Reference no: EM13343385

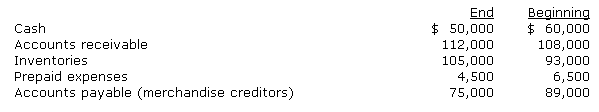

The net income reported on the income statement for the current year was $275,000. Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:

-What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

a. $352,000

b. $198,000

c. $324,000

d. $296,000

-A building with a book value of $ 46,000 is sold for $51,000 cash Using the indirect method, this transaction should be shown on the statement of cash flows as follows:

a. an increase of $46,000 from investing activities and an addition to net income of $5,000

b. an increase of $46,000 from investing activities

c. an increase of $51,000 from investing activities

d. an increase of $51,000 from investing activities and a deduction from net income of $5,000

-If a gain of $9,000 is incurred in selling (for cash) office equipment having a book value of $55,000, the total amount reported in the cash flows from investing activities section of the statement of cash flows is

a. $9,000

b. $46,000

c. $64,000

d. $55,000

-Which of the following below generally is the most useful in analyzing companies of different sizes

a. comparative statements

b. audit report

c. common-sized financial statements

d. price-level accounting

-A company with working capital of $500,000 and a current ratio of 2.5 pays a $85,000 short-term liability. The amount of working capital immediately after payment is

a. $85,000

b. $500,000

c. $585,000

d. $415,000

|

Calculate gauge pressure in feeder pipe at this point

: A drinking fountain projects water at an initial angle of 50 degrees above horizontal Water reaches maximum height of 0.150m above point of exit. Calculate gauge pressure in feeder pipe at this point

|

|

Cash flows from operating activities-indirect method

: Cash flows from operating activities-indirect method and Prepare a schedule of cash flows from operating activities using the indirect method.

|

|

Long term investments - adjusted to market and equity method

: Prepare a schedule of cash flows from operating activities using the indirect method- Explain your answers and show any calculations necessary to arrive at your answers.

|

|

What is the rate earned on total assets for this company

: Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

|

|

What is the amount of cash flows

: A building with a book value of $ 46,000 is sold for $51,000 cash Using the indirect method, this transaction should be shown on the statement of cash flows as follows.

|

|

Prepare journal entries for the issue of the bonds

: Prepare journal entries for the issue of the bonds, the first interest payment on September 1

|

|

Why any unamortized premium should be reported

: The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the number of shares outstanding?

|

|

Prepare newcomb corporations income statement

: Prepare Newcomb Corporation's income statement for 2009, including earnings per share. Assume a weighted average of 100,000 shares of Common Stock outstanding for 2009.

|

|

Common stock transactions and stockholders equity

: Prepare the stockholders' equity section of Blank Company's balance sheet at May 31, 2010. Net Income earned during the first three months was $15,000.

|