Reference no: EM13843849

Finance

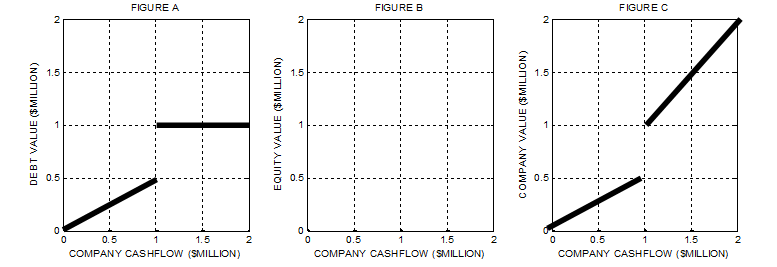

1. Give debt and firm value figure and ask to draw equity value.

2. Find the CAPM beta of the following stock, where RE is stock return, R ¯M is market return, R ¯E is average of stock returns, R ¯M is average of market returns, COV(RE, RM) is covariance between RE and RM, and VAR(RM) is variance of market returns.

CAPM beta = COV(RE, RM) / VAR(RM)=

|

Year

|

RE

|

RE-R ¯E

|

RM

|

RM-R ¯M

|

(RE-R ¯E) *

(RM-R ¯M)

|

(RM-R ¯M)2

|

|

1

|

0.2

|

|

-0.2

|

|

|

|

|

2

|

-0.2

|

|

0.2

|

|

|

|

|

3

|

0.4

|

|

0.4

|

|

|

|

|

4

|

-0.4

|

|

-0.4

|

|

|

|

|

|

|

R ¯E =

|

|

R ¯M =

|

COV(RE, RM)=

|

VAR(RM)

|

3. Currently, Hotel X has no debt (i.e., leverage=0). The CEO of Hotel X considers increasing leverage (=debt/(debt+equity)) 0.4. Currently, Hotel X's CAPM beta is 1.5. The cost of debt (RD) will be 10%, riskfree rate (RF) is 1%, and market return (RM) is 11%. Assume that the corporate tax rate (τ) is ZERO. Your task, as the CFO of Hotel X, is to provide the cost of capital under this proposed capital structure (i.e., 40% leverage).

3-1. The method to compute the cost of capital is called (____________________) cost of capital.

3-2. What is the CAPM beta under the proposed capital structure (i.e.,40% leverage)?

βE=[(D+E)/E] βA=

3-3. What is the cost of equity under proposed capital structure (i.e., 40% leverage)?

R_E=RF+βE (RM-RF )=

3-4. What is the cost of capital under the proposed capital structure (i.e., 40% leverage)?

RWACC=(1-τ) RD [D/(D+E)]+RE [E/(D+E)]=

|

Determine the required return for each company using capm

: Determine the expected return and standard deviation of the MVP consisting of funds S and B - Determine the required return for each company using the CAPM.

|

|

What is the risk of a stock out

: A manager is reordering lubricant when the amount on-hand reaches 422 pounds. Average daily usage is 45 pounds, which is normally distributed and has standard deviation of three pounds per day. Lead time is nine days. What is the risk of a stock out?

|

|

Potential supplier in another country

: Assignment #1: Study the following letter to be sent by a U.S. firm to a potential supplier in another country. Rewrite the letter using theBlock Format Style (Appendix B.2). Be sure to get rid of all the weaknesses that may cause troubles for i..

|

|

What would average inventory level-economic order quantity

: The manager of the Quick Stop Corner Convenience Store (which never closes) sells four cases of Stein beer each day. Order costs are $8.00 per order, and Stein beer costs $.80 per six-pack. If he were to order 16 cases of Stein beer at a time, what w..

|

|

What is the cost of equity under proposed capital structure

: What is the cost of equity under proposed capital structure (i.e., 40% leverage)? What is the cost of capital under the proposed capital structure (i.e., 40% leverage)?

|

|

Vision statement and mission statement

: Should organizations have both a vision statement and a mission statement? If you were to lead an organization and you could have only one, a mission or vision statement, which would you choose and why?

|

|

What are expected returns-standard deviation of portfolio

: Stock A has an expected return of 12% and a standard deviation of 40%. Stock B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between Stocks A and B is 0.2. What are the expected returns and standard deviat..

|

|

Common fallacies in organizational diagnosis

: Where are the weak points in your perspective and understanding and where are the weak points in your organization? How are these weak points linked to the common fallacies in organizational diagnosis?

|

|

Basic capital structure decisions made by corporation

: Without getting into too much personal detail, how does a firm’s capital structure relate to an individual’s capital structure? In what ways are they similar? Provide examples of how an individual might use debt and equity that parallels the basic ca..

|