Reference no: EM131101191

BPC has decided to evaluate the riskier project at a 12 percent rate and the less risky project at a 10 percent rate.

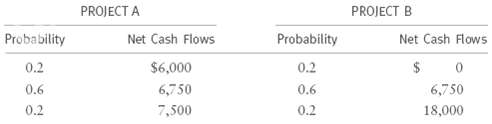

a. What is the expected value of the annual net cash flows from each project? What is the coefficient of variation (CV)? (Hint: =B = $5,798 and CVB = 0.76.)

b. What is the risk-adjusted NPV of each project?

c. If it were known that Project B was negatively correlated with other cash flows of the firm whereas Project A was positively correlated, how would this knowledge affect the decision? If Project B's cash flows were negatively correlated with gross domestic product (GDP), would that influence your assessment of its risk? BPC has decided to evaluate the riskier project at a 12 percent rate and the less risky project at a 10 percent rate.

a. What is the expected value of the annual net cash flows from each project? What is the coefficient of variation (CV)? (Hint: =B = $5,798 and CVB = 0.76.)

b. What is the risk-adjusted NPV of each project?

c. If it were known that Project B was negatively correlated with other cash flows of the firm whereas Project A was positively correlated, how would this knowledge affect the decision? If Project B's cash flows were negatively correlated with gross domestic product (GDP), would that influence your assessment of its risk?

|

Would this project be of high low average stand-alone risk

: Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk?

|

|

Explain how net operating working capital

: Explain how net operating working capital is recovered at the end of a project's life, and why it is included in a capital budgeting analysis.

|

|

What is the value of the stock today

: After Year 5, the company should grow at a constant rate of 8 percent per year. If the required return on the stock is 15 percent, what is the value of the stock today?

|

|

What is the expected irr for the x-ray scanner project

: What is the expected IRR for the X-ray scanner project? Base your answer on the expected values of the variables. Also, assume the after-tax "profits" figure you develop is equal to annual cash flows. All facilities are leased, so depreciation may be..

|

|

What is the expected value of the annual net cash flow

: BPC has decided to evaluate the riskier project at a 12 percent rate and the less risky project at a 10 percent rate. a. What is the expected value of the annual net cash flows from each project? What is the coefficient of variation (CV)? (Hint: =B ..

|

|

What is the project’s expected npv

: Shao Industries is considering a proposed project for its capital budget. The company estimates that the project's NPV is $12 million. This estimate assumes that the economy and market conditions will be average over the next few years. What is the p..

|

|

Should the firm accept the project if total costs consisted

: Should the firm accept the project? (Hint: The project is perpetuity so you must use the formula for perpetuity to find its NPV.) If total costs consisted of a fixed cost of $10,000 per year and variable costs of $95 per unit, and if only the variabl..

|

|

Should the spectrometer be purchased

: The spectrometer would have no effect on revenues, but it is expected to save the firm $25,000 per year in before tax operating cost, mainly labor. The firm's marginal federal-plus-state tax rate is 40%. If the project's cost of capital is 10%, shoul..

|

|

What is the net cost of the machine for capital budgeting

: What is the net cost of the machine for capital budgeting purposes? (That is, what is the Year 0 net cash flow?) What are the net operating cash flows in Years 1, 2, and 3? What is the terminal year cash flow? If the project's cost of capital is 12 ..

|