Reference no: EM131869604

Question 1:

To price options on a stock, construct a 4-period (5-date) binomial lattice describing the evolution of the stock's price over a period of one year. The stock is trading for $60, the risk-free rate is equal to 3% per year, continuously compounded, and the options are trading at an implied volatility of 50%.

A) Calculate the price of a $55-strike European call option on this stock assuming that the stock won't pay any dividends during the option's life.

B) Calculate the price of a $55-strike European call option on this stock assuming that it will pay dividends at a continuously compounded rate of 2% per year during the option's life. What impact does the dividend yield have on the call option's price?

C) Calculate the price of a $45-strike European put option on this stock assuming that the stock won't pay any dividends during the option's life.

D) Calculate the price of a $45-strike European put option on this stock assuming that the stock will pay dividends at a continuously compounded rate of 2% per year during the option's life. What impact does the dividend yield have on the put option's price?

E) Using the alternative specification for the up and down factors and for the risk neutral probability of upward/downward movements, determine the price of the European call and put options assuming that the stock will pay dividends at a continuously compounded rate of 2% per year during the option's life, and compare these prices to those that you obtained in B) and D) above.

Question 2:

The value of an option's early exercise privilege is influenced by the amount of income that its underlying asset pays during the option's life. To explore this phenomenon, construct a 4-period binomial lattice spanning a one-year period to describe the evolution of the underlying stock's price. The stock is trading for $45, the risk-free rate is equal to 2% per year, continuously compounded, and the options are traded at an implied volatility of 45%.

A) Calculate the price of a $40-strike American call option on this stock assuming that the stock won't pay any dividends during the option's life.

B) Calculate the price of a $40-strike American call option on this stock assuming that it will pay a dividend of $0.45 in ten months. What impact does the dividend have on the value of the American call option's early exercise privilege?

C) Calculate the price of a $55-strike American put option on this stock assuming that the stock won't pay any dividends during the option's life.

D) Calculate the price of a $55-strike American put option on this stock assuming that it will pay a dividend of $0.45 ten months. What impact does the dividend have on the value of the American put option's early exercise privilege?

Question 3:

The Monte Carlo simulation procedure is a very powerful tool that financial engineers use to price options, especially complex ones for which no closed form solutions exist. Using this methodology, estimate the price of a two-year at-the-money European call option trading at a 50% implied volatility. The underlying stock is trading for $65, it will pay income at a continuously compounded rate of 1% during the option's life, and the continuously-compounded risk-free interest rate is equal to 2.5%.

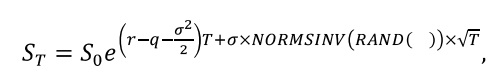

Use the following equation to generate random draws from the underlying stock's terminal price distribution:

where So is the current stock price, T is the option's time to maturity expressed in years, r is the risk-free rate, q is the dividend yield, a is the underlying stock's volatility, and NORMSINV(RAND()) is the combination of MS Excel functions that produces random draws from the standardized normal distribution.

A) Using the above equation, simulate 1,000 random draws for the underlying stock's terminal price, calculate the option's discounted payoffs and its price estimate.

B) The standard error of the option's price estimate is equal to the standard deviation of its discounted expected terminal payoff divided by the square root of the number of random draws used to derive the price estimate. The 95% confidence interval for the true option

S

price lies between +1.96 x ,_____ .

D. Calculate Calculate the 95% confidence interval for the option's

true price for the 1,000 random draws of this simulation.

C) Compare the option's Monte Carlo price estimate obtained in A) to its true value, based on the BSM model, and determine where the BSM price lies in relation to the confidence bounds derived in B).

Question 4:

Today is February 6, 2018. Apple Inc.'s stock is trading for $163.03 and call option prices on Apple's stock with varying strikes are provided below. All these contracts expire on Friday, April 20, 2018. Based on this information, infer each option's implicit volatility and plot the volatility smile implied by these option prices. Does this volatility smile possess the features characterizing typical volatility smiles? The risk-free rate for this tenor is equal to 1.6733% in the U.S. money market, and the stock won't pay dividends between now and the option's expiry date.

|

Price

|

Strike

|

|

24.85

|

140

|

|

20.05

|

145

|

|

15.75

|

150

|

|

12.42

|

155

|

|

9.55

|

160

|

|

6.80

|

165

|

|

4.75

|

170

|

|

3.20

|

175

|

|

2.18

|

180

|

|

1.29

|

185

|

|

0.90

|

190

|

|

0.60

|

195

|

|

0.43

|

200

|

Question 5:

You are managing an option book on a stock that is trading for $65 right now. Your option book consists of five different European call option contracts whose characteristics are described in the table provided below. The stock pays dividends at a continuous rate of 1% per year and the risk-free rate is equal to 2.5% per year, continuously compounded.

|

Contract

|

Strike

|

Tenor (in years)

|

Implied volatility

|

Quantity

|

|

#1

|

$50

|

0.25

|

0.55

|

10,000

|

|

#2

|

$60

|

0.50

|

0.50

|

15,000

|

|

#3

|

$65

|

0.75

|

0.45

|

-20,000

|

|

#4

|

$70

|

1.00

|

0.43

|

15,000

|

|

#5

|

$60

|

1.25

|

0.41

|

-10,000

|

A) Using Professor John Hull's DerivaGem MS Excel Add-on, which is available free of charge on his web site, calculate each option's price, delta, gamma, vega, theta, and rho.

B) Based on your option holdings reported in the last column of the above table, calculate your portfolio's delta, gamma, vega, theta, and rho.

C) Based on your portfolio's delta calculated in B), what position would you need to take in the underlying stock to make your option portfolio insensitive to changes in the stock's price?