Reference no: EM131317916

ALUE-NIKE, INC.

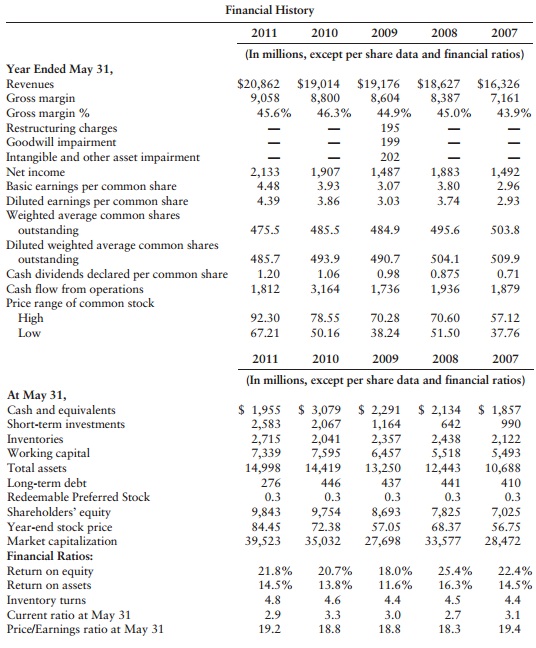

Selected data from Nike's financial statements for the period 2007-2011 follow:

Item 6 Selected Financial Data (In Part)

Required

a. Liquidity

1. Review the summary analysis for Nike, Inc. from 2009-2011. Give your opinion of the liquidity position (refer back to Exhibit 3, Summary Analysis).

2. Review the current ratio in this case (2007-2011). Comment.

3. Review cash provided by operations (2007-2011). Comment.

b. Long-term debt-paying ability

1. Review the summary analysis for Nike, Inc. from 2009-2011. Give your opinion of the debt position (refer back to Exhibit 3, Summary Analysis).

2. Review the debt ratio for 2009-2011. Comment.

c. Profitability

1. Review the summary analysis for Nike, Inc. from 2009-2011. Give your opinion of the profitability (refer back to Exhibit 3, Summary Analysis).

2. Review the trend in revenues (2007-2011). Comment.

3. Review the trend in gross profit margin (2007-2011). Comment.

d. Investor Analysis

1. Review the absolute amount and trend in the price/earnings for 2007-2011. Considering liquidity, debt, and profitability, is there a reasonable probability that the price/earnings may increase?

2. Comment on the trend in market capitalization (2007-2011) (share price x number of outstanding shares).

3. Review cash dividends declared per common share (2007-2011). Is there a likely chance that dividends will be increased during the year ending May 31, 2012?

4. Give your opinion of the stock price of Nike, Inc. on May 31, 2013. In practice, many things would be considered that are not presented in this case. Base your opinion on the summary analysis (2009-2011) and the financial history (2007-2011).

e. Other

1. This case has used a fundamental financial statement approach to valuing Nike. In your opinion, would an analyst likely use this type of approach for valuing Nike? Comment.

|

Calculate the amount of the firm income before tax

: Banana Box Corporation has sales of $4, 463, 310; income tax of $445, 927; the selling, general and administrative expenses of $278, 222; depreciation of $398, 182; cost of goods sold of $2, 724, 730; and interest expense of $152, 910 Calculate the a..

|

|

Considering building stadium for professional football team

: A city with a population of 500,000 and 5% unemployment is considering building a stadium for a professional football team that plays in an old stadium the city owns. The proposal is for the city to pay $400M (M for million) to demolish the old stadi..

|

|

Seller of a corn futures contract

: A corn contract calls for delivery of 5,000 bushels. What happens to the seller of a corn futures contract at $3.8125 cents per bushel if the futures price closes the next day at $3.9000 cents per bushel? Enter the mark to market gain or loss to ..

|

|

What are the salary ranges for the career positions

: List various careers for individuals with a practical knowledge of JavaScript. What are the knowledge requirements for the career positions? What are the salary ranges for the career positions?

|

|

Review the absolute amount and trend in the price

: Review the absolute amount and trend in the price/earnings for 2007-2011. Considering liquidity, debt, and profitability, is there a reasonable probability that the price/earnings may increase?

|

|

What is the company wacc

: Lannister Manufacturing has a target debt-equity ratio of .60. Its cost of equity is 14 percent, and its cost of debt is 8 percent. If the tax rate is 38 percent, what is the company's WACC?

|

|

Cost of existing and new preferred stock respectively

: What would be the cost of existing and new preferred stock respectively? If preferred stock is selling for $27.00 a share. The firm nets $25.60 after issuance costs. And the stock pays an annual dividend of $3.00 a share.

|

|

Consider project to supply postage stamp

: Consider a project to supply 107 million postage stamps per year to the U.S. Postal Service for the next five years. You have an idle parcel of land available that cost $1,970,000 five years ago; if the land were sold today, it would net you $2,170,0..

|

|

Explain what depreciation-cash flow-operating cash flow

: Explain what depreciation, cash flow, operating cash flow and NPV are and how they interact with business decisions. Explain why these financial concepts are important for you as an employee, owner, or investor.

|