Reference no: EM131283196

Question 1 - Stock Valuation Analysis (20 points)

Valeant Pharmaceuticals (VRX) has 347m shares outstanding, $30.3 billion in debt and $597m in cash. It projects free cash flows for next 2 years based on earnings forecasts below, a marginal tax rate of 24%, capital expenditures increasing from $175m in Year 1 to $190m by Year 2, and increases in net working capital (NWC) based on a NWC-to-Sales ratio of 5% per year.

|

Forecasts ($m)

|

Year 0

|

Year 1

|

Year 2

|

|

Sales

|

$10,287

|

$13,095

|

$14,117

|

|

Growth vs Prior Year

|

|

27.3%

|

7.8%

|

|

Cost of Goods Sold

|

|

($3,274)

|

($3,529)

|

|

Gross Profit

|

|

$9,822

|

$10,588

|

|

Other Operating Expenses

|

|

($262)

|

($282)

|

|

SG&A

|

|

($2,619)

|

($2,823)

|

|

Depreciation

|

|

($171)

|

($171)

|

|

EBIT

|

|

$6,770

|

$7,311

|

(a) Determine VRX's free cash flow each year. (10 points)

(b) Suppose VRX's free cash flow is expected to grow at 2% after Year 2. If VRX's weighted average cost of capital (WACC) is 16.7%, what is the value of VRX's stock? (10 points)

Question 2 - Portfolio Analysis (15 points)

What is an efficient portfolio? How is it related to the efficient frontier? What are the key steps involved in identifying an efficient set of portfolios for an investor? What are at least two important limitations of portfolio analysis? (10 points)

Question 3 - Risk and Return (25 points)

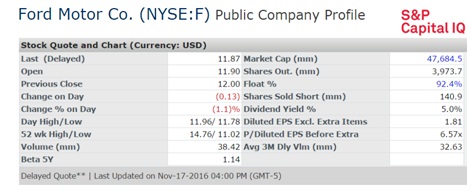

Consider the following information about Ford Motor Co. (F) stock on November 17, 2016:

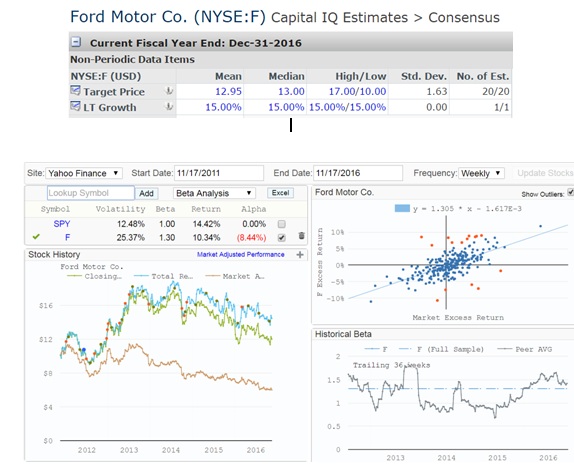

(a) Suppose the market risk premium is 6.48% and the risk-free interest rate is 2.25% (from Ibbotson/Datastream data using S&P 500 and 10-year Treasury Note yields), calculate the expected return of investing in Ford Motor (F) stock using the CAPM? (5 points)

(b) If you believe that the analysts' consensus one-year-ahead forecast for Ford (denoted as "Target Price" in Capital IQ exhibit below) is reasonable, what risk-adjusted return would you expect to earn based on your CAPM-based calculations in (a) above? Would you buy or sell shares of Ford stock to do so? (5 points)

(c) Consider the data above from Berk-DeMarzo's Beta-CAPM Analyzer on Ford stock. With this data, offer at least two reasons why you might hesitate to take the action that you recommend in (b) above? (5 points)

(d) In late-2016, Ford had senior-unsecured, BBB-rated, 2021 bonds outstanding with a yield to maturity of 4.07%. At the time, similar maturity Treasuries had a yield of 2.25%. Suppose the market risk premium is 6.48% and you believe Ford's bonds have a beta of 0.23. If the expected loss rate of these bonds in the event of default is 17%, what annual probability of default would be consistent with the yield to maturity of these bonds? (10 points)

|

Bibliography for the fashion documentary the true cost

: Write a one paragraph annotated bibliography for the fashion documentary The True Cost. You have a young, impressive pitcher who is on a maximum “pitch count” to “save” his arm. Should he be limited to a number of “starts” even if it could impact the..

|

|

Write a commentary on sarbanes oxley

: Write a commentary on Sarbanes Oxley and the importance this act has for American businesses today.

|

|

Understanding of business-to-business activities

: In order to have a better understanding of business-to-business activities (“B2B”), locate an example of an existing business on the Web that is similar to your e-business. Describe the types of B2B activity that you envision is taking place. Provide..

|

|

Dissecting the at-will employment doctrine

: The at-will employment doctrine governs most hiring and firing among non-public sector health care facilities. Discuss the strengths and weaknesses of this doctrine. How would you amend it, if at all?

|

|

What is an efficient portfolio

: What is an efficient portfolio? How is it related to the efficient frontier? What are the key steps involved in identifying an efficient set of portfolios for an investor? What are at least two important limitations of portfolio analysis?

|

|

Planning process begins with an environmental scan

: As mentioned last week the planning process begins with an environmental scan of the business and its relationship to vision and mission statements.

|

|

Improvements in productivity and quality of work life

: How can effective HRM contribute to improvements in productivity and quality of work life? If you could only work on three of the nine key HR competencies, what would they be and why? How does the effective management of people provide a competitive ..

|

|

Regarding leadership behavior and subordinate stress

: Assume you are providing a proposal to the CEO regarding Leadership Behavior and Subordinate Stress. Explain primary, secondary and tertiary interventions levels, and why all three are necessary at different levels of the organization to ensure bette..

|

|

Performance on the concept of the triple bottom line

: Evaluate Seth Goldman’s leadership performance on the concept of the “Triple Bottom Line” using at least two (2) examples from both resources (at least four [4] total examples) to support your evaluation.

|