Reference no: EM131110263

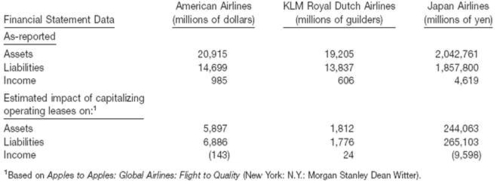

As discussed in the chapter, U.S. GAAP accounting for leases allows companies to use off-balance-sheet financing for the purchase of operating assets. International accounting standards are similar to U.S. GAAP in that under these rules, companies can keep leased assets and obligations off their balance sheets. However, under International Accounting Standard No. 17 (IAS 17), leases are capitalized based on the subjective evaluation of whether the risks and rewards of ownership are transferred in the lease. In Japan, virtually all leases are treated as operating leases. Furthermore, unlike U.S. GAAP and iGAAP, the Japanese rules do not require disclosure of future minimum lease payments. Presented below are financial data for three major airlines that lease some part of their aircraft fleet. American Airlines prepares its financial statements under U.S. GAAP and leases approximately 27% of its fleet. KLM Royal Dutch Airlines and Japan Airlines (JAL) present their statements in accordance with their home country GAAP (Netherlands and Japan, respectively). KLM leases about 22% of its aircraft, and JAL leases approximately 50% of its fleet.

(a) Using the as-reported data for each of the airlines, compute the rate of return on assets and the debt to assets ratio. Compare these companies on the basis of this analysis.

(b) Adjust the as-reported numbers of the three companies for the effects of non-capitalization of leases, and then redo the analysis in part (a).

(c) The following statement was overheard in the library: "Non-capitalization of operating leases is not that big a deal for profitability analysis based on rate of return on assets, since the operating lease payments (under operating lease accounting) are about the same as the sum of the interest and depreciation expense under capital lease treatment." Do you agree? Explain.

(d) Since the accounting for leases worldwide is similar, does your analysis above suggest there is a need for an improved accounting standard for leases? (Hint: Reflect on comparability of information about these companies' leasing activities, when leasing is more prevalent in one country than in others.)