Reference no: EM131197496

Questions-

Q1. Looking at the pricing equations (1, 2), what implicit assumptions about causality are embedded?

Q2. Build a P Monte-Carlo generator for the system of prices (M, {Pi}, π*) in continuous time, ignoring random auction times, pretending you see all prices at all times. Use exact differential equations where possible, the Milstein scheme otherwise.

For instance, for the MSCI define mt:= ln(Mt/M0). Since M is lognormal, we know that (Mt+Δt/Mt) = exp ((μm - ½(σm)2)Δt + σmΔWt) and hence that we have the exact difference equation

mt+Δt = mt + (µm ½(σm)2) Δt + σmΔWt

Simulate a number of paths (M, {Pi}, π*) as an illustration.

Keep the paths if you can so you don't have to generate them each time and also so that you can compare different methods using the same paths, in order to compare apples with apples. If you can't, keep the seeds so you can regenerate the same paths again.

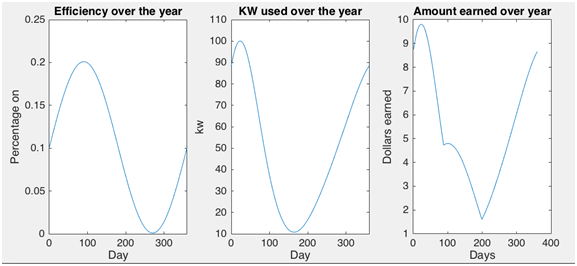

For each path, compute along each path generated with the fine time steps (small Δt):

(a) the average instantaneous return annualised (approximating (1/T+1) 0∫T-+1(dπ*t/π*t))

(b) the average yearly arithmetic return (1/T t=0∑T^-(π*t+1 - π*t/π*t).

(c) the average yearly log return ((1/T)ln(π*T^-/π*0))

(d) the standard deviation of the arithmetic yearly return on the index,

(e) the ex-post Sharpe Ratio, that is the average yearly return on the index minus the average yearly short rate, the total divided by the standard deviation of the difference between the index and the short rate. Show the Sharpe ratios both for the arithmetic and for the geometric returns.

Notice the time conventions. If T ∈ {0, 1, . . .}, then in continuous time π*T+1 is the index at precisely moment T + 1, which in discrete time would be comparable to π*T, the index of the resolved year T that is computed on the last moment of year T (i.e. really at time T + 1).

Q3. Still pretending you see all prices at all times, and not imposing the simplifying assumptions for the simulations, use Itoˆ's Lemma to compute dπ*t. Is it geometric Brownian motion? Why or why not?

Exhibit the diffusion term of dπ*t/π*t and comment.

In what sense can we say that the Bindex π* is a value-weighted index, VWI?

Q4. Compute the instantaneous correlations between the index and the MSCI,

Show graphically the evolution of instantaneous correlation along the selected paths.

Compute the average realised correlation along each path, approximating (1/T+1) 0∫T-+1 ρtπ*,M dt, and compute the average across the paths. How much diversification do rare books offer?

Q5. Now add the auctions at random times τ determined by the Poisson process. Simulate one path1 ω, with small time steps Δt, from date 0 to date 41 (the index value of year 40 is realised at date 41) for each of the drivers {M, {Pi}i, J}. Book prices are encoded only if they appear at auction.

The 41 book index values are encoded as end-of-year values as explained above. If a copy is repeat-sold within a year, only encode the last observation. If a book i is observed three times along the path (but never twice in a year), create a new sale of this book. Repeat for many paths ω and keep the paths saved for future use. Only keep paths that have at least one auction in each year.

Q6. [Moving-horizon ARS index πT] Pick a small set of paths generated in the previous sub question that are meaningful and representative, call them ω1 ∈ Ω1, and always stick to the same paths ω1 in this sub question. We shall use the same paths again in subsequent sub questions. Make sure that this path satisfies the condition that there is at least one sale in each year that is a repeat sale. More precisely, one way of generating such a path(s) is to follow a sequential rule [SR]:

- Generate year 0 and year 1 sales. If there is repeat sale (a book selling both in years one and two), then continue. Else do this step again.

- Generate year 2 sales. If a book was also sold in years 0 or 1 then continue. Else do this step again.

- Do until T = 40.

We know that π0 = 1 always. Put yourself at the end of year T = 1 and compute π1(1), and save the number.

Now put yourself at the end of year T = 2 and compute π1(2) and π2(2), and save the numbers.

Repeat until time T¯ = 40.

Call this Bindex πT:= {πT(T)}T=140.

Q7. Based on the previous subsection, you can now place yourself again at time 0 and follow the same paths ω1 as year T now moves on. As time T moves on, not only can you trace out the current index value πT(T) (where the same T appears in both places, referring to the fact that with T periods of data you look always at the index value at T but having recomputed the entire index path), you realise what happens to the index at any fixed earlier calendar time as the sample increases, say fix calendar time 2 to get the sequence π2(2), π2(3), π2(4),. . . .

Describe what you see and explain.

Q8. [Fixed-horizon ARS index π40] Now generate the paths until year 40. Look back and generate the Bindex π40:= {πt(40)}t=140.

