Reference no: EM131089119

Public Affairs 854 - Midterm 2 Exam

PART I: Multiple Choices

1. Assume that in the long run, the exchange rate is determined by money stocks, incomes and interest rates. Then

a. an increase in the domestic money supply necessarily weakens the currency.

b. an increase in the money supply always causes a proportional increase in the exchange rate immediately.

c. a decrease in the domestic money supply causes a large initial appreciation of the dollar, with depreciation over time if there is some price stickiness.

d. an immediate jump of the nominal exchange rate to its long run value.

e. (a) and (c) above.

2. A central bank wishes to sterilize a reserve outflow. Which of the following achieve this goal?

a. Expand net domestic assets at the same rate as the reserve outflow is contracting the money supply.

b. Reduce net domestic assets at the same rate as the reserve outflow is expanding the money supply.

c. Use open market operations to sell treasury securities on the private market.

d. Use open market operations to reduce domestic money supply

e. Enlist the help of the fiscal branch to create expenditure switching activities.

3. The US CPI is growing at 4 percent per year and the Euro area CPI is growing at 6 percent per year. If relative PPP holds, then one would expect the dollar to be

a. depreciating at 2 percent per year.

b. constant.

c. depreciating at 10 percent per year.

d. appreciating at 2 percent per year.

e. appreciating at 4 percent per year.

4. How does increasing the mobility of capital change the effectiveness of fiscal policy under fixed and floating exchange rate regimes?

a. Under fixed exchange rates, more capital mobility leads to more effective fiscal policy. Under floating exchange rates, more capital mobility leads to less effective fiscal policy.

b. It increases the effectiveness of fiscal policy under both exchange rate regimes.

c. It decreases the effectiveness of fiscal policy under both exchange rate regimes.

d. Under fixed exchange rates, more capital mobility leads to less effective fiscal policy. Under floating exchange rates, more capital mobility leads to more effective fiscal policy.

e. The effect is ambiguous.

5. The one year interest rate in the US is 6 percent and the interest rate in the Euro area is 2 percent. If the covered interest parity condition holds, then it must be true that:

a. the one year forward rate is 4 percent higher than the current spot rate (both exchange rates expressed in $/€).

b. the forward discount is 4 percent.

c. the one year forward rate is 4 percent lower than the current spot rate (both exchange rates expressed in $/€).

d. the market expectation of the spot rate one year hence is 4 percent higher than the current spot rate.

e. (a) and (b) above.

6. Under the monetarist (or flexible price monetary model) of the exchange rate, an increase in the foreign interest rate will

a. lead to depreciation of the domestic currency.

b. increase the demand for real balances.

c. lead to an appreciation of the home currency.

d. lead to an increase in income.

e. none of the above.

7. In the IS-LM-BP=0 model, under fixed exchange rates, in the short-term, a fiscal contraction will lead to

a. decreased income, lower interest rates and a balance of payments deficit.

b. decreased income, lower interest rates and a balance of payments surplus.

c. decreased income, lower interest rates and an ambiguous effect on the balance of payments.

d. decreased income, higher interest rates and an ambiguous effect on the balance of payments.

e. increased income, lower interest rates and an ambiguous effect on the balance of payments.

8. Absolute purchasing power parity

a. Does not seem to hold in the real world.

b. Seems to hold when examining bundles of identical goods, such as a Big Mac.

c. Implies the exchange rate necessarily adjusts to make prices of identical bundles of goods have the same price when expressed in a common currency.

d. Implies that exchange rates and prices adjust to make prices of identical bundles of goods have the same price when expressed in a common currency.

e. both (a) and (d).

9. Uncovered interest rate parity

a. implies that interest rates are equalized.

b. requires that the expected rate of return expressed in dollars of saving in dollar and foreign currency denominated assets must be equal

c. requires that returns denominated in bundles of consumption goods be equalized.

d. requires that the forward rate and the expected spot rate be equal.

e. both (b) and (d).

10. Under fixed exchange rates, an increase in the sensitivity of capital flows to interest rate differentials is likely to result in

a. a larger balance of payments deficit following a fiscal expansion.

b. small losses in reserves following a monetary expansion.

c. a more substantial capital outflow following a monetary expansion.

d. a higher long-run increase in income following a fiscal expansion.

e. none of the above.

PART II: Short Answer

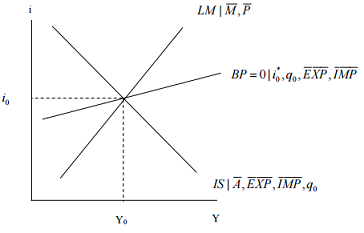

1. Suppose you are given a standard IS-LM-BP=0 model for a small country operating under a floating exchange rate regime:

1.1 Suppose the rest of the world's economy slows down, such that autonomous exports fall. Show what happens immediately to the relevant curve(s), indicating with arrows (marked [1]) the shift(s). Be sure to indicate what variables are changing, by labeling the curves (changes in autonomous exports, changes in real exchange rate, etc.) Explain the economics of what is happening, referring to the graph and specific shifts.

1.2 Show what secondary shift(s) occur(s). Mark these arrows with a [2]. Be sure to indicate what variables are changing, by labeling the curves (changes in autonomous exports, changes in real exchange rate, etc.) Explain the economics of what is happening, referring to the graph and specific shifts.

1.3 Suppose the central bank increases the money. Show what happens, using a graph with arrows (marked [2] for the second set, and [3] for the third set). Be sure to indicate what variables are changing, by labeling the curves (changes in autonomous exports, changes in real exchange rate, etc.) Explain the economics of what is happening, referring to the graph and specific shifts.

2. Fixed exchange rates with imperfect credibility

2.1 Suppose a small open economy, facing perfect capital mobility, is on a fixed exchange rate regime. Assume to begin with the central bank's commitment to a fixed exchange rate is credible. Draw the IS-LM-BP=0 graph.

2.2 Show what happens if the markets start doubting the credibility of the exchange rate peg, and ascribe a 50% probability that the peg will remain, and 50% probability of a 20% depreciation. In order to maintain the peg, what must the central bank do, if anything?

3. Exchange rate determination

Suppose the money supply in the US rises exogenously relative to that in the euro area. What will happen to the nominal dollar/euro exchange rate immediately, and over time, if prices are perfectly flexible? What happens to the interest rate in the US relative to that in the euro area?

Use graphs and/or equations if helpful in explaining your answer.