Reference no: EM131520820

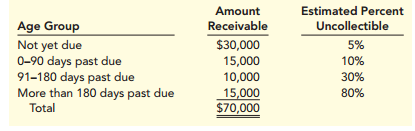

Question: Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2012, Pearl provides services on account of $580,000. Of this amount, $70,000 remains receivable at the end of the year. An aging schedule as of December 31, 2012, is provided below.

Required: 1. Calculate the allowance for uncollectible accounts.

2. Record the December 31, 2012, adjustment, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $4,000 ( credit).

3. On July 19, 2013, a customer's account balance of $7,000 is written off as uncollectible. Record the write-off.

4. On September 30, 2013, the customer whose account was written off in Requirement 3 unexpectedly pays the full amount. Record the cash collection.