Reference no: EM13212825

An asset under your management, with an estimated life of 20 years, costs $5,060,000 to purchase and install. It has a revenue stream of $870,000 per year.

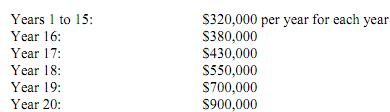

Costs of operation and maintenance of the asset are as follows:

This asset is currently nearing the end of its design life. It therefore should be replaced or rehabilitated. As lead times for ordering equipment and arranging contracts can be quite long, a decision has to be made quickly with respect to the best decision.

There are two options to consider at the end of the 20 year life of the asset:

1. Replacement with a similar asset.

2. Rehabilitation, which will extend its service life by 10 years (i.e., to 30 years in total).

Funds are available for whatever option is selected. There is a lead time of twelve months for ordering and installing a new asset, or undertaking rehabilitation, and therefore a decision on the most suitable option for replacement or rehabilitation is required as soon as possible.

Replacement

If the asset is replaced at the end of its 20 year design life, its residual value then will be $200,000. It will cost $550,000 to remove the asset from service when it is replaced.

The replacement is expected to be commenced immediately after the end of the design life of the asset and be completed within a few months of commencement.

During the period of replacement, there will be no disruption to service of the asset. Hence the normal revenue stream will be maintained. Costs of operation and maintenance for the year in which the asset is replaced are expected to be $420,000, as there will be a period during this year in which the old asset, which has relatively high operation and maintenance costs, will still be functioning.

Under the terms of the replacement contract, all payment for replacing the asset is made after the asset has been successfully replaced.

Rehabilitation

The asset may be rehabilitated after the end of 20 years of service at a cost of $2,150,000. This process will extend its service life by 10 years (i.e., to 30 years in total).

The rehabilitation process will take up to one (1) year, immediately after completion of the design life of the asset. During the year in which rehabilitation is undertaken, overall costs of operation and maintenance will be $360,000. For each of the remaining nine (9) years of service of the asset following rehabilitation, costs of operation and maintenance of the asset will be $440,000 per year.

During the period of rehabilitation, the asset will continue operating, but at a reduced capacity. Revenue received during the year in which rehabilitation is undertaken will be $150,000. The normal revenue stream will be resumed in the following year.

At the end of the period of operation of the rehabilitated asset, it must be replaced. Its scrap value then will be $50,000, and there will be a cost of $600,000 to remove it. Other costs will be the same as those listed above for replacing the asset.

Under the terms of the rehabilitation contract, all payment for rehabilitation of the asset is made after completion of a successful rehabilitation.

Your Task

Part A

Using the net present value method, assess the best option with respect to either rehabilitating or replacing this asset at the end of its life. You should use a spreadsheet, with any necessary explanations, for your calculation.

Money costs 6% per annum. Assume zero inflation. Assume also that for the purposes of analysis, all revenue received and costs incurred in a given year occur at the end of that year.

Assume that once an option for rehabilitation or replacement has been selected that it will be repeated for the second and subsequent asset life cycles following the action taken. For example, if the decision is to rehabilitate at the end of 20 years, then the next life cycle (commencing at an asset age of 30 years) will consist of replacement followed by rehabilitation.

Part B

Repeat your analysis using at least five (5) additional discount rates to the 6% per annum that you used for Part A. The range of these discount rates should be from 3% per annum to 13% per annum.

Plot a graph of Net Present Value against discount rate.

At what discount rate, if any, would the owner of the asset be indifferent with respect to selecting rehabilitation or replacement as the preferred option at the end of the design life of the asset? Briefly discuss your answer.

At what discount rate is rehabilitation not a valid option from the point of view of net present value?

At what discount rate is replacement not a valid option from the point of view of net present value?

What are the implications, if any, of these results?

Part C

Finally, consider (in no more than 400 words) how your answer would be influenced if issues other than economic cost were considered. For example, if the asset was rehabilitated at the end of its useful life, would the reduced capacity of the asset during the rehabilitation process result in the permanent loss of a number of customers, and hence reduced revenue? How would you consider the availability of modern materials with a higher sustainability rating than materials used in the original asset were available? What if one option (rehabilitation or replacement) better contributed to the community than another? What other issues might be relevant?