Reference no: EM13492259

1.For the assumptions in part (a) of Problem 5, assuming a cost of capital of 12%, calculate the following:

a. The break-even annual sales price decline.

b. The break-even annual unit sales increase.

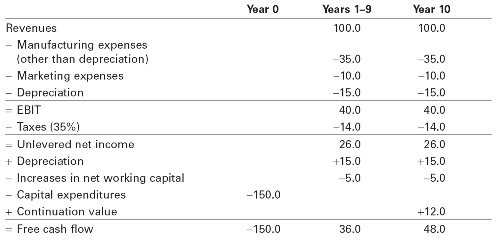

2.Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental free cash flow projections (in millions of dollars):

a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight trucks?

b. Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV if revenues are 10% lower than forecast?

c. Rather than assuming that cash flows for this project are constant, management would like to explore the sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would like to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per year every year starting in year 2. Management also plans to assume that the initial capital expenditures (and therefore depreciation), additions to working capital, and continuation value remain as initially specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 5% per year rather than by 2%?

d. To examine the sensitivity of this project to the discount rate, management would like to compute the NPV for different discount rates. Create a graph, with the discount rate on the x-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV?

|

How fast is the roller coaster traveling

: A roller coaster at an amusement park has a dip that bottoms out in a vertical circle of radius r. how fast is the roller coaster traveling at the bottom of the dip

|

|

Find an adjusting entry for each transaction

: Find an adjusting entry for each transaction. If none is required, explain why. Prepare a corrected income statement for the year, including earnings per share.

|

|

Explain write the net cell equation

: For the following electrochemical cell Cu(s)|Cu2 (aq, 0.0155 M)||Ag (aq, 1.50 M)|Ag(s) write the net cell equation. phases are optional. do not include the concentrations

|

|

What is the energy of the scattered photon

: In particular, if a 2.000Å (.2nm) photon interacts with the bound electron in an hydrogen atom (binding energy 13.6 eV) with a Compton collision. What is the energy of the scattered photon

|

|

What is the npv if revenues are 10% lower than forecast

: Based on input from the marketing department, Bauer is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% hi..

|

|

Compute the mass of iodine that will react

: Calculate the mass of iodine that will react completely with 40.0 g of aluminum (Al) to form aluminum iodid (AH3)

|

|

Determine the kinetic energy of the emitted electrons

: A collection of hydrogen atoms in the ground state is illuminated with ultraviolet light of wavelength 59.0 nm. Find the kinetic energy of the emitted electrons

|

|

What would jones company expect to incur

: At a volume of 10,000 units, Jones Company incurs $30,000 in factory overhead costs, including $10,000 in fixed costs. Assuming that this activity is within the relevant range.

|

|

What is his rate of oxygen consumption

: The oxygen taken in by the body reacts with fats, carbohydrates, and protein, liberating energy internally at a rate of about 1.96×104 J/Liter. what is his rate of oxygen consumption

|