Reference no: EM131306789

ASSIGNMENT 1

PART A

Question 1:-

SSSG Ltd. has just issued a dividend of $1.25 per share on their ordinary shares that have a face value of $1.00. Dividends have been increasing at a rate of 4%pa and this trend is expected to continue for another year. After that the growth rate is expected to be 6%pa for three years before settling down into the long term growth rate of 5%pa. If the market requires a return of 12%pa on these shares:

i. What is their current price?

ii. What is the expected price five years from now?

Please show workings for parts (i) and (ii).

Question 2:-

Three years ago, Batlow Ltd. issued 10 year $1,000 bonds with a 7% coupon rate paid semi-annually, at par value. The market currently requires a 9% yield.

i. What was the price of the bond at issue?

ii. What is the current price of the bond?

iii. If the market yield falls to 6% in two years time, what will the bond's price be at that time?

iv. Explain your results in (i) - (iii).

Please show workings for parts (i) to (iii).

Question 3:-

Comment on the following statements:

i. 'If after all your calculations you tell me that there is a high probability that the share's price will vary between $4.50 and $9.60, I can make a fortune by buying the share at $4.50 and selling when it reaches $9.60.'

ii. 'I don't care how high the price may go, all that worries me is whether or not I will make a loss.'

iii. 'Expected return and standard deviation are of no interest to me, all I want to know is what my investment will be worth one year from now.'

PART B - CASE STUDY

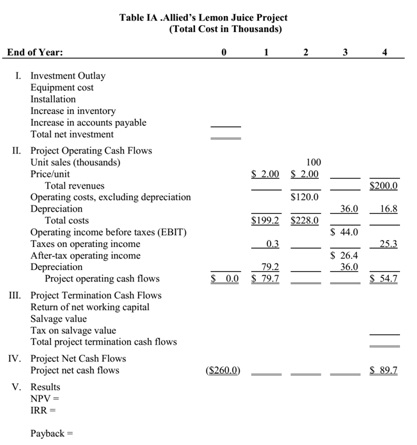

Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you recently hired as assistant to the director of capital budgeting and you must evaluate the new project.

The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plant; Allied owns the building, which is fully depreciated. The required equipment would cost $200,000, plus an additional $40,000 for shipping and installation. In addition, inventories would rise by $25,000, while accounts payable would increase by $5,000.All of these costs would be incurred at t = 0. By a special ruling, the machinery could be depreciated under the MACRS system as 3-year property. The applicable depreciation rates are 33%, 45%, 15%, and 7%.

The project is expected to operate for 4 years, at which time it will be terminated. The cash inflows are assumed to begin 1 year after the project is undertaken, or at t = 1, and to continue out to t = 4. At the end of the project's life (t = 4), the equipment is expected to have a salvage value of $25,000.

Unit sales are expected to total 100,000 units per year, and the expected sales price is $2.00 per unit. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60% of dollar sales. Allied's tax rate is 40%, and its WACC is 10%. Tentatively, the lemon juice project is assumed to be of equal risk to Allied's other assets.

You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. To guide you in your analysis, your boss gave you the following set of tasks/questions:

Question 1:-

Allied has a standard form that is used in the capital budgeting process. (See Table IA) Part of the table has been completed, but you must replace the blanks with the missing numbers. Complete the table using the following steps

(a) Fill in the blanks under Year 0 for the initial investment outlay.

(b) Complete the table for unit sales, sales price, total revenues, and operating costs excluding depreciation.

(c) Complete the depreciation data.

(d) Complete the table down to after-tax operating income and then down to the project's operating cash flows.

(e) Fill in the blanks under Year 4 for the terminal cash flows, and complete the project cash flow line. Discuss working capital. What would have happened if the machinery had been sold for less than its book value?

Question 2:-

(a) Allied uses debt in its capital structure, so some of the money used to finance the project will be debt. Given this fact, should the projected cash flows be revised to show projected interest charges? Explain.

(b) Suppose you learned that Allied had spent $50,000 to renovate the building last year, expensing these costs. Should this cost be reflected in the analysis? Explain.

(c) Suppose you learned that Allied could lease its building to another party and earn $25,000 per year. Should that fact be reflected in the analysis? If so, how?

(d) Assume that the lemon juice project would take profitable sales away from Allied's fresh orange juice business. Should that fact be reflected in your analysis? If so, how?

Question 3 :-

Disregard all the assumptions from Question 2, and assume there is no alternative use for the building over the next 4 years. Now calculate the project's NPV, IRR, and payback. Do these indicators suggest that the project should be accepted? Explain.

Question 4 :-

If this project had been a replacement rather than an expansion project, how would the analysis have changed? Think about the changes that would have to occur in the cash flow table.

ASSIGNMENT 2

PART A - CASE STUDY

Jason Ming was hired as an investment analyst by J.P. Green for the KL office based on his sound academic credentials. At the time of his appointment, he was told that one of his responsibilities would be to conduct education seminars for current and prospective clients.

