Reference no: EM131659269

Assignment -

This assignment consists of 4 questions. These questions will involve doing calculations, and will require written explanations of the answer derived from these calculations. You must show your calculations and how you came up with your answers in order to receive marks.

Question 1 -

Part a) Assume the following facts about a firm:

Annual cost to maintain lock box $1,500

Cost to process each cheque $0.15

Average amount of each cheque received $1,500

Number of cheques received per year 4,000

Interest rate on borrowed funds 8.0%

How many days of float would a lock box system need to save to be justified?

Part b) QWERTY Computer Manufacturing wants to price its new computer to earn a return of 60% on equity before interest and taxes. The computer has technological advantages that make management certain they can sell QWERTY's maximum production of 60,000 units per year at any reasonable price. The variable cost to build and sell a computer is $800, fixed costs are $5,500,000 per year, and the firm has $9,000,000 in its equity account. What is the minimum price QWERTY can sell the computer for and earn the return they want?

Question 2 -

Part a) Jackson Electronics inventories computer chips that cost $30.00 each. Inventory carrying cost is approximately 20% of value. It costs $40 to place, process, and receive an order. The firm uses 3,000 chips a year. What ordering quantity minimizes the sum of ordering and carrying cost?

Part b) Mathey, Inc. uses 4,000 cinder blocks a year. On average, the cinder blocks cost $14, and the annual cost of carrying one in inventory is $1.44. The cost of placing an order is $45. Use the economic order quantity model to determine annual, total inventory cost.

Part c) APPL, Inc. uses 10,000 litres of resin a year. On average, a litre of resin costs $43, and the annual cost of carrying one in inventory is $2.40. The cost of placing an order is $120. Use the economic order quantity model to determine annual, total inventory cost.

Part d) What is the approximate effective interest rate implied by not taking the discount when credit terms are 1/10, net 20?

Part e) Franklin Inc has a $20M revolving credit agreement with its bank at prime plus 3%. Prior to April, it had taken down $10M. On April 15, it took down another $5M. Prime is 9%, and the bank's commitment fee is 0.25% annually. Calculate Franklin's April interest charges.

Question 3 -

Part a) You have been assigned to estimate the interest rates that your company may have to pay when borrowing money in the near future. The following information is available.

kPR = 2%

MR = 0.1% for a 1 year loan increasing by 0.1% for each additional year

LR = 0.05% for a 1 year loan increasing by 0.05% for each additional year

DR = 0 for a 1 year loan, 0.2% for a 2-year loan, increasing 0.1% for each additional year

Expected Inflation Rates

Year 1 = 7%

Year 2 = 5%

Year 3 and thereafter = 3%

a. Calculate the inflation adjustment (INFL) for a 5-year loan.

b. Calculate the appropriate interest rate for a 5-year loan.

Part b) Olde-Style Baking Inc. manufactures gourmet baking products, and needs to borrow money to get through a brief cash shortage. Sales have been slow over the last few months and lenders have decided that the firm is risky. The CFO has asked you to estimate the interest rate Olde-Style should expect to pay for a one-year loan. Assume a 4% default risk premium, and assume liquidity and maturity risk premiums are each 1%. Inflation is expected to be 3% over the next twelve months. Economists believe the pure interest rate is currently about 4%.

Part c) BrandyWine Company just issued a two-year bond at 11%. Inflation is expected to be 2% next year and 3% the year after. BrandyWine estimates its default risk premium at about 1.8% and its maturity risk premium at about 1%. Because it's a relatively small and unknown firm, its liquidity risk premium is about 2% even on relatively short debt like this.

a. What is the average inflation rate over the two years?

b. What pure interest rate is implied by these assumptions?

Part d) Calculate the annual nominal rate (APR) in the following situations.

a. You borrow $1000 and repay $1110 in one year.

b. You lend $2,850 and are repaid $3,324.24 in two years.

c. You lend $920 and are repaid $2,015.83 in five years with quarterly compounding.

d. You borrow $20,500 and repay $29,330.76 in three years with monthly compounding.

Question 4 -

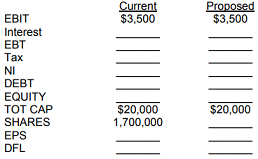

Part a) Southern Inc. has EBIT of $3,500,000, and total capital of $20,000,000 that is 15% debt.

There are 1,700,000 shares outstanding, which sell at book value. The firm pays 10% interest on its debt and is subject to a combined tax rate of 40%. Southern plans to restructure its capital to 60% debt.

a. Make a simple calculation that indicates whether at the current level of profitability more debt will enhance results? Draw a conclusion in fifteen words or less.

b. Calculate EPS, and DFL at the current and proposed structures using the following worksheet:

($000 except for EPS, DFL and Shares)

c. Use your results to point out two conflicting influences the change will have on share price.

Part b) Alasco Inc.'s fixed operating costs are $20.8 million and its variable cost ratio is 0.30. The firm has $10 million in bonds outstanding with a coupon interest rate of 9%. Revenues are $32.2 million. Compute Alasco's degree of total leverage (DTL).

Part c) New Generation Enterprises has an EBIT of $3.5 million, can borrow at 15% interest, and pays combined provincial and federal income taxes of 40%. It currently has no debt and is capitalized by equity of $20 million. The firm has 2 million shares of common shares outstanding that trade at book value.

Calculate New Generation's NI, ROE, and EPS currently and at capital structures that have 20%, 40%, 60%, and 80% debt.

Compare the EPS at the different leverage levels, and the amount of change between levels as leverage increases. What happens to the effect of more debt as leverage increases from a little to a lot?