Reference no: EM131105589

Why are ratios useful? What are the five major categories of ratios?

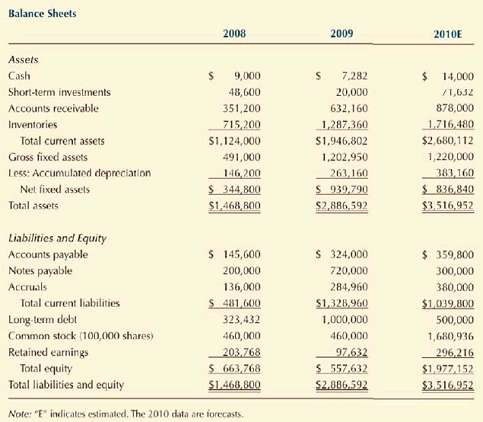

The first part of the case, presented in Chapter 7, discussed the situation that Computron Industries was in after an expansion program. Thus far, sales have not been up to the forecasted level, costs have been higher than were projected, and a large loss occurred in 2009, rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firm's survival. Donna Jamison was brought in as assistant to Fred Campo, Computron's chairman, who had the task of getting the company back into a sound financial position.

Computron's 2008 and 2009 balance sheets and income statements, together with projections for 2010, are shown in the following tables. Also, the tables show the 2008 and 2009 financial ratios, along with industry average data. The 2010 projected financial statement data represent Jamison's and Campo's best guess for 2010 results, assuming that some new financing is arranged to get the company "over thehump."

|

Calculate the 2009 debt and times-interest-earned ratios

: Calculate the 2009 debt and times-interest-earned ratios. How does D'Leon compare with the industry with respect to financial leverage? What can you conclude from these ratios?

|

|

Calculate the 2009 inventory turnover days sales outstanding

: Calculate the 2009 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does D'Leon's utilization of assets stack up against other firms in its industry?

|

|

What can you say about the company''s liquidity positions

: Calculate D'Leon's 2009 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity positions in 2007, 2008, and as projected for 2009?

|

|

Which bid should be accepted by wal mart

: (Analysis of Alternatives) Assume that Wal-Mart, Inc. has decided to surface and maintain for 10 years a vacant lot next to one of its discount-retail outlets to serve as a parking lot for customers.

|

|

What are the five major categories of ratios

: Why are ratios useful? What are the five major categories of ratios? The first part of the case, presented in Chapter 7, discussed the situation that Computron Industries was in after an expansion program.

|

|

What is the amount of the payments that tom brokaw

: What is the amount of the payments that Tom Brokaw must make at the end of each of 8 years to accumulate a fund of $70,000 by the end of the eighth year, if the fund earns 8% interest, compounded annually?

|

|

Calculate those ratios that you think would be useful

: Calculate those ratios that you think would be useful in this analysis. b. Construct a DuPont equation and compare the company's ratios to the industry average ratios. c. Do the balance sheet accounts or the income statement figures seem to be primar..

|

|

What should be the required initial investment

: Rather Corporation wants to withdraw $100,000 (including principal) from an investment fund at the end of each year for 9 years. What should be the required initial investment at the beginning of the first year if the fund earns 11%?

|

|

What will be its stock price 1 year from now

: Over the next year, it also anticipates issuing an additional 150,000 shares of stock so that 1 year from now it will have 650,000 shares of common stock. Assuming Fontaine's price/earnings ratio remains at its current level, what will be its stock p..

|