Reference no: EM13381799

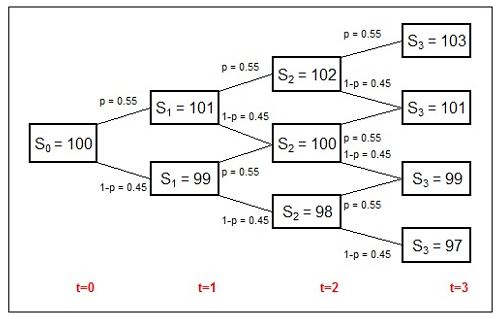

Takes place at dates t = 0; 1; 2; 3. t = 0 denotes the present date.

The interest rate is assumed to be zero and trading

1. What is the probability distribution of S3?

2. Compute E[S3jS1 = 101].

A derivative contract called the corridor option pays 100 at t = 3 if the share price of Binomial Corp. changes by more than 2.5% between t = 0 and t = 3.

Carblays Bank sells 1000 put options on Binomial Corp. to Soci�et�e Particuli�ere (SocPart), a French fund.

3. What is the value at t = 0 of the corridor options sold by Carblays?

4. What is the probability that SocPart gets a payo� from the options?

5. Describe how Carblays can set up a hedging portfolio at t = 0.

At t = 1, the price increases to 101.

6. What is now the value of the options held by SocPart?

7. How should Carblays adjust its hedging portfolio at t = 1?