Reference no: EM131139069

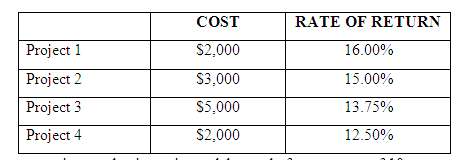

Adams Corporation has four investment opportunities with the following costs and rates of return:

The company estimates that it can issue debt at a before-tax cost of 10 percent, and its tax rate is 30 percent. The company can also issue preferred stock at $49 per share, which pays a constant dividend of $5 per year. The company's stock currently sells at $36 per share. The year-end dividend, D1, is expected to be $3.50, and the dividend is expected to grow at a constant rate of 6 percent per year.

The company's capital structure consists of 75 percent common stock, 15 percent debt, and 10 percent preferred stock.

What is the cost of each of the capital components (debt, preferred equity, and common equity)?

What is the WACC?

Which investments should the firm select if the projects are all of average risk?

What is the cost of each of the capital components (debt, preferred equity, and commonequity)?

|

Describe what is meant by the term book income

: Describe what is meant by the term book income? Which number in ZAGG's statement of operation captures this notion for fiscal 2012? Describe how a company's book income differs from its taxable income.

|

|

Is the theory designed for short- or long-term counseling

: What will be the goals of counseling and what intervention strategies are used to accomplish those goals? Is the theory designed for short- or long-term counseling? What will be the counselor's role with this client? What is the client's role in coun..

|

|

How you will develop a robust business continuity plan

: As a security manager at a large facility, you have been tasked with developing a business continuity plan. - How will you develop the plan using the knowledge management process?

|

|

Do the 1981 applicants have greater gre scores than previous

: In the past, 20% of applicants for admission into a master's program had GRE scores above 650. Of the 88 students applying to be admitted into the program in 1981, 22 had GRE scores above 650. Do the 1981 applicants have greater GRE scores than pr..

|

|

What is the cost of each of the capital components

: What is the cost of each of the capital components (debt, preferred equity, and common equity)? What is the WACC? Which investments should the firm select if the projects are all of average risk?

|

|

Brief synthesis and conclusion of the material presented

: A brief synthesis and conclusion of the material presented (one page). A critical evaluation and summation of three current (no older than five years) research articles on Turner's Syndrome (one to two pages).

|

|

Find the marginal cost for the company

: Based on this information, find the following: The marginal cost for the company. The marginal revenue for the company

|

|

Cost of preferred stock capital

: If Ink were to sell new preferred stock, it would pay $4 per share as flotation cost. Ink’s tax rate is 40%. What is Ink’s? 1. After tax cost of debt capital? 2. Cost of preferred stock capital? 3. Cost common stock? 4. Cost of capital?

|

|

Which is likely to produce more varied meals

: Mary plans the entire week's meals for her family, while Fred shops each day. Which is likely to produce more varied meals? What is this effect called?

|