Reference no: EM131071435

Electronics I and Lab

AC Models

1. The impedance of a capacitor is inversely proportional to the frequency and the capacitor effectively blocks dc voltage.

a. True

b. False

2. A coupling capacitor couples an ac signal into an amplifier without disturbing its operating point.

a. True

b. False

3. The voltage gain of an amplifier is defined as the ac output voltage divided by the ac input voltage.

a. True

b. False

4. The ac resistance of the emitter diode equals the ac base-emitter voltage divided by the ac emitter current.

a. True

b. False

5. The common-collector amplifier has:

a. its collector at ac ground

b. its collector at dc ground

c. its emitter at ac ground

d. its emitter at dc ground

6. The ac collector current divided by the ac base current is referred to as:

a. dc current gain.

b. ac current gain.

c. alpha.

d. delta.

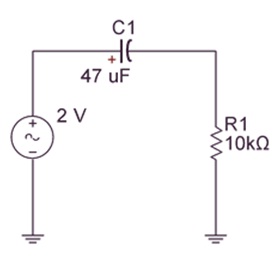

7. Refer to the figure 1 below, what is the lowest frequency at which good coupling exists?

Figure 1

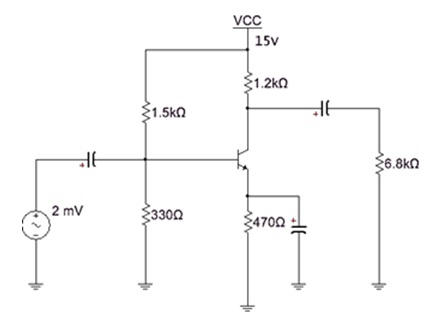

8. Given the parameters in figure 2 below calculate:

a. ac resistance of the emitter diode

b. if the emitter resistance is doubled, what is the ac resistance of the emitter diode?

c. explain in your own words the relationship of the emitter diode and the ac resistance of the ac emitter diode?

Figure 2

9. Using the values listed on the circuit shown in figure 3 below:

a. what effect do the capacitors have on the dc biasing?

b. What type of amplifier is in figure 3 below?

10. Which statement is true with regard to the circuit shown in figure 3 below?

a. the ac signal out of the transistor is amplified and inverted

b. the ac signal out of the transistor is amplified and in-phase with the input

c. the ac signal out of the transistor is not amplified

d. the ac signal out of the transistor is attenuated

|

Concept of the voice of the customer

: Explain the concept of the voice of the customer (VOC). Why would a clear VOC process be important in the supplier to receiving organization relationship? Support your answer with links to the Kano model.

|

|

How much must he invest at the end of each year

: Mr. McNab wants to retire in 20 years and estimates that he'll need $10 million at that time. If his money can earn 4% per year, how much must he invest at the end of each year in order to accumulate his fund? The annual factor is 29.778. A. $29,778 ..

|

|

What will be the new operating cash flow

: A proposed project has fixed costs of $96,000 per year. The operating cash flow at 6,600 units is $96,200. Ignoring the effect of taxes, what is the degree of operating leverage? If units sold rise from 6,600 to 7,100, what will be the new operating ..

|

|

What is the beta of stock b if: portfolio beta

: What is the beta of stock B if: portfolio beta is 1.1 and portfolio is made up of 30% U.S. treasuries, 30% stock A and 40% stock B? Stock A has a risk level equivalent to the overall market.

|

|

The frequency and capacitor effectively blocks dc voltage

: 1. The impedance of a capacitor is inversely proportional to the frequency and the capacitor effectively blocks dc voltage.

|

|

Calculate that the degree of operating leverage

: At an output level of 85,000 units, you calculate that the degree of operating leverage is 3.50. Suppose fixed costs are $220,000. What is the operating cash flow at 79,000 units? What is the degree of operating leverage?

|

|

Discuss the three primary models of crm

: Define and discuss the three primary models of CRM: the IDIC model; the QCI Model and the CRM Value Chain Model. How are these models similar? How do they differ?

|

|

Profit is defined as value of position at maturity minus

: Table 2 gives today’s prices of one-year European put and call options written on a share of stock ABC at different strike prices. Call Price ($) Strike Price ($) Put Price ($) 13.30 100 8.30 10.45 105 10.45 8.30 110 13.30 6.50 115 16.50 Table 2 a) A..

|

|

Initial fixed asset investment-variable costs-quantity sold

: Consider a four-year project with the following information: initial fixed asset investment = $470,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $30; variable costs = $20; fixed costs = $160,000; quantit..

|