Reference no: EM131414055

Compute the net present value of the mold in Example 13.4, assuming that the debt capacity of the project is zero.

Example 13.4

Using the APV Method with the Certainty Equivalent Method

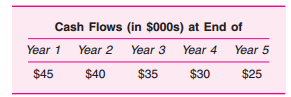

Emruss Ltd. is considering the purchase of a mold to make a new, improved dish drainer. The mold costs $150,000 and lasts five years, after which it has zero salvage value. Analysts estimate the expected unlevered cash flows to be $50,000 per year for the next five years and zero thereafter. The certainty equivalent cash flows, which tend to decline with the horizon when the expected cash flows are constant, are given in the table below:

The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the NPV of this investment if the risk-free rate is 5 percent?

|

Briefly describe the global health issue

: Briefly describe the Global Health issue and its impact on the larger health care system (i.e., continents, regions, countries, states, and health departments)

|

|

Is the fault in themselves or their settings

: While your beloved English instructor is very low on Symbolism, as you well know, it's inescapable in both Things Fall Apart and Heart of Darkness. For the purpose of this essay, focus on the symbolism of light and dark in both novels. How does it..

|

|

Compute the effect of the adoption of this project

: Use the risk-neutral valuation method to directly show that the risk-neutral discounted value of the existing debt of Unitron is $636,000 higher if the project in Example 13.17 is adopted.

|

|

What other descriptive statistic should be included and why

: BUS 308- Why is the average alone not enough information to make informed judgements about the result? What other descriptive statistic should be included? Why?

|

|

What is the npv of this investment

: The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the N..

|

|

Gasoline production function

: Firms often face the problem of allocating an input in fixed supply among different products. Find theoptimal crude oil allocationfor the following example if the profit associated with square foot of fiber is cut to $0.375, while the profit asso..

|

|

What is the primary purpose of health care regulations

: Create a 9-slide Microsoft PowerPoint presentation answering the following question: What is the primary purpose of health care regulations and regulatory agencies

|

|

What is the net present value of this project

: The company's discount rate for the unlevered cash flows associated with this new product is 18 percent and the tax rate is 40 percent. What is the net present value of this project?

|

|

Federal reserve is operated by appointed officials

: Compare two scenarios: One where the Federal Reserve is operated by appointed officials (as it is now and always has been) and one where the officials are elected every 4 years. Discuss the short and long run ramifications of each scenario. Keep a..

|