Reference no: EM131781327

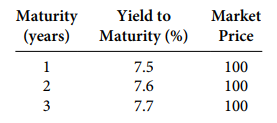

Question: The current on-the-run yields for the Ramsey Corporation are as follows:

Assume that each bond is an annual-pay bond. Each bond is trading at par, so its coupon rate is equal to its yield to maturity.

a. Using the bootstrapping methodology, complete the following table:

b. Using the spot rates, what would be the value of an 8.5% option-free bond of this issuer?

c. Using the one-year forward rates, what would be the value of an 8.5% coupon option-free bond of this issuer?

d. Using the binomial model (which assumes that one-year rates undergo a lognormal random walk with volatility s), show that if s is assumed to be 10%, the lower one-year forward rate one year from now cannot be 7%.

e. Demonstrate that if s is assumed to be 10%, the lower one-year forward rate one year from now is 6.944%.

f. Demonstrate that if s is assumed to be 10%, the lower one-year forward rate two years from now is approximately 6.437%.

g. Show the binomial interest-rate tree that should be used to value any bond of this issuer.

h. Determine the value of an 8.5% coupon option-free bond for this issuer using the binomial interest-rate tree given in part g.

i. Determine the value of an 8.5% coupon bond that is callable at par (100) assuming that the issue will be called if the price exceeds par.