Reference no: EM13955889

Scenario 15-1

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

|

|

A

|

B

|

C

|

D

|

|

1

|

|

Payoff Matrix

|

|

|

2

|

|

|

|

|

|

3

|

|

Economy

|

|

|

4

|

Investment

|

Decline

|

Expand

|

|

|

5

|

A

|

0

|

85

|

|

|

6

|

B

|

25

|

65

|

|

|

7

|

C

|

40

|

30

|

|

|

8

|

Bank

|

10

|

10

|

|

|

|

Payoffs

|

|

|

|

|

|

|

|

|

1. Refer to Scenario 15-1. What decision should be made according to the maximin decision rule?

2. Refer to Scenario 15-1. What decision should be made according to the minimax regret decision rule?

Scenario 15-2

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

|

|

A

|

B

|

C

|

D

|

E

|

F

|

G

|

H

|

|

1

|

|

Payoff Matrix

|

|

|

|

Regret Matrix

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

Economy

|

|

|

|

Economy

|

|

|

|

4

|

Investment

|

Decline

|

Expand

|

|

Investment

|

Decline

|

Expand

|

|

|

5

|

A

|

0

|

85

|

|

A

|

|

|

|

|

6

|

B

|

25

|

65

|

|

B

|

|

|

|

|

7

|

C

|

40

|

30

|

|

C

|

|

|

|

|

8

|

Bank

|

10

|

10

|

|

Bank

|

|

|

|

3. Refer to Scenario 15-2. What formula should go in cell F5 of the Regret Matrix to compute the regret value?

|

a.

|

=B$5-MAX(B$5:B$8)

|

|

b.

|

=MAX(B$5:B$8)-MAX(B5)

|

|

c.

|

=MAX(B$5:B$8)-MIN(B$5:B$8)

|

|

d.

|

=MAX(B$5:B$8)-B5

|

4. Expected regret is also called

|

a.

|

EMV.

|

|

b.

|

EOL.

|

|

c.

|

EPA.

|

|

d.

|

EOQ.

|

Scenario 15-3

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

|

|

A

|

B

|

C

|

D

|

|

1

|

|

Payoff Matrix

|

|

|

2

|

|

|

|

|

|

3

|

|

Economy

|

|

|

4

|

Investment

|

Decline

|

Expand

|

EMV

|

|

5

|

A

|

-10

|

90

|

|

|

6

|

B

|

20

|

50

|

|

|

7

|

C

|

40

|

45

|

|

|

8

|

Bank

|

15

|

20

|

|

|

9

|

|

|

|

|

|

10

|

Probability

|

0.7

|

0.3

|

|

|

|

Payoffs

|

|

|

|

|

|

|

|

|

5. Refer to Scenario 15-3. What decision should be made according to the expected monetary value decision rule?

Scenario 15-5

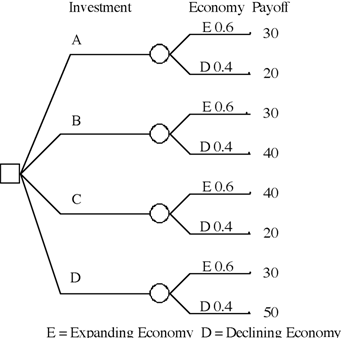

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

6. Refer to Scenario 15-5. What is the correct decision for this investor based on an expected monetary value criteria?

7. Refer to Scenario 15-5. What is the expected monetary value for the investor's problem?

Scenario 15-6

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

|

|

A

|

B

|

C

|

D

|

|

1

|

|

|

|

|

|

2

|

|

Joint Probabilities

|

|

|

3

|

|

High Demand

|

Low Demand

|

Total

|

|

4

|

Favorable Response

|

0.58

|

0.05

|

0.63

|

|

5

|

Unfavorable

Response

|

0.11

|

0.26

|

0.37

|

|

6

|

Total

|

0.69

|

0.31

|

1.00

|

|

7

|

|

|

|

|

|

8

|

|

|

|

|

|

9

|

|

Conditional Probability

|

|

|

10

|

|

For A Given Survey Response

|

|

|

11

|

|

High Demand

|

Low Demand

|

|

|

12

|

Favorable Response

|

0.92

|

0.08

|

|

|

13

|

Unfavorable Response

|

0.30

|

0.70

|

|

|

14

|

|

|

|

|

|

15

|

|

Conditional Probability

|

|

|

16

|

|

For A Given Demand Level

|

|

|

17

|

|

High Demand

|

Low Demand

|

|

|

18

|

Favorable Response

|

0.84

|

0.16

|

|

|

19

|

Unfavorable Response

|

0.16

|

0.84

|

|

8. Refer to Scenario 15-6. What formula should go in cell C13 of the probability table?

|

a.

|

=C5/$D4

|

|

b.

|

=C5/C$6

|

|

c.

|

=C5/$D5

|

|

d.

|

=C4/$D4

|

Scenario 15-7

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p=0.45.

Alternative 1: Receive $82,000 with certainty

Alternative 2: Receive $143,000 with probability p and lose $15,000 with probability (1-p).

9. Refer to Scenario 15-7. What is the decision maker's certainty equivalent for this problem?

|

a.

|

-$15,000

|

|

b.

|

$82,000

|

|

c.

|

$56,100

|

|

d.

|

$82,000

|

10. What is the formula for the weighted average score for alternative j when using a multi-criteria scoring model?

|

Going to college and obtaining a degree is a crucial step

: Going to college and obtaining a degree is a crucial step in one's life. Many benefits can come from attending college such as learning communication skills and increasing your marketability. For those who chose not to attend college and obtain a deg..

|

|

Problem regarding the auditor for the upcoming audit

: You are an audit manager with ConstantinTsiakos(CT) .For the past four yearsCT has been the auditor of Touring Away (TA), a travel company specialising in overseas adventure holidays .Peter the senior audit partner has asked you to contact Jake ..

|

|

Part of your role as a leader is to think critically

: Finally, based on the information presented in the Owen and Dietz article along with the articles that you find that conflict with the four myths, explain which of the myths you agree with and which of the myths you disagree with...and why.

|

|

Century corporate social responsibility

: Read Chapter 2 of the textbook as well as the Snider, Hill, and Martin (2003) article on corporate social responsibility in the 21st century. Conduct research on the Internet and select a company for which you will summarize the corporate social r..

|

|

What is expected monetary value for the investor''s problem

: What is the formula for the weighted average score for alternative j when using a multi-criteria scoring model?

|

|

Determine the service-related variance for surgical volume

: Determine the service-related variance for Surgical Volume. Determine the service-related variance for Patient Days. Prepare a flexible budget estimate. Present a side-by-side budget, and the actual Surgical Revenues.

|

|

How far does the car travels before it comes to a stop

: How far does the car travels before it comes to a stop. What does the mathematical model say will happen to the car after it comes to a stop? What will actually happen? Why are the two different?

|

|

Should tanya make the investment if her required rate

: Assuming Tanya wishes to evaluate the project with a five-year tine horizon, what is the internal rate of return of the investment? (Ignore taxes.)

|

|

The purpose of a rough draft

: The purpose of a rough draft is to provide raw material for you to revise. A draft may be compared to the ingredients for my spaghetti. Once your rough draft is completed you can organize it by grouping ideas together under subtopics. I organize the ..

|