Reference no: EM13201068

Part A of this assignment requires an analysis of certain aspects of "Brown Ltd"

After studying "Brown Ltd", answer the following questions:

Assuming that -

- Brown has no uncommitted internal funds which can be applied to financing the proposed expansion and replacement program;

- Brown will finance any funding shortfall (after the proposed capital restructuring) with new debt. Brown's cost of equity will remain at 11% after tax, irrespective of changes to its debt ratio (i.e. the ratio of market value of total long-term debt to market value of total long-term funds) -

Justify your answers to the following questions with full explanations, including, where applicable, itemised schedules of relevant capital structure components.

(a) Quantify Brown's debt ratio before and after the capital restructuring.

(b) Quantify Brown's WACC before and after the capital restructuring.

(c) What discount rate did you use to evaluate the investment alternatives offered by the proposed capital expansion and replacement program? Justify your answer.

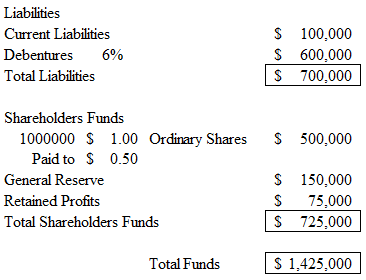

The present capital structure of the company is shown below. The current market value of the company's $1 ordinary shares paid to 50c is 85c. The company's debentures are currently quoted at their nominal value. On the basis of the above market value of ordinary shares the company's cost of equity capital is estimated at 11 per cent. Any new debt can be obtained at 7%.

Capital Structure as at 30 June 2011

Proposed Investment Program

Brown Plastics is planning to spend $700,000 on restructuring.

Proposed Changes to Capital Structure

The planned expansion and replacement program is to be financed partly by calling up the amount uncalled on the $1 ordinary shares. The reaction of the share market to the announcement of the planned expansion is expected to be favourable, and the market price per share is expected to rise to $1.45 per fully-paid share. Cost of equity capital is expected to remain at approximately 11 per cent despite this rise in market value of shares. Repayment of debentures with a total value of $300,000 is due and this is to be met partly from the call of 50c per ordinary share. Any additional financing will be sought through borrowings at the same cost as that of existing debt.

|

State largest rectangle inscribed in a semicircle

: Determine the area of the largest rectangle that can be inscribed in a semicircle of radius 8". Figure shows that the area can be written as A =(2x)y, if (x,y) is the point of the upper right corner of the rectangle.

|

|

How long does it take the object to hit the ground

: An object is dropped from the top of a 576 feet tall building. The height h (in feet) of the object t seconds after it is dropped is given h+-16*t^2+576. How long does it take the object to hit the ground?

|

|

What is the most likely outcome in the situation

: Suppose the payoffs are instead as follows If they both open at location A, theater earns 12 while the restaurnat earns 8. If both open at B, the theater earns 8 and the restaurant earns 12. IF they open at different locations, they both earn 2.

|

|

How much does she really bring home each year

: My mom makes $70,000 a year in her job. Our state income tax rate is 6.00%. What is the federal rate on this salary? Then, How much does she really bring home each year, month, two weeks? Thanks

|

|

Show the proposed investment program

: Quantify Brown's debt ratio before and after the capital restructuring and quantify Brown's WACC before and after the capital restructuring.

|

|

Which smoothing constants would make an exponential

: Which smoothing constants would make an exponential smoothing forecast equivalent to a naive forecast?

|

|

Find out the optimal route

: Jon is a traveling salesman for a pharmaceutical company. His territory includes 5 cities and he needs to find the least expensive route to the cities and home. Starting at city A, determine the optimal route using nearest neighborhood method.

|

|

What might prevent first-degree price discrimination

: the branch manager given the objective to maximize revenues by pricing a new stereo system composed of a reciever, CD player, and speakers. Your economists have estimated that two diffeernt groups will purchase these products.

|

|

What is the compound amount of the loan

: Tom bond borrowed $6,600 at 5 1/2% for three years compounded annually. What is the compound amount of the loan and how much interest will he pay on the loan?

|