction from net income of $5,000

-If a gain of $9,000 is incurred in selling (for cash) office equipment having a book value of $55,000, the total amount reported in the cash flows from investing activities section of the statement of cash flows is

a. $9,000

b. $46,000

c. $64,000

d. $55,000

-Which of the following below generally is the most useful in analyzing companies of different sizes

a. comparative statements

b. audit report

c. common-sized financial statements

d. price-level accounting

-A company with working capital of $500,000 and a current ratio of 2.5 pays a $85,000 short-term liability. The amount of working capital immediately after payment is

a. $85,000

b. $500,000

c. $585,000

d. $415,000

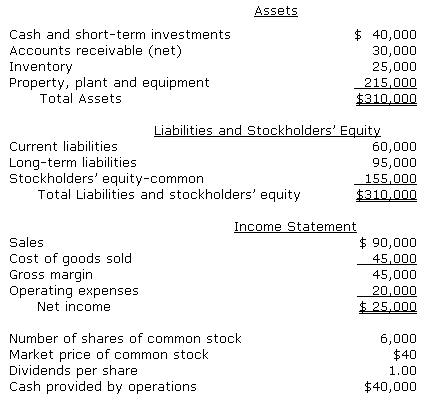

-The following information pertains to Newman Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the rate earned on total assets for this company?

a. 6.8%

b. 8.1%

c. 16.1%

d. 10.5%

Which of the following is required by the Sarbanes-Oxley Act of 2002?

a. A report on internal control.

b. A vertical analysis.

c. A price-earnings ratio.

d. A common-sized statement.