Reference no: EM131905170

1.Your parents are 50 today and plan to retire after reaching age 65, making their first withdrawal of funds at age 66 (i.e., 16 years from now).

2. You forecast that they will need, each year in retirement, an annual income with the same purchasing power as $60,000 has today, i.e., their retirement income must keep up with inflation. There is currently a 1.5% annual price inflation rate that is expected to continue indefinitely. (I.e., their first withdrawal from their retirement account must account for the annual price inflation during the 16 years between now and the first retirement withdrawal. If this is not done, their standard of living will decline every year.)

3. Your parents expect to live for 30 years in retirement, and want to have sufficient funds in their retirement account so that they do not run out of funds.

4. At the end of the year they retire (i.e., when they are 65) they also intend to sell their current home and purchase a retirement home in another state. They believe that this will require $100,000 (nominal - i.e., $100,000 in t=15 dollars) in addition to the equity they will have in their current home.

5. They have already accumulated savings of $200,000 as of today.

6. Beginning at the end of this year, they will save a certain amount, and increase that amount at the inflation rate every year until they retire. The last deposit into savings will be when they are 65. (They can do this because while working they expect their income to increase each year by at least the rate of inflation.)

7. Based on their experience, they believe that they can earn 8.0% per year on savings throughout the entire period (i.e., in their retirement investment fund, not a bank savings account).

Questions to answer:

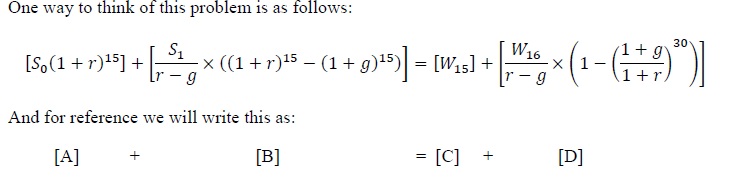

Assuming that t=16 is the time when they make a withdrawal because they are retired:

a. What is r in the expressions above, and what is g?

b. What does S0 represent and what does the first term [A] represent?

c. What is W16 and what does the term ([D]) represent?

d. What is W15 (i.e., term [C]) represent?

e. What does S1 represent and what does term [B] represent?

f. How much must your parents save at the end of this year and every future year until they retire (I.e., the cash amount put into savings in each of these years)?

g. Suppose your parents do not make move to a new home at t=15, and so do not need to withdraw the $100,000. Instead they plan keep their annual retirement withdrawals exact the same as originally planned, and the $100,000 in order to make a big bequest to UNH.

How large will the bequest be if they live until they are 95?