Reference no: EM131234945

Financial Management Assignment

PART 1

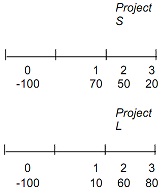

Assume that for a car manufacturer, Chrysler Ford. Your boss, the chief financial officer, has just handed you the estimated cash flows for two proposed projects. Project L involves adding a new item to the firm's ignition line; it would take some time to build up the market for this product, so the cash inflows would increase over time. Project S involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 3-year lives, because Chrysler is planning to introduce entirely new models after 3 years.

Here are the projects net cash flows (in thousands of dollars):

|

Expected after-tax

|

|

|

net cash flows (CFt)

|

|

Year (t)

|

Project S

|

Project L

|

|

0

|

($100)

|

($100)

|

|

1

|

70

|

10

|

|

2

|

50

|

60

|

|

3

|

20

|

80

|

Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows.

The CFO also made subjective risk assessments of each project, and he concluded that both projects have risk characteristics which are similar to the firm's average project. Chrysler's weighted average cost of capital is 10%. You must no determine whether one or both of the projects should be accepted.

Required

Evaluate the projects using the 5 key techniques: (1) payback period, (2) discounted payback period, (3) net present value, (4) internal rate of return, and (5) modified internal rate of return.

Identify those projects that will lead to the maximization of the firm's stock price.

Part 2

Critically appraise the appraisal techniques above. Discuss their limitations, the social and ethical factors that should also be considered when making such decisions.

Part 3

Multiple Choice Questions and Short Answers

Please attempt all answers.

Q1. Which of the following is correct? The bid quote represents the rate at which

1. the dealer will buy foreign currency from you.

2. the dealer will sell foreign currency to you.

3. you can buy the foreign currency from the dealer.

4. None of these

Q2. Sole proprietorship is an owner's only business.

False

True

Q3. Which of the following is correct? A stakeholder is

1. anyone geographically close to the firm's headquarters.

2. Anyone with a claim on the cash flows of the firm.

3. any governmental agency

4. All of these.

Q4. Which of the following is correct? Corruption in business

1. creates inefficiencies in an economy.

2. inhibits growth in an economy.

3. slows the rate of economic growth in a country.

4. all of these

Q5. Which senior executive, when he or she is guilty of serious misconduct, can subject the firm to the most serious losses in financial wealth?

1. Chief Technology Officer

2. Chief Financial Officer

3. Chief Risk Officer

4. Chief Executive Officer

Q6. Which of the following is correct? With regard to information, a central idea of fairness suggests that

1. outsiders should not be allowed to trade since, by definition, they are at a disadvantage.

2. insiders should never be able to trade.

3. decisions should be made on an even playing field.

4. insiders should be able to trade whenever they want.

Q7. Which of the following is correct? Secondary financial markets are similar to

1. direct auction markets.

2. new-car markets.

3. used-car markets.

4. all of these.

Q8. Which of the following is correct? The ease with which a security can be sold and converted into cash is called

1. convertibility.

2. book value.

3. marketability.

4. none of these.

Q9. Which is the following indices is not a broad market average index?

1. CAC-40

2. DAX

3. FTSE 100

4. Amex Oil Index

Q10. Use the following table to calculate the expected return for the asset.

Return Probability

0.10 0.25

0.20 0.50

0.25 0.25

What is the asset's expected return?

1. 20.00%

2. 18.75%

3. 17.50%

4. 15.00%

Q11. Use the following table to calculate the expected return for the asset.

Return Probability

0.05 0.10

0.10 0.15

0.15 0.50

0.25 0.25

What is the asset's expected return?

1. 12.50%

2. 15.75%

3. 13.75%

4. 16.75%

Q12. The return distribution for an asset is as shown in the following table. What are the missing values if the expected return is 10 per cent?

Return Probability

0.10 0.25

X 0.50

X 0.25

1. 0.20

2. 0.15

3. 0.10

4. None of these.

Q13. Explain the difference between systematic and non-systematic risk.

Q14. Which of the following is correct? In computing the NPV of a capital budgeting project, one should NOT

1. estimate the cost of the project.

2. ignore the salvage value.

3. make a decision based on the project's NPV.

4. discount the future cash flows over the project's expected life.

Q15. Which of the following is correct? The net present value

1. uses the discounted cash flow valuation technique.

2. will provide a direct measure of how much the firm value will change because of the capital project.

3. is consistent with shareholder wealth maximisation goal.

4. All of these.

Q16. Which of the following is correct? Disadvantages of the payback method include the following.

1. It ignores the time value of money.

2. It is inconsistent with the goal of maximising shareholder wealth.

3. It ignores cash flows beyond the payback period.

4. All of these.

Q17. Which one of the following statements about IRR is NOT true?

1. The IRR is the discount rate that makes the NPV greater than zero.

2. The IRR is a discounted cash flow method.

3. The IRR is an expected rate of return.

4. None of these.

Q18. Which of the following is correct? When estimating the cost of debt capital for the firm, we are primarily interested in

1. the cost of short-term debt.

2. the cost of long-term debt.

3. the coupon rate of the debt.

4. none of these.

Q19. Which of the following is correct? The recommended model to estimate the cost of ordinary shares for a firm is

1. a one-stage constant growth model.

2. a multistage growth model.

3. the CAPM.

4. none of these.

Q20. Which of the following is correct? Disadvantages of going public include all EXCEPT

1. The transparency that results from this compliance can be costly for some firms.

2. The costs of complying with ongoing listing and disclosure requirements.

3. The high cost of the IPO itself.

4. Managers' tendency to focus on long-term profits.