Reference no: EM13343566

Part -1 -Select a company you are interested in and obtain a copy of its most recent annual report(Panera Bread). Keep this report for use throughout this book. Based on the information in this report, answer the following questions:

A. What type of business is this company (service, merchandising, or manufacturing)?

B. Does the company conduct business internationally?

C. What are the company's primary products and/or services?

D. Who is the chief executive officer of the company?

E. Who is the auditor for the company?

F. Did the company have positive or negative income during the period?

G. What are the total assets at the end of the most recent period?

H. What are the total liabilities at the end of the most recent period?

I. What are the cash flows from operating activities for the most recent period?

J. What are the current, return on sales, and debt-to-equity ratios for the most recent period?

-Refer to C1.1. Based on your knowledge of this company, describe its revenue, expenditure, and conversion (if applicable) processes.

Part -2

- P3.2-Forster is estimating costs for the last half of the year based on activity during the first half of the year. The results from January through June are as follows:

|

Month

|

Units

|

Production Costs

|

|

January

|

3,500

|

$ 56,700

|

|

February

|

6,200

|

81,800

|

|

March

|

4,600

|

69,800

|

|

April

|

12,500

|

128,900

|

|

May

|

8,100

|

95,800

|

|

June

|

9,800

|

122,100

|

- Required:

- A. Using the high/low cost estimation method, determine the total variable cost per unit made.

- B. Using the high/low cost estimation method, determine the total fixed cost per month.

- C. What is the cost estimation equation?

- D. Estimate the total cost if 11,000 units are made during July using the equation developed in part (C).

- E. Why are the high and low points chosen based on units?

Top of Form

Bottom of Form

Part -3

- On December 29, 2009, Wolfe Company ships $100,000 of merchandise by common carrier to the Audio Midwest Company. The terms of the sale are 2/15, n/30, FOB destination. It takes five days for the merchandise to arrive at Audio Midwest. Wolfe and Audio Midwest have December 31 year-ends. Which company should report the merchandise on their balance sheet? Why?

- Refer to E3.1. What is the available sales/purchase discount? When is it available?

- On December 30, 2009, Parker Company ships $250,000 of merchandise by common carrier to Jackson, Inc. The terms of the sale are 2/10, n/60, FOB shipping point. It takes four days for the merchandise to arrive at Jackson, Inc. Both Parker and Jackson have December 31 year-ends. Can Parker report a sale on its income statement for fiscal 2009? Why?

- Refer to E3.3. What is the available sales/purchase discount? When is it available?

- Eddie Bauer accepts Visa, MasterCard, Discover, and American Express as well as its own Eddie Bauer charge cards. Assume that Visa and MasterCard charge a 1.8 percent processing fee while Discover and American Express charge a 3.5 percent processing fee. During the period, the following charge card sales occurred at a particular Eddie Bauer store (no payments were made by customers):

|

Visa

|

$ 8,650

|

|

MasterCard

|

10,625

|

|

Discover

|

6,175

|

|

American Express

|

2,130

|

|

Eddie Bauer

|

25,843

|

- What is the net amount of cash received from charge sales during the period?

- E3.6LO 1 Shea, a regional jewelry store, issues its own charge cards to customers. It bills its customers on the first day of every month for purchases made during the previous month. In addition, Shea accepts Visa and MasterCard, both of which charge a 1.8 percent processing fee. The following sales were made during the period:

|

Visa

|

$ 5,490

|

|

MasterCard

|

3,401

|

|

Shea card

|

10,980

|

|

Cash sales

|

2,695

|

|

Sales paid by check

|

6,400

|

What is the net amount of cash received from the sales made during the period (assume 10% NSF checks)?

- E3.7LO 2 Trollinger is an automotive parts retail store. It sells motor oil, oil filters, automotive batteries, and other automotive equipment. Assume that activity is defined as the number of products sold. Identify each of the following costs as variable, fixed, or mixed. Use V for variable, F for fixed, and M for mixed.

