Reference no: EM13496367

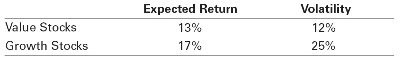

1.Suppose you group all the stocks in the world into two mutually exclusive portfolios (each stock is in only one portfolio): growth stocks and value stocks. Suppose the two portfolios have equal size (in terms of total value), a correlation of 0.5, and the following characteristics:

The risk free rate is 2%.

a. What is the expected return and volatility of the market portfolio (which is a 50–50 combination of the two portfolios)?

b. Does the CAPM hold in this economy? (Hint : Is the market portfolio efficient?)

2.Suppose the risk-free return is 4% and the market portfolio has an expected return of 10% and a volatility of 16%. Johnson and Johnson Corporation (Ticker: JNJ) stock has a 20% volatility and a correlation with the market of 0.06.

a. What is Johnson and Johnson’s beta with respect to the market?

b. Under the CAPM assumptions, what is its expected return?

3.Suppose Intel stock has a beta of 2.16, whereas Boeing stock has a beta of 0.69. If the risk-free interest rate is 4% and the expected return of the market portfolio is 10%, what is the expected return of a portfolio that consists of 60% Intel stock and 40% Boeing stock, according to the CAPM?

4.What is the risk premium of a zero-beta stock? Does this mean you can lower the volatility of a portfolio without changing the expected return by substituting out any zero-beta stock in a portfolio and replacing it with the risk-free asset?

|

What is the amount of ending finished goods inventory

: In most organizations, customer satisfaction is one of the top priorities. As such, attention to customers is necessary for success. Briefly describe the four types of demands customers are currently placing on organizational performance.

|

|

What is the final angular speed of the fan

: A ceiling fan consists of a small cylindrical disk with 5 thin rods coming from the center. The disk has mass md = 3.4 kg and radius R = 0.26 m. What is the final angular speed of the fan

|

|

Define weak base and a strong base

: In the reaction: NH3 + H2O ? NH + OH-, the water molecule serves as a. a proton donor b. a proton acceptor c. a weak base d. a strong base

|

|

Components of stockholders equity

: Identify the major components of stockholders equity by examining the Statement of Stockholders Equity. What types of accounts and transaction resulted in major changes in the Stockholder Equity accounts during the most recent year?

|

|

What is johnson and johnson beta with respect to the market

: Suppose the risk-free return is 4% and the market portfolio has an expected return of 10% and a volatility of 16%. Johnson and Johnson Corporation (Ticker: JNJ) stock has a 20% volatility and a correlation with the market of 0.06.

|

|

Estimate the moment of inertia of the disk

: A disk with mass m = 8.8 kg and radius R = 0.38 m begins at rest and accelerates uniformly for t = 17.2 s, to a final angular speed of ? = 33 rad/s. What is the moment of inertia of the disk

|

|

Explain hydrogen is oxidized and oxygen is oxidized

: In the reaction Na + H2O ? NaOH + H2, which of these is true. a. Sodium is oxidized b. Water is oxidized c. Hydrogen is oxidized d. Oxygen is oxidized

|

|

Explain and contrast the nitrogen requirements

: Compare and contrast the nitrogen requirements of microorganisms and higher forms of life, describing how their respective requirements are met

|

|

Components of stockholders equity

: Identify the major components of stockholders equity by examining the Statement of Stockholders Equity. What types of accounts and transaction resulted in major changes in the Stockholder Equity accounts during the most recent year?

|