Reference no: EM131206397

Assignment: Elasticity and Labor Market Equilibrium

Instructions: Answer all of the following questions. You are required to follow proper APA format. Read the Criteria section below for more information before you begin this Assignment.

1. Is the price elasticity of demand for gasoline more elastic over a shorter or a longer period of time? Explain.

2. Is the price elasticity of supply, in general, more elastic over a shorter or a longer period of time? Explain.

3. Why is the supply curve for labor usually upward sloping? Explain.

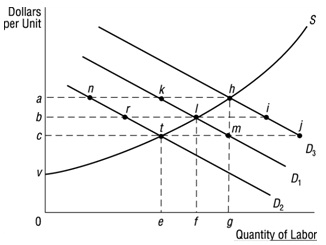

4. In the graph below, assume that the market demand curve for labor is initially D1. The market supply curve for labor is indicated with figure "S". Wage rate is depicted on theother things held constant vertical axis (dollars per unit) ad employment level (quantity of labor) is depicted along the horizontal axis. Answer the following questions.

a. What are the initial equilibrium wage rate and employment level?

b. Other things held constant, assume that the price of a substitute resource decreases.

What will happen to demand for labor? Will it increase or decrease?

What are the new equilibrium wage rate and employment level?

c. Other things held constant, suppose that demand for the final product increases. Using labor demand curve D1 as your starting point, what happens to the demand for labor?

What are the new equilibrium wage rate and employment level?

d. Assume this industry is dominated by non-union workers. How would the equilibrium wage compare to that earned in a similar industry with similarly skilled union workers? Explain.

5. Use the following data to answer the questions below. Assume a perfectly competitive product market.

|

Units of Labor

|

Units of Output

|

|

0

|

0

|

|

1

|

8

|

|

2

|

12

|

|

3

|

17

|

|

4

|

21

|

|

5

|

23

|

a. Calculate the total revenue product and marginal revenue product at each level of labor input if output sells for $4 per unit.

b. If the wage rate is $15 per hour, how manyunits of labor will be hired?

|

What is the variable cost per unit sold

: Martinez company's relevant range of production is 8,900 units to 13,900 units when it produces and sells 11,400 units its unit cost are as follows: direct material 6.70 Direct labor 4.20 variable manufacturing overhead 1.40 fix manufacturing overhea..

|

|

The company contribution margin ratio is closest to

: A manufacturer of cedar shingles has supplied the following data: The company's contribution margin ratio is closest to:

|

|

An initial proposal for research

: An initial proposal for research, including motivation to study for a PhD will be considered. An initial proposal guidelines are available attached

|

|

Analyze the factors that impact your choice of inputs

: Analyze the factors that impact your choice of inputs to produce the chosen product or service. For example, how would a change in the price of raw materials impact the combination of inputs?

|

|

What are the new equilibrium wage rate and employment level

: What will happen to demand for labor? Will it increase or decrease? What are the new equilibrium wage rate and employment level?

|

|

Simple payback calculation

: What is the NPV of the Alaska purchase, assuming that you arein 1867 looking forward? (Enter just the number in dollars without the $ sign or a comma and round off decimals.) Hint: Simple payback calculation, but with discounting.

|

|

Semi-annual coupon interest payments

: A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity (YTM) on the bond is 10%, calculate the price of the bond assuming that the bond makes semi-annual coupon interest payments

|

|

Equivalent to having what amount

: Suppose the risk-free interest rate is 4.5%.a. Having $400 today is equivalent to having what amount in one year? b. Having $400in one year is equivalent to having what amount today? c. Which would you prefer,$400 today or 400 in one year? Does yo..

|

|

Risk-free interest rate

: Suppose the risk-free interest rate is 4.6 % a. Having $200today is equivalent to having what amount in one year? b. Having $200in one year is equivalent to having what amount today?

|