Reference no: EM1388454

Ques 1. What is the need of International Financial Management? List out the difference between domestic Finance & International Finance.

Ques 2. i) An investor has two options to choose from: a) $ 7000 after 1 year b)$ 10000 after 3years.Assuming the discount rate of 9% which alternative he should opt for?

ii) A person would need USD 5000, 6 years from now. How much should he deposit each year in his bank account, if yearly interest rate is 10 %?

Ques3. Zain corporation ltd is trying to decide on replacement decision of its current manually operated machine with a fully automatic version. The existing machine was purchased ten years ago. It has a book value of $ 140000 and remaining life of 10 years salvage value $40000. The machine has recently begun causing problems with breakdown and its costing the company $ 20000 per year in maintenance expenses. The company had been offered $ 100000 for the old machinery as a trade-in on the automatic model which has a deliver price of $ 220000. It is expected to have a ten year life & a salvage value of $ 20000. The new machine will require installation modifications costing $ 40000 to the existing facilities, but it is estimated to have cost savings in materials of $ 80000 per year. Maintenance costs are included in the purchase contract and are borne by machine manufacturer. The tax rate is 40 % .Find out the relevant cash flows

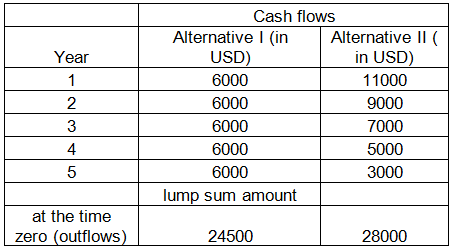

Ques 4. a) You have a choice of accepting either of two

Calculate the payback period and give your opinion that which project is better.

b) Why is the consideration of time important in financial decision making? How can time be adjusted?

Ques 5. Rico Ltd & Sico Ltd are in the same risk class & are identical in all respects except that the company Rico uses debt while company Sico does not use debt. The levered firm has USD 900000 debentures carrying 12 % rate of interest. Both the firms earn 20 % operating profit on their total assets of value USD 25 lacs. The company is in tax bracket of 35% & capitalization rate of 15% on all equity shares.

You are required to compute the value of both the firms using Net Income approach.

|

Use the concepts of impulse and momentum

: If the mass of the child and sled is 40 {rm kg}, what average force do you need to apply to stop the sled? Use the concepts of impulse and momentum.

|

|

Effective communicable disease control

: How is public apathy a serious challenge to effective communicable disease control? How is the stigma associated with serious diseases and the social hostility a challenge to effective communicable disease control?

|

|

Find the maximum number of amino acid

: Sidney Brenner discussed that the code was non overlapping because he considered that coding restrictions would occur if it were overlapping.

|

|

Relationship between height and doing gymnastics

: Based on a study of heights of men and women who do gymnastics, a researcher concludes that the exercise from playing gymnastics causes people to become shorter. Do you agree with this conclusion?

|

|

What is the need of international financial management

: What is the need of International Financial Management? List out the difference between domestic Finance & International Finance.

|

|

Find the mass of planet z

: A 1.80Kg brick is sliding next to on a rough horizontal surface at 13.5m/s .If the brick stops in 4.80, how much mechanical energy is lost.

|

|

What is the current density in the wire

: A 4.00 {rm A} current runs through a 12 gauge copper wire (diameter 2.05 {rm mm}) and through a light bulb. Copper has 8.5 times 10^ {28} free electrons per cubic meter.

|

|

Epidemic or pandemic potential

: Critically discuss ten diseases which have Epidemic or Pandemic potential, and for which quarantine, or related isolation methods are recommended control measures.

|

|

Forecast phenotypes and phenotypic ratios

: Blue skin color in smurfs is controlled by two independent biochemical pathways. Pathway one has two enzymatic steps under the control of gene A and gene B respectively

|