The office manager asked Jason to prepare and present a seminar outlining the various implications of fixed income investments. As 60% of their investors aged over 55, it would not be difficult to convince them of the benefits of investing in bonds. However, they may need clarification regarding various terms and concepts associated with fixed income investing.

In preparation for the seminar, Jason found out that most customers were not very familiar about the bond features (like callability, convertibility, bond ratings and interest rate risk, etc.) apart from a good knowledge about the current level of interest rates and inflation. Most of them were keen to know more about the opportunities offered by bond investing. Jason downloaded current data for outstanding bonds of various maturities, rating, and coupon rates (see Table 1) and started preparing his PowerPoint slides.

|

Corporate Bond Information

|

|

Issuer

|

Face Value

|

Coupon late

|

Rating

|

2uotcd Price

|

Years until maturity

|

:all Period

|

|

Wcstpac Bank

|

51000

|

)%

|

AAA

|

SI80

|

20

|

N/A

|

|

Wcstpac Bank

|

S L000

|

5%

|

AAA

|

5760

|

20

|

3 Years

|

|

Coles Group

|

5100

|

3%

|

AA

|

SIOS

|

10

|

3 Years

|

|

Telco Utilities

|

SI00

|

10%

|

AA

|

5120

|

30

|

5 Years

|

You are required to answer the following questions 1 to 9. Your assignment will be graded based on presentation, good understanding and logical explanation, and accuracy of calculations in solving the problems. For numerical questions, you need to show sample workings in deriving the answers to be awarded full marks.

Answer ALL questions

1. How should Jason go about explaining the relationship between coupon rates and bond prices? Why do the coupon rates for the various bonds vary so much? Your analysis should highlight the interrelationship among the bond's face value, coupon rate, current yield and price. (Hint: use one of the bonds given in Table 1 to illustrate the relationships.)

2. How are the rating of these bonds determined? What happens when the bond ratings get adjusted downwards?

3. During the presentation one of the clients is puzzled why some bonds sell for less than their face value while others sell for a premium. She asks whether the discount bonds are a bargain. How should Jason respond?

4. What does the term "yield to maturity" (YTM) mean? Calculate the YTM for each bond listed in Table 1 assuming all coupon interest rates are paid quarterly.

5. What is the different between the "nominal" and "effective" YTMs for each bond? Which one should the investor use when deciding between corporate bonds and other securities of similar risk? Please explain.

6. Jason knows that the call period and its implications will be of particular concern to the audience. How should he go about explaining the effects of the call provision on bond risk and return potential.

7. How should Jason go about explaining the riskiness of each bond? Rank the bonds listed in Table 1 in terms of their relative riskiness and explain why.

8. One of Jason's best clients poses the following question, "If I buy 10 of each of these bonds, reinvest any coupons received at the rate of 6% per year and hold them until they mature, what will myrealised return to be on each bond investment?" How should Jason respond?

[Hint: Realised return = {(FV of reinvested coupons + Face Value)/Price of bond}1/n- 1]

9. Another client voices his concern, "Isn't it very risky to invest all my money solely in bonds? Should I spread my risk and invest in preference shares which offer a fixed periodic dividend?" How should Jason respond and explain to him the various features of preference shares?

PART B

Question 1 :-

(a) ‘Equity holders want 16% on their investment, whereas debt holders only require 8%. I wouldbe crazy to expand using equity since debt is so much cheaper.' Comment.

(b) Explain the trade-off between retaining internally generated funds and paying cash dividends. (7 marks)

Question 2 :-

A company's current capital structure comprises $400,000 of 8.5% fixed interest debt and 150,000 ordinary shares currently priced at $8.00 per share. The company's most recent annual profit before interest and tax was $214,000. The company needs to raise additional finance of $400,000 and is therefore considering raising the required funds either through a one-for-three rights issue or by borrowing the full amount at a fixed rate of 9%. The company pays tax at the rate of 30%.

(a) What are the company's current after-tax earnings per share (EPS)?

(b) If the company's dividend pay-out ratio is 100%, what is its after-tax cost (% per year to two decimal places) of equity?

(c) If the company's profit before interest and tax increases to $250,000 after raising the additional funds:

i. What would be the company's earnings per share if it had used the share alternative to raise the additional funds?

ii. What would be the company's earnings per share if it had used the debt alternative to raise the additional funds?

(d) Which of the two financing alternative would you recommend? Discuss the reasons to support your recommendation.

Question 3:-

The Murphy Motor Company (MMC) purchases raw materials on terms of '2/10, net 30'. A review of the company's records revealed that payments are usually made 15 days after purchases are received. It is the company's policy to not take advantage of its discounts as it only costs 2% for these funds, whereas a bank loan would cost the company 12%.

i. What mistakes is the company making?

ii. What is the real cost of not taking advantage of the discount?

iii. If the company could not borrow from the bank and were forced to resort to the use of trade credit funds, what suggestion might be made to MMC that would reduce the annual interest cost?