Reference no: EM131827076

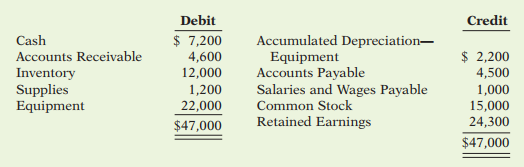

Question: On December 1, 2017, Devine Distributing Company had the following account balances.

During December, the company completed the following summary transactions.

Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable.

8 Received $1,900 cash from customers in payment of account (no discount allowed).

10 Sold merchandise for cash $6,300. The cost of the merchandise sold was $4,100.

13 Purchased merchandise on account from Hecht Co. $9,000, terms 2/10, n/30.

15 Purchased supplies for cash $2,000.

18 Sold merchandise on account $12,000, terms 3/10, n/30. The cost of the merchandise sold was $8,000.

20 Paid salaries $1,800.

23 Paid Hecht Co. in full, less discount.

27 Received collections in full, less discounts, from customers billed on December 18

Adjustment data:

1. Accrued salaries payable $800.

2. Depreciation $200 per month.

3. Supplies on hand $1,500.

4. Income tax due and unpaid at December 31 is $200. Instructions

(a) Journalize the December transactions using a perpetual inventory system.

(b) Enter the December 1 balances in the ledger T-accounts and post the December transactions. Use Cost of Goods Sold, Depreciation Expense, Salaries and Wages Expense, Sales Revenue, Sales Discounts, Supplies Expense, Income Tax Expense, and Income Taxes Payable.

(c) Journalize and post adjusting entries.

(d) Prepare an adjusted trial balance.

(e) Prepare an income statement and a retained earnings statement for December and a classified balance sheet at December 31.

|

Computing trial balance amounts into the t-accounts

: Create T-accounts for all accounts used in part (a). Enter the trial balance amounts into the T-accounts and post the adjusting entries.

|

|

Solving problem using adjusted trial balance

: At the end of Oates Department Store's fiscal year on November 30, 2017, these accounts appeared in its adjusted trial balance.

|

|

Computing the gross profit rate for each fiscal year

: The vice presidents of sales, marketing, production, and finance are discussing the company's results with the CEO.

|

|

Prepare an income statement through gross profit

: At the beginning of the current season on April 1, the ledger of Granite Hills Pro Shop showed Cash $2,500, Inventory $3,500, and Common Stock $6,000.

|

|

Review problem of Devine Distributing Company

: Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable.

|

|

Write a paper on a specific cultural group

: NUR 502 - Theoretical Foundations for Nursing Roles and Practice Assignment. Write a paper of 1,000-1,250 words on a specific cultural group

|

|

Journalize and post adjusting entries

: On November 1, 2017, IKonk, Inc. had the following account balances. The company uses the perpetual inventory method.

|

|

Calculate the gross profit rate and the profit margin

: Assume the marketing department has presented a plan to increase advertising expenses by $340 million. It expects this plan to result in an increase.

|

|

Determine multiple-step income statement for company

: In its income statement for the year ended December 31, 2017, Darren Company reported the following condensed data.

|