Reference no: EM131752259

Question: Accounting consolidation - show work.

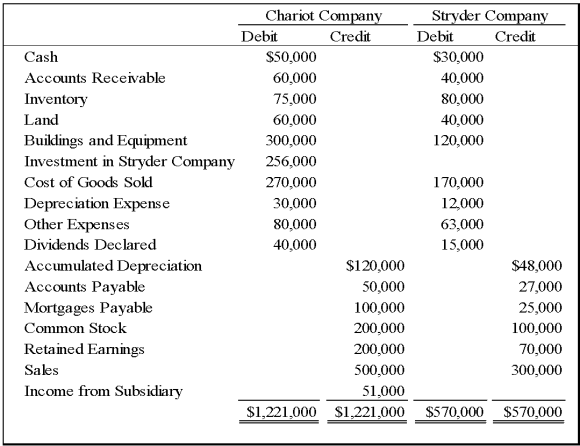

On January 1, 20X8, Chariot Company acquired 100 percent of Stryder Company for $220,000 cash. The trial balances for the two companies on December 31, 20X8, included the following amounts:

On the acquisition date, Stryder reported net assets with a book value of $170,000. A total of $10,000 of the acquisition price is applied to goodwill, which was not impaired in 20X8. Stryder's depreciable assets had an estimated economic life of 10 years on the date of combination. The difference between fair value and book value of tangible assets is related entirely to buildings and equipment. Chariot used the equity method in accounting for its investment in Stryder. Analysis of receivables and payables revealed that Stryder owed Chariot $10,000 on December 31, 20X8.

1. Based on the information provided, what amount of retained earnings will be reported in the consolidated financial statements for the year?

2. Based on the information provided, what amount of net income will be reported in the consolidated financial statements for the year?

The answers respectively are $331,000 and $171,000. Can you please show your work on how to get these answers?

Chariot Com Stryder Com Debit Credit Debit Credit $50,000 $30,000

Cash Accounts Receivable 40,000 00.000 75,000

Inventory 80.000 60,000

Land 40,000 120,000

Buildings and Equipment 300,000

Investment in Stryder Company 256,000

Cost of Goods Sold 170,000 270,000 30,000

Depreciation Expense 12,000 80,000

Other Expenses 63,000 15,000 Dividends Declared 40,000

Accumulated Depreciation $120,000 $48,000 27,000 50,000

Accounts Payable 100,000 25,000

Mortgages Payable 100,000

Common Stock 200,000

Retained Earnings 200,000 70,000 500,000 Sales 300,000

Income from Subsidiary 51,000 $1,221.000 si 221,000 $570,000 $570,000