Reference no: EM13913975

Journal Entry Worksheet

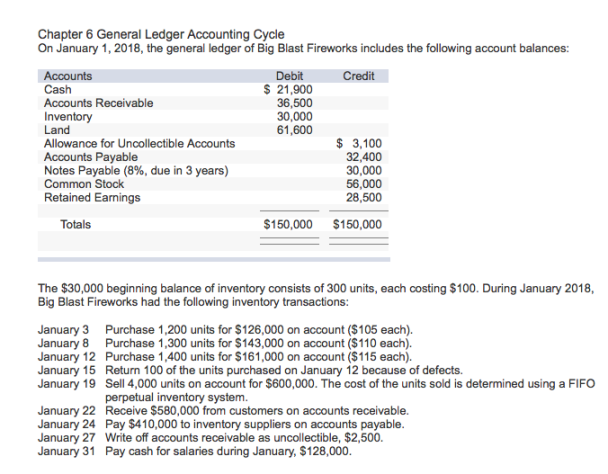

1. Purchase 1,200 units for $126,000 on account ($105 each).

2. Purchase 1,300 units for $143,000 on account ($110 each).

3. Purchase 1,400 units for $161,000 on account ($115 each).

4. Return 100 of the units purchased on January 12 because of defects.

5. Sell 4,000 units on account for $600,000.

6. The cost of the units sold is determined using a FIFO perpetual inventory system.

7. Receive $580,000 from customers on accounts receivable.

8. Pay $410,000 to inventory suppliers on accounts payable.

9. Write off accounts receivable as uncollectible, $2,500.

10. Pay cash for salaries during January, $128,000.

11. Record the adjustment of inventory for market below cost. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each.

12. Record the adjustment needed for the allowance for uncollectible accounts at the end of January. At the end of January, $4,000 of accounts receivable are past due, and the company estimates that 40% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 4% will not be collected.

13. Record the adjustment for interest expense. Accrued interest expense on notes payable for January.

14. Record the adjustment for income expense. Accrued income taxes at the end of January are $12,300.

15. Record the entry to close the revenue accounts.

16. Record the entry to close the expense accounts.

|

Discuss capital gains tax consequences of each transaction

: Your letter of advice should be written in language suitable for the audience (individual taxpayer) and discuss the capital gains tax consequences of each transaction. You should also advise Billy of any record-keeping requirements

|

|

Compute current ratio quick ratio and receivables turnover

: Compute the current ratio, quick ratio, receivables turnover, days' sales uncollected, inventory turnover, days' inventory on hand, payables turnover, days' payable for each year, and financing period.

|

|

The names of the employees of hogan thrift shop

: The names of the employees of Hogan Thrift Shop are listed on the following payroll register.

|

|

Rocket propulsion velocity of exhaust

: For a rocket propulsion velocity of exhaust gases relative to rocket is 2km/s.If mass of rocket system is 1000kg, then what is the rate of fuel consumption for a rocket to rise up with acceleration 4.9m/s^2?

|

|

Units of inventory

: Record the adjustment of inventory for market below cost. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each.

|

|

Compute the receivables turnover and payables turnover

: Compute the receivables turnover, inventory turnover, and payables turnover for each of the four years, and comment on the results relative to the cash flow problem that the firm has been experiencing.

|

|

Why is inventory an investment

: What problems might occur with the full implementation of RFID technology in retail industries? Specifically consider the amount of data that might be collected.

|

|

Calculate the withholding taxes and the gross amount

: Youngston Company (a Utah employer) wants to give a holiday bonus check of $750 to each employee.

|

|

Would content from recent articles to e-commerce marketing

: Would like content from recent articles about e-commerce marketing. Please cite at least three(3) sources. 400 words discussing your viewpoint on the topic and refer to the content from the articles to support your findings.

|