Reference no: EM13495602

1.You are considering how to invest part of your retirement savings. You have decided to put $200,000 into three stocks: 50% of the money in GoldFinger (currently $25/share), 25% of the money in Moosehead (currently $80/share), and the remainder in Venture Associates (currently $2/share). If GoldFinger stock goes up to $30/share, Moosehead stock drops to $60/share, and Venture Associates stock rises to $3 per share,

a. What is the new value of the portfolio?

b. What return did the portfolio earn?

c. If you don’t buy or sell shares after the price change, what are your new portfolio weights?

2.You own three stocks: 1000 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5000 shares of Goldman Sachs Group. The current share prices and expected returns of Apple, Cisco,and Goldman are, respectively, $125, $19, $120 and 12%, 10%, 10.5%.

a. What are the portfolio weights of the three stocks in your portfolio?

b. What is the expected return of your portfolio?

c. Assume that both Apple and Cisco go up by $5 and Goldman goes down by $10. What are the new portfolio weights?

d. Assuming the stocks’ expected returns remain the same, what is the expected return of the portfolio at the new prices?

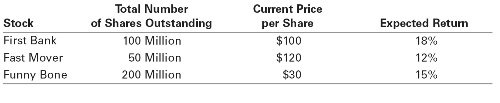

3.Consider a world that only consists of the three stocks shown in the following table:

a. Calculate the total value of all shares outstanding currently.

b. What fraction of the total value outstanding does each stock make up?

c. You hold the market portfolio, that is, you have picked portfolio weights equal to the answer to part b (that is, each stock’s weight is equal to its contribution to the fraction of the total value of all stocks). What is the expected return of your portfolio?

4.There are two ways to calculate the expected return of a portfolio: either calculate the expected return using the value and dividend stream of the portfolio as a whole, or calculate the weighted average of the expected returns of the individual stocks that make up the portfolio. Which return is higher?

|

A piston-cylinder arrangement holds a thermally perfect gas

: A piston-cylinder arrangement holds a thermally perfect gas at p1=100kPa and T1 = 300K. Assume that cp = 1.0035 kJ/kg-K, cv = 0.7165 kJ/kg-K, and R = 0.287 kJ/

|

|

A typical gas stove burner supplies a kettle filled

: A typical gas stove burner supplies a kettle filled with water at a rate of 15,000 Btu/hr with a flame temperature of 750C

|

|

Discuss the pros and cons of boutique healthcare

: Discuss the pros and cons of boutique healthcare. Go back and critique the positions and identify strengths and weaknesses. Also, be sure to discuss any ethical concerns that your role might identify. Please create a few paragraphs.

|

|

Assume disturbance torques are zero

: Assume disturbance torques are zero and spacecraft moment of inertia is 400 kg.m2

|

|

What are the portfolio weights of the three stocks in your

: You own three stocks: 1000 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5000 shares of Goldman Sachs Group. The current share prices and expected returns of Apple, Cisco,and Goldman are, respectively, $125, $19, $120 and 12%, 10%, 10..

|

|

Demographic market segments and internet purchases

: Synthesise the information presented regarding variance among demographic market segments and internet purchases.

|

|

What are the factors a business

: What are the factors a business considers before finding the right location? What are the many reasons facility location isimportant to a business?

|

|

Estimate the minimum accelerating voltage

: Estimate the minimum accelerating voltage required for an X-ray tube with a Fe26 anode to produce a Ka line

|

|

Estimate the force on the wire

: A electric wire with 3.85A current is placed in a magnetic field of strength .97T. What is the force on the wire

|