Reference no: EM13376179

Question

You have recently been appointed as an audit senior and have been assigned to the audit of TNO Limited (TNO) a listed public company. It is the beginning of January 2014 and you are gathering information in order to prepare the audit plan for the year ended 31 December 2013. The firm for which you work has been the auditor of TNO for a number of years. The following information has been gathered to date.

The principal activities of TNO are:

- research and development of technologies relating to medical equipment;

- manufacture and distribution of medical equipment;

- investment of surplus funds; and

- investment in the property market.

TNO was incorporated in 1990 and has operated successfully and profitably since that date. In the last few years it has branched out into the property market, acquiring a number of commercial properties which are let mainly to medical practitioners.

The directors of TNO are:

- Mr. John Stanton, Chairman

- Ms Jane Quade, Chief Executive Officer

- Mr. Joe Quade

- Dr Jim Xie

- Dr Jenny Yeo

Doctors X and Y are independent non-executive directors and have been directors since 2001. The other three executive directors have been employed by the company since its incorporation and have considerable experience in the industry. Mr Stanton controls a number of private companies.

In prior years, the audit firm placed reliance on internal controls based on satisfactory results of extensive tests of control. Recent discussions with the client have revealed no changes in the system of internal control since last year.

The company does not have an internal audit function.

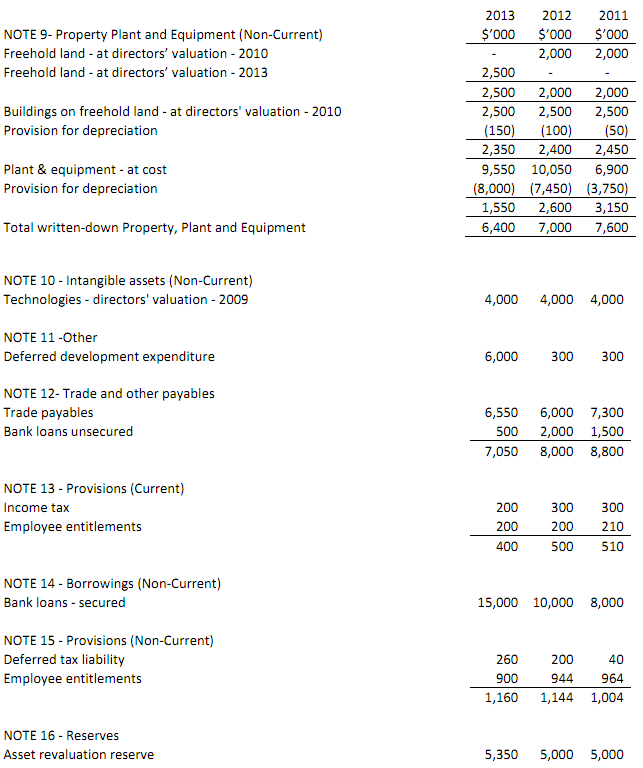

In February 2013, research activities relating to a new laser surgery device commenced. Significant costs were incurred in relation to this research. In April 2013 a competitor announced that it had successfully developed and patented a similar device.

In order to finance the research activities noted above the company borrowed from its bankers an additional $5 million during the year. The loan agreement contains a covenant to the effect that should the company's debt to equity ratio (measured as total liabilities: shareholders' equity) increase above 1.2:1.0 at any time, the bankers have the right to demand immediate repayment.

Throughout 2013, the property market has been in decline. The interim audit is scheduled to take place in September 2013 for approximately two weeks. The final audit is scheduled to start on 1 February 2014 and should take about two weeks to complete. The client completed a stock count on 31 December 2013. The directors require the signed audited final financial report by 25 February 2014.

Your audit partner, John Richards, has approached you and advised that there are several account areas he is concerned about. Before you complete your audit program he wants you to report back to him about the following accounts:

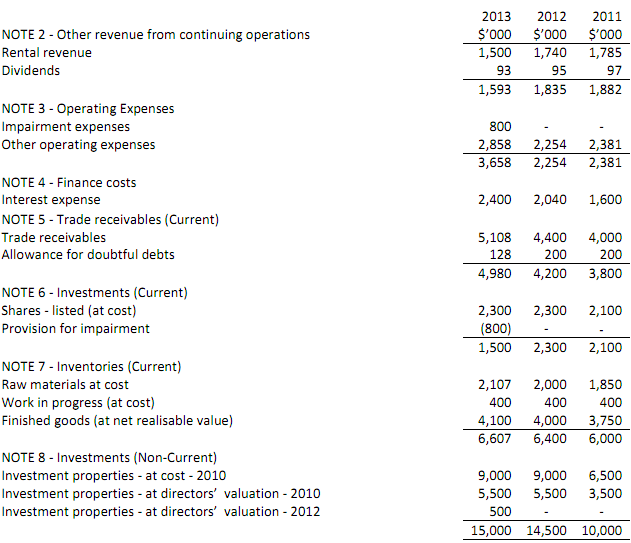

- Accounts receivable.

