Reference no: EM131298924

1. John Taylor has suggested the following rule as a policy guide for the Federal Reserve

Rt = RR* + πt + 0.5(πt- πtar) + 0.5Yt

Rt = federal funds rate

RR* = real rate

πt = target inflation rate

πtar = target inflation rate

Yt = Okun's law - 2 (Ut - U*)

Ut = natural rate of unemployment

Suppose that the real rate is 2%, expected rate of inflation is 1.5 %, current unemployment rate is 5.5%, and the natural rate of unemployment is estimate to be 6%. According to the Taylor model, what federal funds rate would achieve a target inflation rate of 2%? Suppose with a global savings glut we assume a real rate of zero, what the nominal federal funds rate associated with a 2% inflation target? Still assuming a zero real rate, what happens to the nominal federal funds rate if the Fed tries to achieve a target inflation rate of 3%?

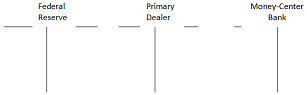

2. Suppose the Fed does an overnight repo in the amount of $20 million with a primary dealer. Illustrate this transaction with the T-accounts below.

If the reserve requirement is 10%, by how much will deposits increase as a result of this transaction? If the demand for money was assumed to be constant, what is your prediction about the level of interest rates?

3. Arrange the items listed below into a correct Federal Reserve balance sheet; i.e., lists the assets and liabilities.

Net portfolio holdings of Maiden Lane LLC

Deferred availability cash items

Reverse repurchase agreements

Mortgage-backed securities

Gold certificate account

Federal Reserve notes

Central bank liquidity swaps

Items in process of collection

Term deposits held by depository institutions

Net portfolio holdings of TALF LLC

Treasury Bills

Federal agency debt securities

U.S. Treasury, General Account

Capital paid in

Foreign currency

Bank premises

Treasury Notes and Bonds

Coins

Foreign deposits

Surplus

Federal Reserve notes

Special drawing rights (SDRs)

Repurchase agreements

Loans

4. Indicate the effect of each of the following changes on bank reserves (+ = increase and - = decrease).

Increase in Federal Reserve Notes Outstanding

Decrease in foreign deposits

Increase in Treasury cash holdings

Decrease in primary credit

Decrease in Treasury bills

Increase in agency securities

Increase reverse repos

Increase in secondary credit

Increase in Treasury deposits

5. Suppose the Federal Reserve instructs the Trading Desk to purchase $1 billion of securities. Show the result of this transaction on the balance sheets of the Federal Reserve System and commercial banks. What happens to the liquidity of the banking system?

6. Suppose the Federal Reserve instructs the Trading Desk to sell $850 million of securities. Show the result of this transaction on the balance sheets of the Federal Reserve System and commercial banks. What happens to the liquidity of the banking system?

7. A recent headline in Reuter's read as follows:

China's central bank on Sunday cut the amount of cash that banks must hold as reserves, the second industry-wide cut in two months ...

The People's Bank of China (PBOC) lowered the reserve requirement ratio (RRR) for all banks by 100 basis points to 18.5 percent, ....

Explain what impact this policy change would have on the balance sheet of PBOC and the commercial banks.

8. Using the Federal Reserve Statistical Release (H.4.1) (https://www.federalreserve.gov/releases/h41/Current/) classify the sources of reserves, uses of reserves and the net change in reserves.