Reference no: EM13495559 , Length: 75

1. For Question I to IV, choose only one answer and explain the rationale in one or two sentences.

I. Which of the followingcontradicts the proposition that the stock market is weakly efficient?

a) An analyst is able to identify mispriced stocks by looking at stock charts.

b) Mutual funds do not outperform the market on average.

c) Some investorscan earn abnormal profits.

d) The autocorrelations of stock returns are not significantly different from zero.

II. Which of the following would provide the strongest evidence against the semi-strong form of the efficient market theory?

a. Fundamental analysis does not help generate abnormal returns.

b. Technical analysis is worthless in identifying mispriced stocks.

c. Stock prices response to firms' earnings announcements gradually.

d. Mutual fund managers do not beat the market on average.

III. A random walk occurs when

a) Stock price changes are random but predictable.

b) Stock prices respond slowly to both new and old information.

c) Past information is useful in predicting future prices.

d) Future price changes are uncorrelated with past price changes.

IV. Which of the following statements is true about the efficient market hypothesis?

a. It implies a rational market.

b. It implies that everyone makes zero profit from trading.

c. It implies perfect forecasting ability.

d. It implies that prices do not fluctuate.

2. Mr. Weissjustbought a zero-coupon bond issued by Risky Corp. for $870, with $1000 face value and one year to mature. He believes that the market will be in expansion with probability 0.9 and in recession with probability 0.1. In the event of expansion, Risky Corp. can always repay the debt. In the event of recession, the companywould fail to meet its debt obligation. The bondholders would recover nothing and completely lose their investment, should the firm default. A zero-coupon government bond with the same maturity and face value is selling at $952.38.Assume that the government never defaults. The expected value and the standard deviation of the return of the market portfolio are 15% and 30%, respectively. Risky Corp's bond return has a correlation of 0.67 with the market portfolio return. Assume that interest is compounded annually.

(a) Suppose Mr. Weiss holds the bond to maturity. What will behis holding period return if Risky Corp. does not default? What will be his holding period return if the firm defaults?

(b) What is the expected return of the Risky Corp. bond? Is the bond risky or riskfree? Explain.

(c) What is the YTM of the government bond? Is this YTM the riskfree rate? Explain.

(d) Compare the expected return of the Risky Corp. bond with the riskfree rate. Would a risk-averse investor buy the Risky Corp. bond at $870? Explain.

(e) The standard deviation of the return of the Risky Corp. bond is 34.48%.What is the beta of the bond? What would be the equilibrium expected return of the Risky Corp. bond if the CAPM holds? Does Mr. Weiss overvalue or undervalue the bondrelative to the CAPM?

(f) Suppose Mr. Weiss changes his mind and sells his Risky Corp. bond. He invests in a portfolio that allocates 50% of the money on the market portfolio, and the other 50% on the government bond. What are the expected value and the standard deviation of his portfolio return? Is his portfolio efficient? Explain.

3. Prices of bond futures can be used to access the market's expectations about future interest rates and therefore can be used as the basis for pricing other financialsecurities. A 10-year annual coupon bond with face value $1,000 is currently selling for $890. The futures price of this bond for delivery in 1 year is $831.5. The bond pays coupon of$80 annually. Assume that the coupon is paid before the delivery of the bond.

(a) What is the 1-year interest rate implied by the spot and futures prices of bonds? (Hint: Recall the PV formula of bond prices for a one-year horizon.)

(b) In the gold futures market, the spot price of gold is $1412 per ounce. There is no storage cost. What is the futures price per ounce of gold for delivery in one year? Suppose there is no uncertainty in interest rates.

(c) Suppose your friend Emily has also longed a forward contract on gold for delivery one year from now. But the contract was entered last year. The forward price she locked in was $1400. Clearly her contract is valuable now because the gold price has risen since last year, and no one is able to lock in such a low price now. What is the maximum amount you would pay now for having her contract? Does it violate the proposition that forward and futures contracts should have zero value at the time of initiation? Explain.

(d) A jewelry producer just received an order that is worth $1 million from a department store for gold necklaces to be delivered in 6 months. The producer will be paid in 6 months. He can't buy gold now because he can't affordthe storage cost. Suppose the gold necklaces can be produced instantaneously. What is the risk of the producer? What hedging strategy would you recommend to him? Explain briefly why the strategy would work.

4. Consider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%.

(a) What are the possible payoffs to the equityholders at date 1? What kind of financial product has the same payoffs? Please describe the detailed characteristics of the financial product.

(b) What are the possible payoffs to the bondholders at date 1? Are they riskfree? What kind of financial product/portfolio has the same payoffs? Please describe the detailed characteristics of the financial product/portfolio.

(c) What is the value of the debt at Date 0? What is the value of the equity at Date 0?

(d) Suppose the government announces that it guarantees the company's payment to the debtholders. How much is the government guarantee worth?

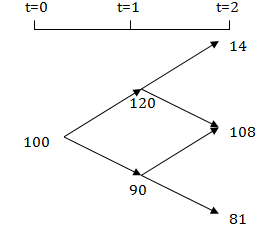

(e) Now we extend the model to a three-date setting. At both Date 1 and Date 2, it is equally likely that the value of the company increases by 20% or decreases by 10%, as depicted in the graph below. Suppose there is an American put option written on the entire firm with strike price 100. What is the value of this American put at Date 0?

Value of the firm in a three-date setting.

Note: This applies to part (e) only.

5. Trident Corporation is currently worth $1,000,000. Its current debt-to-value (D/V) ratio is 40%. The company is confident in meeting its debt obligation, and wants to introduce more debt to take advantage of the tax shield of interest payment. It is planning to repurchase part of the common stock by issuing more corporate debt. As a result, the firm's debt value is expected to rise from $400,000 to $500,000. The cost of debt is 10 percent per year. Trident expects to have an EBIT of $200,000 per year in perpetuity. Trident's tax rate is 50%.

a. What would be the market value of Trident Corporation if it were unlevered?

What would be the expected return on equity if Trident were an all-equity firm?

b. What is the expected return on the firm's equity before the announcement of the stock repurchase plan?

c. What is the value of equity after the announcement of the stock repurchase plan? How much money do the equityholders expect to receive each year under the new capital structure? What is the expected return on the firm's equity after the announcement?

d. How much does the value of the firm increase after the announcement? If the goal is to maximize the firm's value, would you recommend the CEO of Trident to borrow as much as they can? Please explain your rationale. Ignore the cost of financial distress and agency cost.

e. Now we consider the downside of debt borrowing: cost of financial distress and agency cost. The more debt there is, the more costly it could be when the firm fails to meet its debt obligation. Suppose the firm expects to incur an additional cost of $40,000 for this $100,000 increase in leverage. If the goal is to maximize the firm's value, would you recommend the CEO of Trident to proceed with this repurchase plan? Please explain your rationale.