- Current investments.

- Property assets.

- Intangible assets.

- Deferred development expenditure.

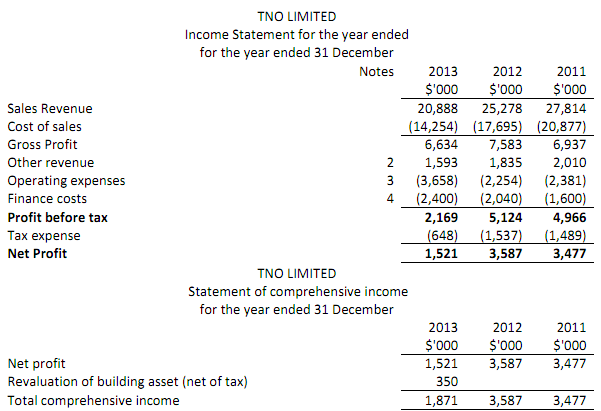

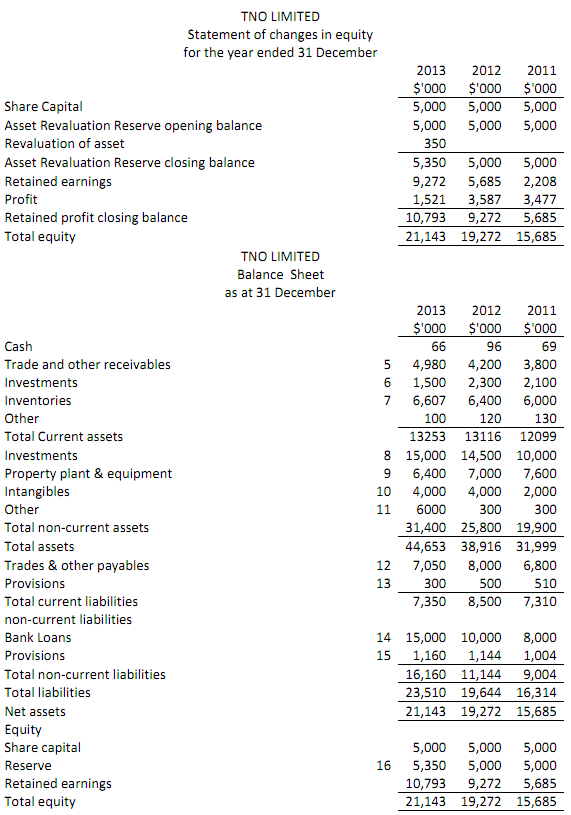

An unaudited set of financial reports at 31 December 2013 together with audited comparatives for the year ended 31 December 2012 and 2011 is set out below for your review.

Significant Account Policies

The accounting policy note states that the company complies with Accounting Standards and the Corporations Act 2001. It also reveals the following:

- commercial properties owned but not occupied by the company and which generate rental income are classified as non-current investments. These assets are not depreciated. Some of the investment properties are stated at cost and some are at directors' valuation

- technologies relating to modified equipment are included in the accounts as intangible assets. These assets stated at directors' valuation and are not amortised. The Director's believe that these assets do not have a limited useful life.

- deferred development expenditure is included in the accounts under 'other' non-current assets. This expenditure relates to the new laser surgery device.

REQUIRED:

1. Use Excel to undertake detailed analytical procedures covering all three years and comprising:

- a trend statement;

- a common size statement;

- a simple comparison between years on the Income Statement and Balance Sheet; and

- profitability, efficiency (activity), liquidity and solvency ratios where applicable.

The results of your analytical procedures are to be included as an appendix to the report you complete for John. Note: A copy of your Excel file is to be separately lodged via EASTS.

2. Prepare a report (excluding an executive summary) for John that outlines:

a. Your analysis and other information provided, to make an assessment of the risk associated with the five accounts identified by John and the reasons for that assessment.

b. The key assertion common to all the identified account balances and, for each of the account balances, one substantive audit procedure that verifies the key assertion.

c. Details of other business risks identified from your analytical procedures and background details.