Reference no: EM131145279

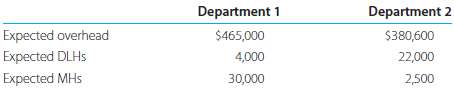

Country Products manufactures quilt racks. Pine is introduced in Department 1, where the raw material is cut and assembled. In Department 2, completed racks are stained and packaged for shipment. Department 1 applies overhead on the basis of machine hours; Department 2 applies overhead on the basis of direct labor hours. The company's predetermined overhead rates were computed using the following information:

Sue Power contacted Country Products to produce 500 quilt racks as a special order. Power wanted the racks made from teak and to be made larger than the company's normal racks. Country Products designated Power's order as Job #462.

During July, Country Products purchased $346,000 of raw material on account, of which $19,000 was teak. Requisitions were issued for $340,000 of raw material, including all the teak. There were 285 direct labor hours worked (at a rate of $11 per DLH) and 2,400 machine hours recorded in Department 1; of these hours, 25 DLHs and 320 MHs were on Job #462. Department 2 had 1,430 DLHs (at a rate of $18 per DLH) and 180 MHs; of these, 158 DLHs and 20 MHs were worked on Job #462.

Assume that all wages are paid in cash.

Job #462 was completed on July 28 and shipped to Power. She was billed cost plus 20 percent.

a. What are the predetermined overhead rates for Departments 1 and 2?

b. Prepare journal entries for the July transactions.

c. What were the cost and selling price per unit of Job #462? What was the cost per unit of the raw material?

d. Assume that enough pine had been issued in July for 20,000 quilt racks. The RM inventory manager is a friend of Power and he conveniently "forgot" to trace the cost of the teak specifically to Job #462. What would have been the effect of this error on the raw material cost, total cost, and selling price for each unit in Job#462?

|

Pay as factor in making job decisions

: As a supervisor, if you asked or surveyed your employees about the importance of pay as a factor in making job decisions, do you think employees would over-state or understate its value to them?

|

|

Discuss the economic costs impacted by patriot act

: Discuss the economic and constitutional costs impacted by this Act. Explain if security has increased since the enactment of the Patriot Act and if so, has that increased security been worth the cost? Provide examples to support your claims.

|

|

Job requirements job analysis

: Write the answers of the question given below related to the topic "Job Requirements Job Analysis" Which of the following is not a good reason for using an outside consultant for job analysis?

|

|

Training session on how to avoid appraisal rating errors

: As a manager you realize the supervisors who report to you make errors when they rate their employees (e.g., too lenient, rate everyone the same, etc.). You notice a consultant is offering a training session on how to avoid appraisal rating errors. H..

|

|

What are the predetermined overhead rates for departments

: What are the predetermined overhead rates for Departments 1 and 2? Prepare journal entries for the July transactions. What were the cost and selling price per unit of Job #462? What was the cost per unit of the raw material?

|

|

What will be the anticipated outcome of this intervention

: What is the target population associated with the selected health promotion program? Consider the hypothetical target population, consisting of middle-aged women, male adolescent gang members, premature infants, etc., and describe the characterist..

|

|

Format the gantt chart

: Create a Gantt chart in Microsoft Project or Microsoft Excel that takes you from your freshman year to graduation in your senior year.

|

|

All depreciation expense is in the selling expense category

: Data for Klemmer Company are presented in P12-7B. Further analysis reveals the following.

|

|

Encouraging employees to participate in work

: If you were a work unit supervisor, which of the following do you think is more important to improving organizational performance? Explain. Encouraging employees to participate in work and organizational decisions. Setting clear, challenging work goa..

|