Reference no: EM13492315

1.A 30-year bond with a face value of $1000 has a coupon rate of 5.5%, with semiannual payments.

a. What is the coupon payment for this bond?

b. Draw the cash flows for the bond on a timeline.

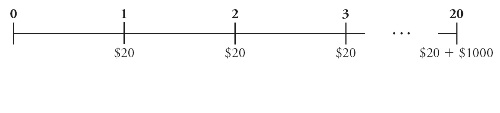

2.Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods):

a. What is the maturity of the bond (in years)?

b. What is the coupon rate (in percent)?

c. What is the face value?

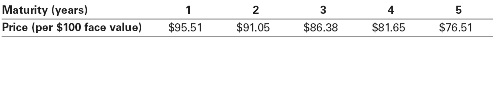

3.The following table summarizes prices of various default-free, zero-coupon bonds (expressed as a percentage of face value):

a. Compute the yield to maturity for each bond.

b. Plot the zero-coupon yield curve (for the first five years).

c. Is the yield curve upward sloping, downward sloping, or flat?