Reference no: EM131827081

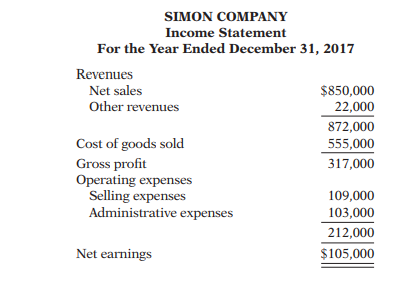

Question: An inexperienced accountant prepared this condensed income statement for Simon Company, a retail fi rm that has been in business for a number of years.

As an experienced, knowledgeable accountant, you review the statement and determine the following facts.

1. Net sales consist of sales $911,000, less freight-out on merchandise sold $33,000, and sales returns and allowances $28,000.

2. Other revenues consist of sales discounts $18,000 and rent revenue $4,000.

3. Selling expenses consist of salespersons' salaries $80,000, depreciation on equipment $10,000, advertising $13,000, and sales commissions $6,000. The commissions represent commissions paid. At December 31, $3,000 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense.

4. Administrative expenses consist of office salaries $47,000, dividends $18,000, utilities $12,000, interest expense $2,000, and rent expense $24,000, which includes prepayments totaling $6,000 for the first quarter of 2018.

|

Prepare journal entries for recording the transactions

: Assume that Alfi e Co. paid the balance due to Bach Company on May 4 instead of April 15. Prepare the journal entry to record this payment.

|

|

Prepare an income statement using gross profit

: Post the transactions to T-accounts. Be sure to enter the beginning cash and common stock balances.

|

|

Review problem on merchandising transactions

: Powell Warehouse distributes hardback books to retail stores and extends credit terms of 2/10, n/30 to all of its customers.

|

|

Analyse a particular situation and the management process

: Choose a specific incident from your life where you have used the four primary management functions of Planning, Organising, Leadership and Controlling

|

|

Review the statement and determine the given facts

: An inexperienced accountant prepared this condensed income statement for Simon Company, a retail fi rm that has been in business for a number of years.

|

|

Computing trial balance amounts into the t-accounts

: Create T-accounts for all accounts used in part (a). Enter the trial balance amounts into the T-accounts and post the adjusting entries.

|

|

Solving problem using adjusted trial balance

: At the end of Oates Department Store's fiscal year on November 30, 2017, these accounts appeared in its adjusted trial balance.

|

|

Computing the gross profit rate for each fiscal year

: The vice presidents of sales, marketing, production, and finance are discussing the company's results with the CEO.

|

|

Prepare an income statement through gross profit

: At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash $2,500, Inventory $3,500, and Common Stock $6,000.

|