Reference no: EM13687342

Q1 (Delta Hedging):

On Sept 30th, 2011, Exxon Mobil (XOM) stock was traded at $72.63 while the December XOM put option with $75 exercise price is traded at $5.00 and the December XOM call option with $70 exercise price is traded at $5.60. The put option's delta is -0.65 and the call option's delta is 0.7.

A) On October 3rd, XOM stock price changed to $71.15 on Oct 3rd, what will be the values of the put and call options?

B) Consider a portfolio composed of:

1,005 XOM stocks

20 Dec XOM Call options

37 Dec XOM Put options

What is the portfolio position delta?

C) Using the portfolio position delta, calculate the portfolio value before AND after the stock price change.

|

Exercise Price |

Option Premium |

| Call Option #1 |

$10/bbl |

$11.00 |

| Call Option #2 |

$15/bbl |

$6.50 |

| Call Option #3 |

$20/bbl |

$5.00 |

| Call Option #4 |

$25/bbl |

$3.00 |

| Call Option #5 |

$30/bbl |

$1.00 |

| Call Option #6 |

$35/bbl |

$0.75 |

Q2 (Risk Profile)

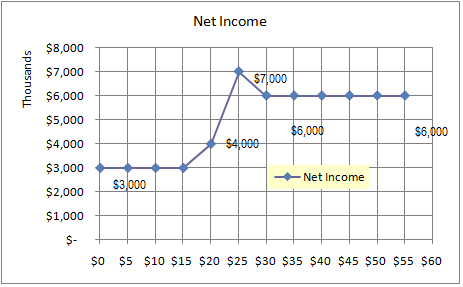

The ABC Oil Company is exposed to the fluctuations of the crude oil price. The risk profile of its net income for the current fiscal year as a function of the crude oil price (spot on March 15, 2001) is given in the graph. The company wishes to make its income independent of the crude oil price using the call options with various exercise prices as indicated in cells [I3:J9]. The contract size of the option is 1000 barrel of crude oil and the net income is in thousands.

A) What is the appropriate hedging strategy using call options?

B) What is the cash flow of the hedging strategy? Indicate whether or not the cash flows will be positive or negative for the ABC company.

C) What is the level of income with the hedging strategy?

Q3 (Bull Spread)

AstraZeneca plc (AZN) stock was trading at $45 on August 3, 2011 and the following options prices are available:

SEPT 40 put - $1.50

SEPT 50 put - $6

SEPT 40 call - $6

SEPT 50 call - $1

A) What would you do to take a bull spread position using put options?

B) What is the net premium or cost of such a spread? Indicate whether you have to pay or to receive net premium.

C) What is the maximum gain possible on expiration?

D) What is the maximum loss possible on expiration?

E) What is the break-even point of AZN on expiration?

Q4 (Box Spread)

AstraZeneca plc (AZN) stock was trading at $45 on August 16, 2011 and the following options prices are available:

Sept 40 put - $1.50

Sept 50 put - $6

Sept 40 call - $6

Sept 50 call - $1

Consider a long box spread using AZN by buying a bull call spread and buying a bear put spread. Answer the following questions.

A) What is the cost of the bull call spread?

B) What is the cost of the bear put spread?

C) What is the value of the box spread on expiration date. Assume the expiration is on Sept 16?

D) If the risk-free annual interest rate is 4%, is there an arbitrage opportunity? If so, explain a strategy to profit from the market condition and show the amount of arbitrage profit from your strategy.

Q5 (Strangle)

AstraZeneca plc (AZN) stock was trading at $45 in AUG and the following options prices are available:

SEPT 40 put - $1.50

SEPT 50 call - $1

Consider a short strangle using AZN by selling one SEPT 40 put and one SEPT 50 call. Answer the following questions.

A) What is the maximum profit you would expect from the strangle?

B) What are the two break-even prices for AZN on expiration?

C) What is the maximum loss you might experience from the strangle?

D) The stock price declined to $39 on the expiration. What is the amount of profit or loss from the short strangle?