________ A. Cost of automotive batteries

________ B. Wages paid to employees who deliver parts to customers

________ C. Cost of shelving for the showroom

________ D. Utilities: water, electricity, and heat

________ E. Freight paid to receive parts from the warehouse

________ F. Insurance paid on shipments from the factory to Trollinger

________ G. Insurance paid on retail store

________ H. Computer costs for inventory maintenance

________ I. Wages paid to employees who wait on customers

________ J. Cost of oil

- E3.8LO 2 Leasure Locks is a hair styling salon. The following is a list of costs connected with the salon. Identify each of the costs as variable, fixed, or mixed. Assume that activity is measured as the number of customers. Use V for variable, F for fixed, and M for mixed.

________ A. Hair products sold to customers

________ B. Computer costs for inventory maintenance

________ C. Stylists' wages and commissions

________ D. Hair dryers

________ E. Combs, brushes, and miscellaneous hair supplies

________ F. Perming solution

________ G. Laundry service for towels and gowns

________ H. Shampoo and rinse

________ I. Utilities: water, electricity, and heat

________ J. Rent on the facilities

E3.9LO 2 Woznick offers clients a variety of legal services. Some clients pay Woznick a monthly retainer, while others are billed as services are rendered. Identify each of the revenues below as variable, fixed, or mixed. Use V for variable, F for fixed, and M for mixed. Activity is measured as the number of hours of legal service provided.

________ A. Nicky hires Woznick to handle her divorce. She is billed for the hours worked.

________ B. Paul hires Woznick for estate planning. He is billed a research fee plus time worked.

________ C. Michelle hires Woznick to handle her real estate transactions. This is an ongoing situation for which Michelle pays a monthly fee.

________ D. David hires Woznick for legal advice as he incorporates his business. Woznick charges David a flat fee to prepare the documents plus a fee per hours worked.

________ E. Katie hires Woznick to write a partnership agreement. Woznick charges a flat fee for this service.

________ F. Jason hires Woznick to obtain local permits to operate his business. Woznick bills Jason for time worked.

- E3.10LO 2 Duckworth is a manufacturing firm that makes ping-pong paddles. Each ping-pong paddle consists of a handle, a wooden paddle, and a rubber backing for the wooden paddle. As the paddles progress through the assembly process, workers attach the handles and glue on the rubber backing. Identify each of these costs as variable, fixed, or mixed. Use V for variable, F for fixed, and M for mixed. Activity is measured as the number of ping-pong paddles produced.

________ A. Cost of shipping crates

________ B. Cost of glue

________ C. Cost of wooden paddles

________ D. Production supervisor's salary

________ E. Cost of rubber backing for the ping-pong paddles

________ F. Utilities for the production facilities: water, electricity, and heat

________ G. Commission of sales personnel

________ H. Rent on production facilities

________ I. Wages of assembly workers

________ J. Cost of handles for the paddles

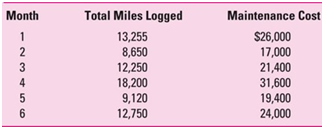

- E3.11LO 3Mitchem Fleet, Inc., has incurred the following maintenance costs on its fleet of taxicabs during the past six months. Use the high/low cost estimation method to determine the expected cost if 12,000 miles are logged in one month.

- E3.12LO 4 Refer to E3.11. These data were entered into a regression program, resulting in the following output. Use this output to determine the expected cost if 12,000 miles are logged in one month. What is the T statistic and what does it indicate?

|

Intercept

|

5013.585

|

|

X coefficient

|

1.473

|

|

R square

|

0.952

|

|

Standard error

|

0.1658

|

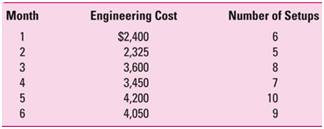

- E3.13LO 3 The engineering costs and the number of machine setups for each month during the first half of the year at Decklever Company follow. Using the high/low cost estimation method, determine the cost equation.