Q9. [All-sales index πa] Denote by πa the index constructed from all actual sales in a given year, including those not matched up with any second sales in the sample. If Ia(t) is the set of all books coming up at auction in year t, then πat:= (∑i∈Ia(t)Pit/∑i∈I^aPi0).

Based on the simulations of the paths Ω1 in the previous question, also keep track of the paths of πa.

Q10. [Full-information yearly index π*,y] Let π*,y be the index {π*t}Tt=0, the annual index constructed from all books (even those not actually observed).

Q11. [Full-information yearly random times index π*,r] Based on the continuously observable π*, denote by π*,r := {1, π1*,r, . . . , π40*,r} the annual index constructed from all books, including the books never actually traded, but as if every book price was observable at one random time τit within the year only. You generate N random sales dates {τti}t=1N in each year t. As for the other indices, that book price enters the index as if it was observed say on 31 Dec. In other words,

Q12. [Compare the four Bindices]. We now have four annual approximations to the true latent annual Bindex π*,y, call them ∏˜ := { πT, π40, πa, π*,r}.

For each path in Ω1, compare those five indices. Also, compute

(a) the average annual return on the index,

(b) the annual standard deviation,

(c) the ex-post annual Sharpe Ratio,

(d) the auto-correlation function,

(e) the yearly realised variance series {(πt+1(·) - πt(·)/πt(·))2}t=140 and realised correlation series (the sample analogue to the correlation computed above in question 4.) between the index and the MSCI.

Describe.

Do any of the observed paths exhibit excessive smoothing or jaggedness compared to the others? Is the yearly full observation benchmark π*,y behaving markedly differently from the limited information approximations π ∈ ∏˜?

Is any approximation better than the others in terms of those statistics?

Q13. What does the assumption about the values of σim and σm imply about beta? Now that you know the true theoretical beta, consider paths ω1 ∈ Ω1 and run - for each path ω1 - a market regression using your four constructed Bindices, such as for instance

πt - πt-1/πt-1 = α + β (Mt - Mt-1/Mt-1) + εt

for π ∈ ∏˜. Repeat for other paths, and compare to the true betas, both the continuous time true beta and the beta of π*,y.

Q14. Since the stock market index M is supposed to be observed always whereas π ∈ ∏˜ are observed only at the end of each year and may include auction outcomes that happened before the end of the year, there is a time aggregation - or non-synchronicity - problem.

For each π ∈ ∏˜, run the regression

Take the estimated coefficients along each path and compute βˆ(ω) := β-2(ω)+ β-1(ω)+ β0(ω) + β+1(ω) and compare to the true continuous time true beta and the beta of π*,y.

Q15. [Risk-neutral world.] Now we move into derivatives and Q. The difference between P and Q are the drifts. This is the essence of the Girsanov theorem and which works as follows.

Consider equation (1) and define dWˆtm = dWtm + ξmdt. Replace dWtm by dWˆtm - ξmdt. ξm is called the market price of risk and is constant in this case. Once you have replaced a Brownian motion dWt by its 'hat' version, you are "under Q," so by NA you can set the drift to rMtdt. Solve for ξm and explain why it is called the market price of risk.

Q16. Now assume that dWˆti0 = dWti0 and dWˆtk = dWtk + ξkdt. What is the interpretation?

Q17. Rewrite the stochastic differential equation for dPti under Q, i.e. having replaced all W by Wˆ. [In the lecture notes we then simply dropped the hats again to save on notation]

Look at the drift of dPti/Pti under Q and verify that it is less than r. Usually there would be an arbitrage if this term were different from r. If the drift was less than r, then to profit from the arbitrage, one would need to short the rare books, which is impossible. Instead, call y the difference between r and the drift coefficient. How large is y? So now the Q drift of dPti/Pti is r - y. Interpret.

Q18. [Futures on Bindex]. Now assume that at time 0 a futures contract is introduced on the rare book index. Assume maturity is year 10, the typical holding period of a portfolio of rare books, as well as years 5 and 20.

Denote the futures price process at time t with maturity T by Ft,T and ignore marking- to-market and daily settlement, so really we consider a forward on rare books.

By definition, the final payoff of the forward/futures along path ω is FT,T (ω) - F0,T = πT(ω; T ) - F0,T for T = 10.

(a) Intuitively, can this forward be replicated risklessly in real time?

(b) Use the Q Monte-Carlo to compute {F0,T}T ∈ {5,10,20}. Is the curve in contango, backwardation or neither? Why?

(c) Given this F0,10, for a given path ω1, start at time 0 and compute the cash-flow at time 10, π10(ω1; 10) - F0;10.

(d) Continuing on that same path ω1 for times T after time 10, display the revisions of that cash flow, π10(ω1; T ) - F0;10 and explain.

(e) Repeat for more paths ω and get some average view of the issue.

(f) Why does this make regularly (here continuously) traded futures (or options) on indices of rarely traded assets troublesome?

(g) Can you think of remedies?

Q19. Can you show that the return process {πt40/πt40} is independent of the choice of base year? Currently the base year is in year 0, so that π0(40) = 1, but what if we chose year τ ∈ {1, 2,. .., 40} to be the base year?

Attachment:- Assignment.rar