Reference no: EM131097089

1. You are a manager in a perfectly competitive market. The price in your market is $35. Your total cost curve is C(Q)= 10+2Q+0.5Q2. (Note that MC= 2 + Q)

a. What level of output should you produce in the short run?

b. What price should you charge in the short run?

c. Will you make any profits in the short run?

d. What will happen in the long run?

e. How would your answer change if your costs were C(Q)=80+5Q+30Q2 ?

2. The Snow City Ski Resort caters to both out-of-town skiers and local skiers. The demand for ski tickets for each market segment is independent of the other market segments. The marginal cost of servicing a skier of either type is $12. Suppose the demand curves for the two market segments are:

Out of town: Qo = 60 - P

Local: Ql = 60 - 2P

a. If the resort charges one price to all skiers, what is the profit-maximizing price? Calculate how many lift tickets will be sold to each group. What is the total profit?

b. Which market segment has the highest price elasticity at this outcome? Explain.

c. If the company sells tickets at different prices to the two market segments, what is the optimal price and quantity for each segment? What are the total profits for the resort?

d. What techniques might the resort use to implement such a pricing policy? What must the resort guard against, if the pricing policy is to work effectively? Explain effective pricing strategies.

3. A small fitness center offering only personal training services has the following demand and cost parameters:

Demand: The fitness center has found that it has some discretion in pricing - that is, it can raise price marginally without drastic reductions in volume. Based on statistical estimates of demand, and assuming external factors stay constant (e.g. price of competitors' services, income levels, etc.), the following relationship exists between the hourly rate for a personal training session (P), and the number of sessions demanded per day (Q):

P = 140 - Q

Costs: The fitness center finds that its variable costs (e.g. labor) increase at a constant rate of $40 with each additional training session provided per day. Fixed costs such as rent total $200 per day. This yields the following total variable cost (TVC) and Total Fixed Cost (TFC) equations:

TVC = 40Q

TFC = 200

a. What is the approximate minimum number(s) of personal training sessions needed to break even (earn zero total profit).

b. Find the price and quantity demanded (P and Q) that maximize total profit.

c. What is the maximum possible profit?

4. Wet-n-Wild Indoor Water Park offers family fun year-round in the Northstar state to locals and out-of-state visitors to the nearby Mall of America. The demand for day-passes to the water park for each market segment is independent of the other market segment. The marginal cost of providing service to each visitor is $5 per day. Suppose the daily demand curves for the two market segments are:

Local: QL = 3000 - 200P or P = 15 - 0.005 · QL

Out-od-town: QO = 3000 - 100P or P = 30 - 0.01 · QO

a. If Wet-n-Wild Indoor Water Park charges one price to all visitors, what is the profit maximizing price? How many day-passes will be sold per day?

b. If Wet-n-Wild Indoor Water Park charges one price to locals, what is the profit maximizing price for locals? How many day-passes will be sold per day to locals?

c. If Wet-n-Wild Indoor Water Park charges one price to out-of-towners, what is the profit maximizing price for out-of-town guests? How many day-passes will be sold per day to out-of-town guests?

d. Compare the prices from uniform pricing to the prices from price discrimination.

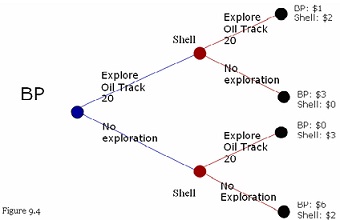

5. Refer to the Figure the payoffs to each firm (in billions) are listed on the following diagram and an extensive form game between BP and Shell. BP has 20% of the U.S. gasoline market share and Shell has 16% market share. BP and Shell are attempting to determine whether to send geologists to explore Oil Track 20.

a. Is there a dominant strategy for Shell? What is the dominant strategy, if any, for Shell?

b. What is the Nash equilibrium or equilibria in this game?

c. What is a first-mover advantage? Does BP have a first-mover advantage in this game?

d. Use the above information to advise BP on whether they should pursue a merger with Shell.