Reference no: EM13376822

Question 1

Please answer the followings:

a. What is the maximum price that you are willing to pay for a machine if it is expected to provide annual savings of $20,000 at the end of each year for 10 years and to have a resale value of $50,000 at the end of year 10. Assume an interest rate of 9% p.a. compounded annually.

b. If $8,000 is deposited annually starting on January 1, 2010 and earns 9% p.a. compounded annually, how much will be accumulated by December 31, 2019?

c. Compute the cost of an investment if it earns $6,000 at the end of every 3 months for 5 years at 12% compounded quarterly.

d. How much must be invested now -to receive $40,000 for ten years if the first $40,000 is received today and the interest rate is 8% p.a. compounded annually?

e. A machine will be leased for 15 years with rent received at the beginning of each year. If the machine cost is $160,000 and return of 10% p.a. compounded annually is required, compute the amount of the annual rent.

f. Determine the market price of a $400,000, ten-year, 10% (pays interest semiannually. at the end of each period) bond sold to yield an interest rate of 12% p.a. compounded semi-annually.

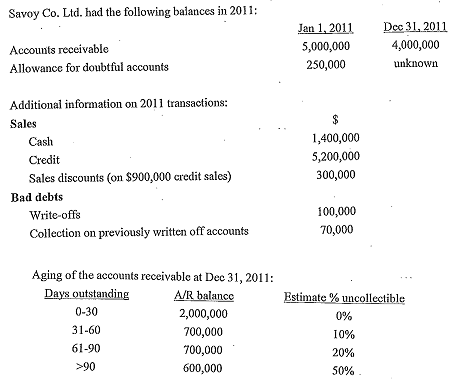

Question 2:

Required:

a. How much cash was collected from accounts receivable during 2011?

b. Prepare the journal entry to record the sale revenue of $900,000 and related discounts using both the gross and net method. Repeat the same using net method if Such discounts were not taken by customers under the net method.

c. Assume sales discounts were taken by customers and that gross method is used, compute total gross sales, net sales and bad debt expenses in 2011.

d. What would the bad debt expenses be if Savoy wanted to use the percentage of sales method and estimated that 4.5% of sales were not collectible?

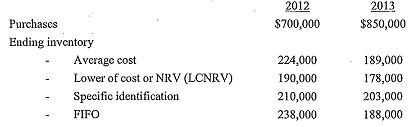

Question 3:

Stevenson Ltd. began operations on January 1, 2012. Merchandise purchases and four alternative methods of valuing inventory for the first two years of operations were summarized below:

Required:

a. Calculate COGS using the four alternative methods and determine the cost flow assumption or inventory valuation method that would report the highest net income for 2012.

b. Assuming that FIFO had been used for both years, how much would the cost of goods sold be in 2013?

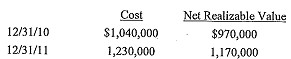

Question 4:

Adrian Company began operations in 2010 and had the following ending inventory information at cost and at LCNRV on December 31, 2010 and December 31, 2011:

Required:

a. Using a perpetual inventory system and the cost-of-goods-sold method, prepare the journal enhies required at December 31, 2010 and December 31, 2011.

b. Using a perpetual system and the loss method with an allowance account, prepare the journal entries required at December 31, 2010 and December 31, 2011.